Andrew Bailey, the Bank of England Governor, acknowledged the second-quarter GDP contraction of 35% outlined by the Office of Budget Responsibility (OBR) was within reason. He notes the central bank will release its assessment of the Covid-19 pandemic, derived with a new high-frequency data tool developed to measure the outcome of a hard Brexit. Where the OBR assumes a quick recovery, Bailey is one of barely a few who recognizes the potential of economic hysteresis. Unemployment may reach two million, and businesses could face long-lasting structural changes, leaving scarring effects. Admitting to reality will position the UK ahead of the curve for sustained recovery. The GBP/USD is anticipated to extend the breakout above its short-term support zone.

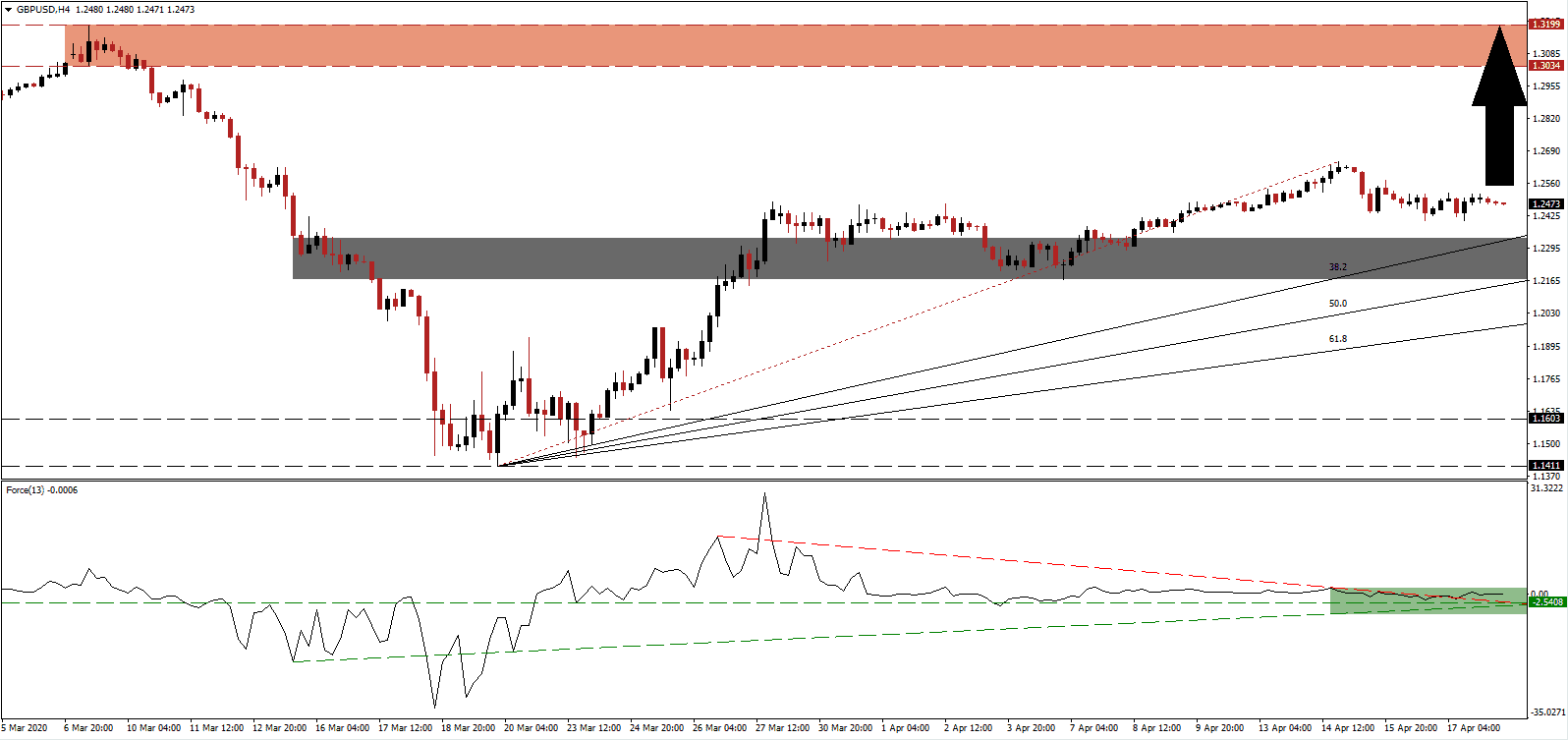

The Force Index, a next-generation technical indicator, pushed through its descending resistance level, as marked by the green rectangle, confirming the dominance of bullish momentum. It remains above its horizontal support level, with the ascending support level adding upside pressure. This technical indicator is trading above-and-below the 0 center-line. A sustained advance on the back of accumulating bullish developments is favored to initiate more upside in the GBP/USD. You can learn more about the Force Index here.

After verifying the conversion of its short-term resistance zone into support, with a sustained breakout, the presence of a bullish chart pattern was confirmed. This zone is located between 1.2166 and 1.2333, as identified by the grey rectangle. The ascending 38.2 Fibonacci Retracement Fan Support Level just crossed above this zone, increasing pressures in the GBP/USD to continue its advance. Providing a fundamental catalyst is the significantly weaker economic state of the US in combination with false hope on the strength and speed of the post-Covid-19 recovery by its leadership.

One essential level to monitor is the intra-day high of 1.2646, the peak of the existing breakout sequence, and the end-point of the redrawn Fibonacci Retracement Fan sequence. A move higher is expected to attract the next wave of net buy orders in the GBP/USD. It is favored to elevate price action into its resistance zone located between 1.3034 and 1.3199, as marked by the red rectangle. While the costs of the UK government’s stimulus package will spike the debt-to-GDP ratio, the country is in a superior fiscal position than the US. The long-term outlook for this currency pair is increasingly bullish.

GBP/USD Technical Trading Set-Up - Breakout Extension Scenario

Long Entry @ 1.2475

Take Profit @ 1.3200

Stop Loss @ 1.2245

Upside Potential: 725 pips

Downside Risk: 230 pips

Risk/Reward Ratio: 3.15

Should the Force Index collapse below its ascending support level, the GBP/USD is likely to be pressured into a temporary sell-off. Given existing fundamental developments, the downside potential remains limited to its 61.8 Fibonacci Retracement Fan Support Level, which maintains the bullish stance of this currency pair. Forex traders are advised to consider this an excellent buying opportunity.

GBP/USD Technical Trading Set-Up - Limited Correction Scenario

Short Entry @ 1.2160

Take Profit @ 1.2000

Stop Loss @ 1.2225

Downside Potential: 160 pips

Upside Risk: 65 pips

Risk/Reward Ratio: 2.46