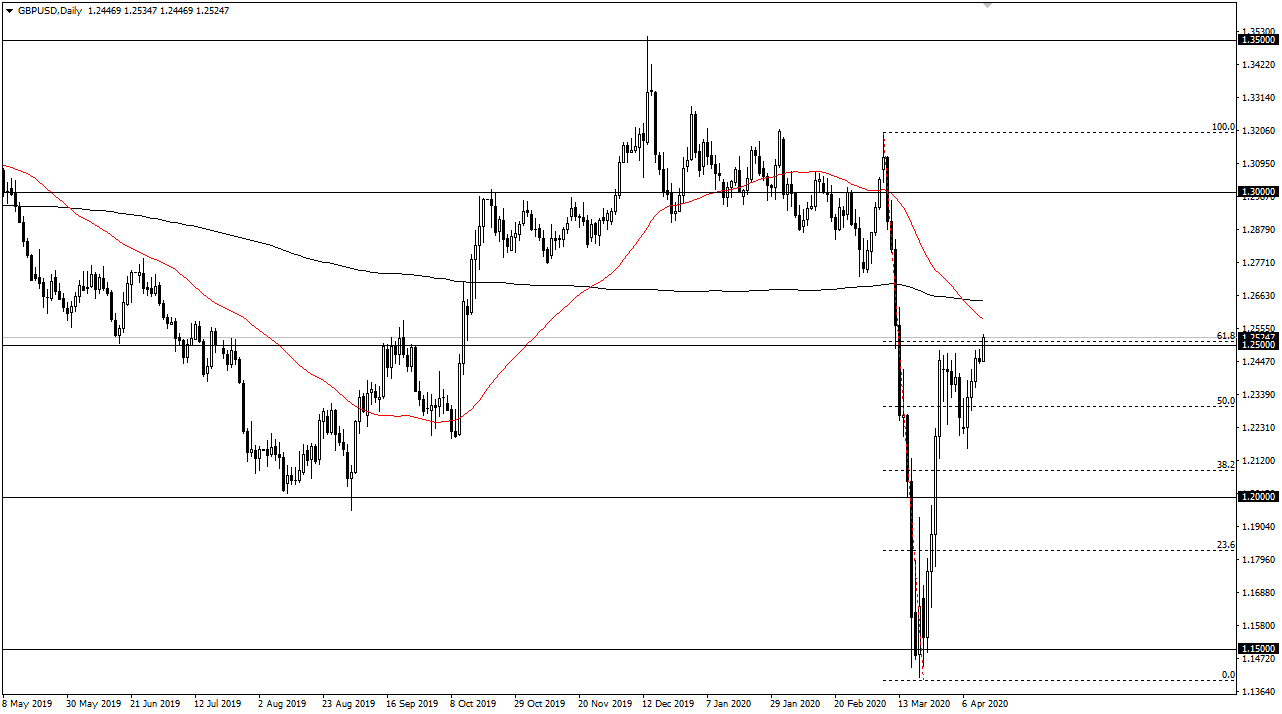

The British pound broke above the 1.25 level during the trading session on Monday to kick off the week, which of course is significant from a psychological standpoint. The question now is whether or not there is going to be enough momentum to continue going higher? One thing that you need to keep in mind is that it has essentially been the Americans only driving this market, as most European banks were away. Nonetheless, this is a market that looked like it was trying to break out anyway, so it’s not a huge surprise that this has been the case. I believe that given enough time, this market could go looking towards the 200 day EMA next which is near 1.2650 but I also believe that we could go another 100 pips above there rather easily.

However, if liquidity comes back and we find ourselves trading below the range for the quiet Friday session, then I anticipate that we could pull back towards the 1.2250 level where you should be buyers. I recognize that we are at a crucial level, but when we get these breakouts during the holiday, it always makes me a little less convinced. If this were a normal day, I would be much more bullish at this point that I. Nonetheless, we have been pointing higher for a while now, so it clearly goes with the overall move as of late. The 61.8% Fibonacci retracement level is right here as well, and that of course has a certain amount of influence on the market.

If we do continue higher, it might be more of a grind, but the Tuesday session will be crucial as it will be the first time London is back online and it will be interesting to see what they do with the Pound. At this point, it’s likely that the market will be very jittery, but that makes sense considering everything that’s going on. Quite frankly, we have seen a massive recovery so far and the fact that we broke above the couple of significant short-term barriers suggests that we could see a little bit more momentum. At this point all we are going to need is some type of catalyst. Until then, expect a lot of sloppy trading which has been a bit of the norm over the last couple of weeks anyway.