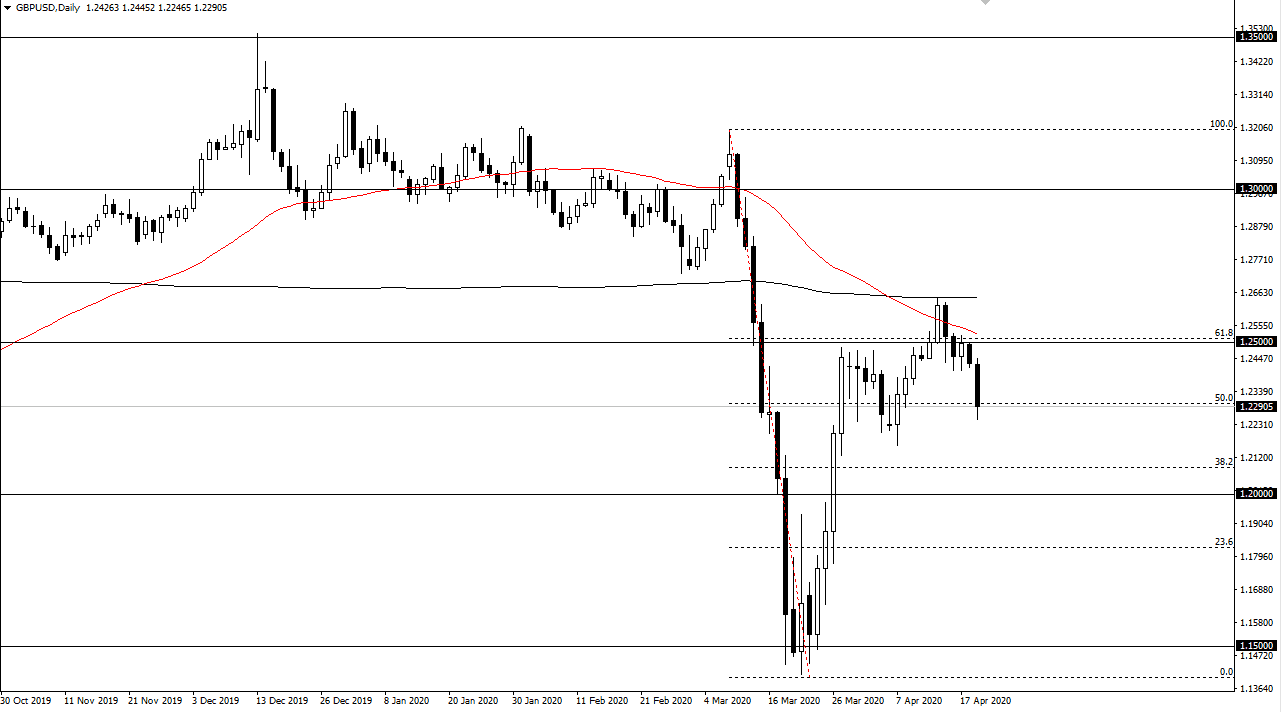

The British pound has fallen a bit during the trading session on Tuesday, breaking below the 1.23 level before bouncing slightly. Ultimately, this is a market that has a significant amount of bearish pressure on it, and I think that it is only a matter of time before the British pound breaks down significantly. Short-term rally should be thought of as a gift at this point, offering cheap US dollars. I look at the 1.25 level as the beginning of the “ceiling” in this market and I will be looking for short-term signs of exhaustion that I can take advantage of.

To the downside, if we can break below the 1.22 handle then I suspect what we will see next is a move to the 1.20 level, which is something that I do believe it’s only a matter of time before we get to. A breakdown below that level opens up the door to the 1.1750 handle. That level opens up the door to the 1.15 level underneath, so that is my longer-term blueprint as to where this pair should go. Granted, it’s probably going to take quite some time to get down there, because this pair doesn’t seem to be willing to give up gains very easily.

On the other hand, if the market was to make a fresh, new high and perhaps more importantly break above the 200 day EMA, then the 1.30 level would be targeted, followed by the 1.35 handle. That would take a lot of good news coming in at one time, and I just don’t see how that happens. The United Kingdom is very likely to be locked down much longer than many parts of the United States, and of course we have to worry about the Brexit situation, although it is most certainly on the back burner at this point. Because of this, I think that the British pound does offer nice selling opportunities on rallies, and at this point I have no interest in trying to buy this market. All things being equal, I simply look for short-term spikes in this pair that show signs of rolling over. I think simply nibbling away at the British pound might be the way to go, using short-term charts to pick up little bits and pieces of gains. As far as holding on to big moves, it’s going to be very difficult to have happen with all of the volatility that we see in just about every market in the world.