The British pound has gapped lower to kick off the trading week on Monday, but then turned around to rally not only billing the gap but breaking above there. That’s a positive sign obviously, and there was more of a “risk on” type of attitude around the global markets. That being the case, the British pound showed signs of strength, as we have broken above the 1.23 handle. Nonetheless, there is a significant amount of resistance above so it’s only a matter of time before I anticipate seeing sellers above. After all, there are a world of problems in the United Kingdom that should only get worse.

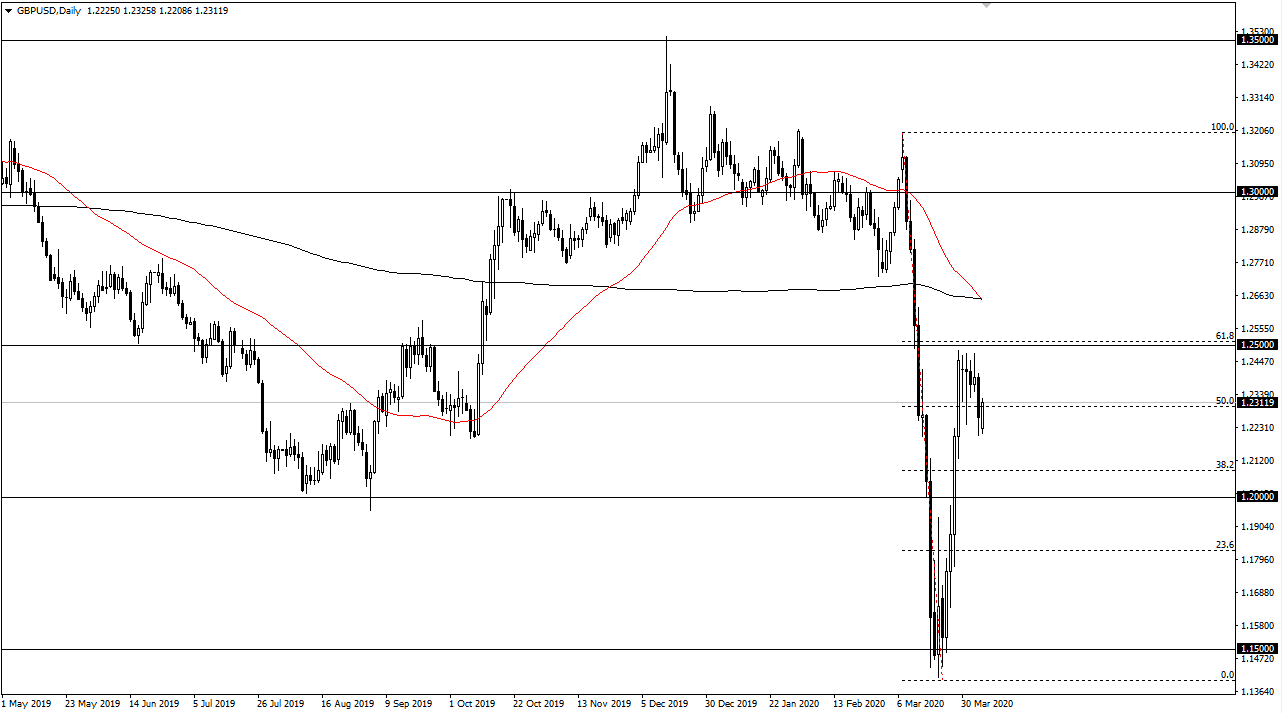

Looking at the chart, you can see that the 61.8% Fibonacci retracement level has offered enough resistance to push the market back down, and therefore it’s very likely that the longer-term traders have looked at that as an opportunity to start shorting. Nonetheless, I think short-term rallies will continue to offer selling opportunities, as the US dollar still highly in demand. Beyond that, the coronavirus is hitting the United Kingdom rather hard, and it is driving money out of the United Kingdom. Look at the candlestick you can see that we did spend most of the day rallying, but the range of the candlestick is and as impressive when you look at the overall negativity that we have seen of the last couple of days. With that in mind I am simply biding my time and looking for a selling opportunity on short-term charts.

If we can break down below the bottom of the range for the trading session on Friday, that could open up a move down to the 1.20 level underneath which is not only structurally important but psychologically important as well. In fact, that is my base case scenario, but it may take some time to have that happen. The 1.20 level should be relatively stable, so I don’t necessarily think that we simply slice through it. However, we did break down below that level we could open up the door down to the 1.1750 level relatively quickly. That being said, the alternate scenario of course is a break above the 1.25 handle, which would change a lot of things, perhaps opening up the move to the 1.2750 level eventually. That being said, I find it very unlikely to happen so I still looking for those selling opportunities it will clearly pop up from time to time.