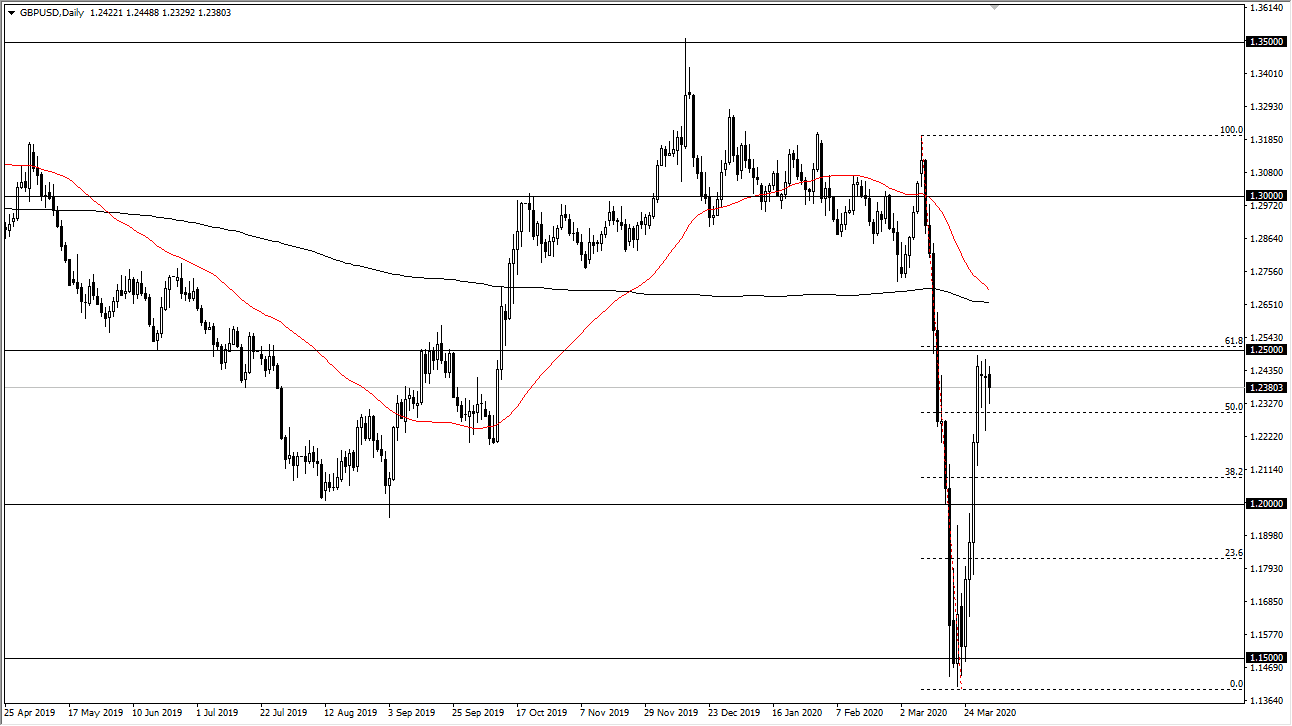

The British pound fell during most of the trading session on Wednesday, but as you can see, we also have a bit of a bounce. When you look at the last several trading candles, you can see that the market continues to try to press against the 1.25 level above. It’s not until we break above there that it is truly a market that you should be buying for a bigger move, but at this point it’s obvious that the 1.25 level offers extraordinarily difficult resistance to deal with.

If we can break down below the lows of the longest hammer on the chart over the last week, the Tuesday candlestick, then I believe that this market probably falls apart and then goes down to the 1.20 level at the very least, if not further. The British pound of course is looking at a home economy that is falling apart and it’s likely than the US dollar will continue to attract a bit of attention, as there are so many problems out there. Furthermore, the liquidity of the US dollar has picked up a bit, but at the end of the day it’s obvious that the 1.25 level has been extraordinarily difficult to break above.

Three hammer like candle sticks in a row of course is a very bullish sign, so one would expect that a lot of retail traders are stepping in and trying to buy right here. It’s not until we actually clear the area that it becomes a viable trade. On the other hand, if the buyers get blown out here, look out below because the market has been far too parabolic. We are certainly at an interesting level, so keep in mind that this is a market worth paying attention to. I believe that the next couple of days will determine the next 500 pips or so, especially after the Friday jobs report in the United States. One thing is for sure, we should continue to see a lot of noise in the Forex markets, and this pair of course will continue to be one of the main battlegrounds going forward. I believe at this point the fact that the 61.8% Fibonacci retracement level and the 1.25 level converging might be one of the biggest influences on this chart. While people are worried about the United States and the US dollar, the reality is that the United Kingdom is locked down as well.