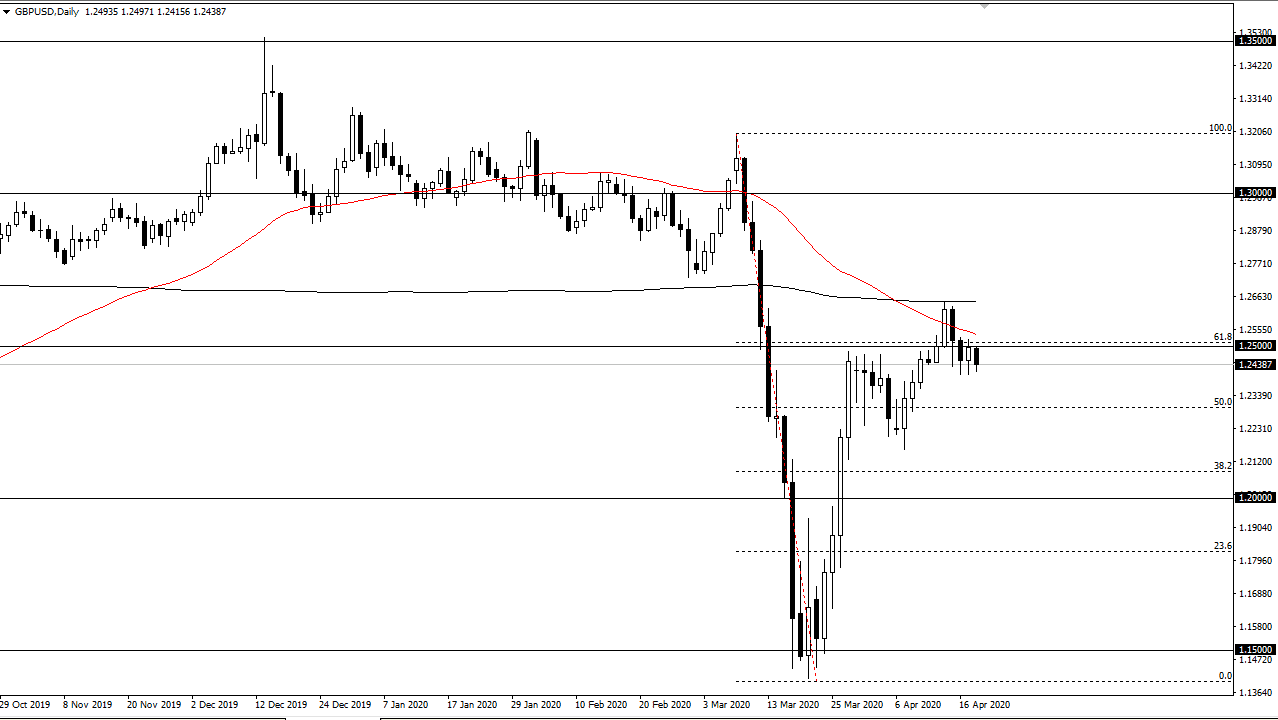

The British pound has broken down a bit during the trading session on Monday, as the 1.25 level continues to be a bit too much for the market. Ultimately, I think that this market does roll over, as we have seen a major rejection a price above the 1.25 handle. If we can break down below the lows of the Friday candlestick, that opens up a move down to the 1.2250 level given enough time, perhaps even lower at this point.

It’s worth noting that the 50 day EMA is offering resistance, the 200 day EMA has offered major resistance, and of course the 61.8% Fibonacci retracement level is in this area as well, as it is just above the psychologically important 1.25 handle. In other words, there is a major confluence of resistance in one spot. I like the idea of shorting this pair on smallpox to the upside, because I recognize that it may take several attempts to break this down significantly. There was a massive move to the upside, and one has to wonder whether or not the British pound has simply gotten “over its skis” at this point.

Looking at the chart, you can make an argument for the bullish flag that had previously kicked off to be a major sign, but what I don’t like is the way the market is behaving afterwards. Furthermore, it’s very likely that the shutdown in global economies will change everything. After all, the United Kingdom is likely to be locked up for much longer than many of the other economies out there, and of course we have the US dollar offering a bit of safety, so at this point it’s likely that we will eventually see this market rollover but it has been rather resilient.

As far as buying is concerned, it’s difficult to do so until we break above the 200 day EMA at this point, or at the very least the 1.25 handle on a daily close. All things being equal though, the British pound has kind of has been in its own realm of reality, and therefore it’s been a great place to lose money. At this point though, it certainly looks as if the downward momentum is starting to pick up and send this lower. Currently, my default case is that we go looking towards the 1.2250 level but that does not mean it’s going to be very easy.