The British pound has broken down significantly during the trading session on Thursday only to find buyers below the 1.24 handle. That is an area that extends all the way down to the 1.2250 level as far as support is concerned, so it’s very possible that although things look very negative for the British pound in general and of course risk appetite, this pair could be more of a grind to the downside than anything else.

Under normal circumstances, I would suggest that there should be a lot of support underneath that will continue to push this market to the upside. However, with the United Kingdom extending its lockdown and having a whole slew of issues, it’s very likely that the British pound is going to soften over the longer term. That being said, there is so much in the way of noise all the way down to the 1.2250 level that I think it’s going to be difficult to short this pair without a certain amount of wherewithal. For what it’s worth, as we roll into the Friday session, the weekly candlestick is going to form a shooting star. However, we will have to see how Friday pans out by the close.

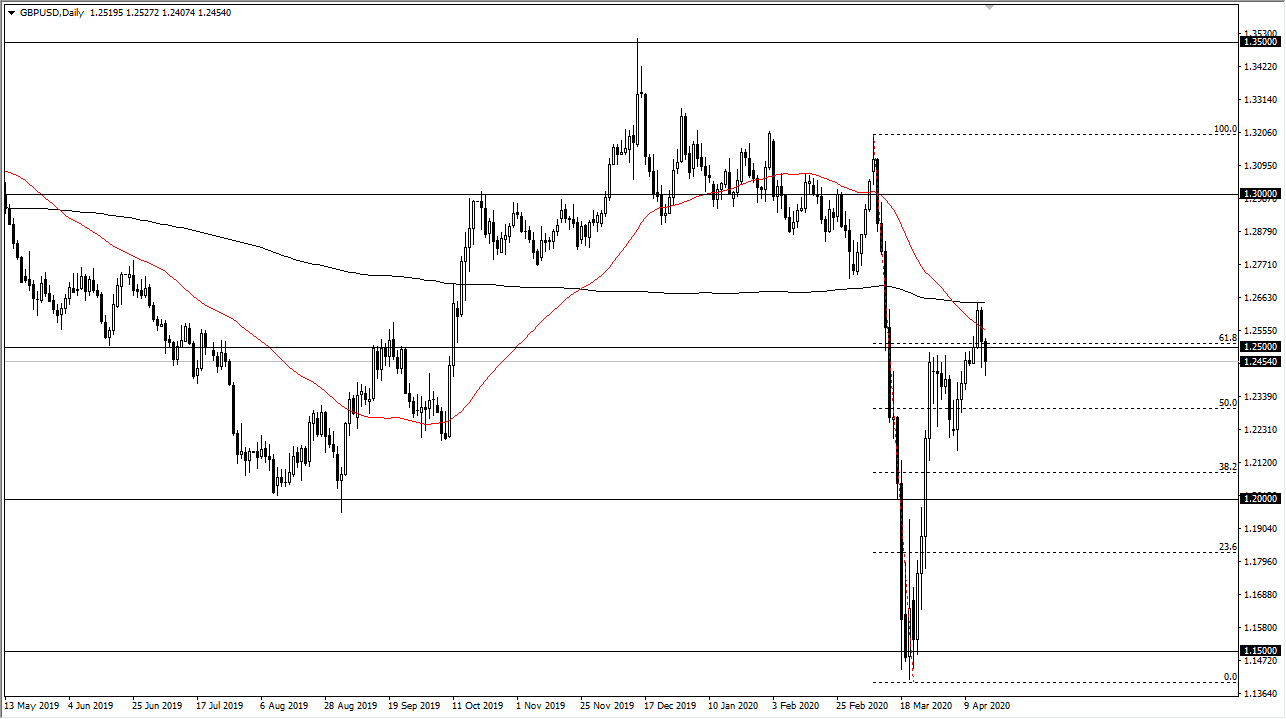

The 200 day EMA above has offered significant resistance as you can see, which is quite common. Furthermore, you could also make an argument for the 61.8% Fibonacci retracement level offering resistance right at the 1.25 handle as well. With the United Kingdom locking down and the possibility of the United States opening up sooner rather than later, this will also be negative for this pair. Beyond that, the United Kingdom still has to deal with the entire Brexit situation which is something that nobody has even thought of over the last month or so. In other words, there is a ton of uncertainty when it comes to the British pound at the moment.

All of that being said, if we broke above the 200 day EMA then it’s a very bullish sign, and probably opens up the door to the 1.2750 level, and then the 1.30 level after that. All things being equal, I think that the Friday session will be crucial, but I would be waiting for a little bit more clarity before putting a lot of money to work in this pair. If you are looking to buy the US dollar, there are other currencies out there that will put up much less of a fight, as we have seen the British pound be so stubbornly resilient.