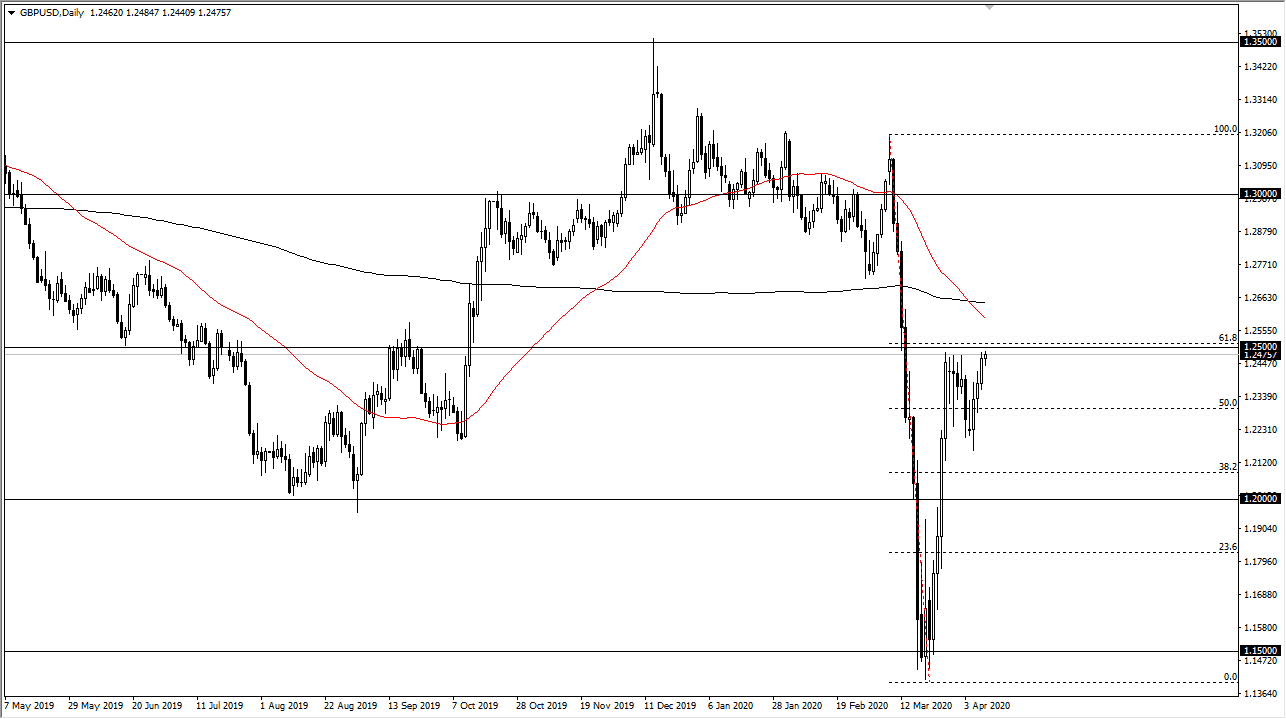

The British pound initially dipped on Friday, but as it was Good Friday there would have been a significant lack of volume. Nonetheless, the 1.25 level above offers significant resistance as we have seen for quite some time. With that being said, when we get to the Monday opening it will be interesting to see whether or not the headlines over the weekend move anything. At this point, I think of the gap above the 1.25 level it would be a sign that the market is ready to finally break above this area.

For what it’s worth, the GBP/JPY pair has broken above the ¥135 level, which was similar resistance in that market. That being the case, the GBP/USD pair may follow suit. Keep in mind that the US dollar has been weakened by the Federal Reserve, so a breakout would not be a huge surprise. With the Federal Reserve offer and now the $2 trillion worth of fiscal stimulus, that should in theory work against the value of the greenback. However, there is the alternate scenario would be will begin to worry about what the Federal Reserve knows and is reacting to. Sometimes, these types of moves work against the markets a little further down the road.

If we do break out to the upside, I believe that the market will go looking towards the 1.27 handle. The 200 day EMA is just below there, so don’t be overly surprised if we see a little bit of resistance in that region. Having said that, the market has formed a bullish flag underneath, which measures for a huge move, with at least a move to the 100% Fibonacci retracement level which is all the way up at the 1.32 handle. Obviously, there are a lot of resistance barriers between here and there, not the least of which would be the psychologically significant 1.30 level. This is probably going to be more or less an indictment on the US dollar than some type of huge push for the British pound, but you should also keep in mind that the Australian dollar has broken out, so I do feel that it’s probably only a matter of time before the British pound follows suit. However, if we break down below the bottom of the Friday candlestick, I anticipate that we will probably go looking towards 1.22 level for support again.