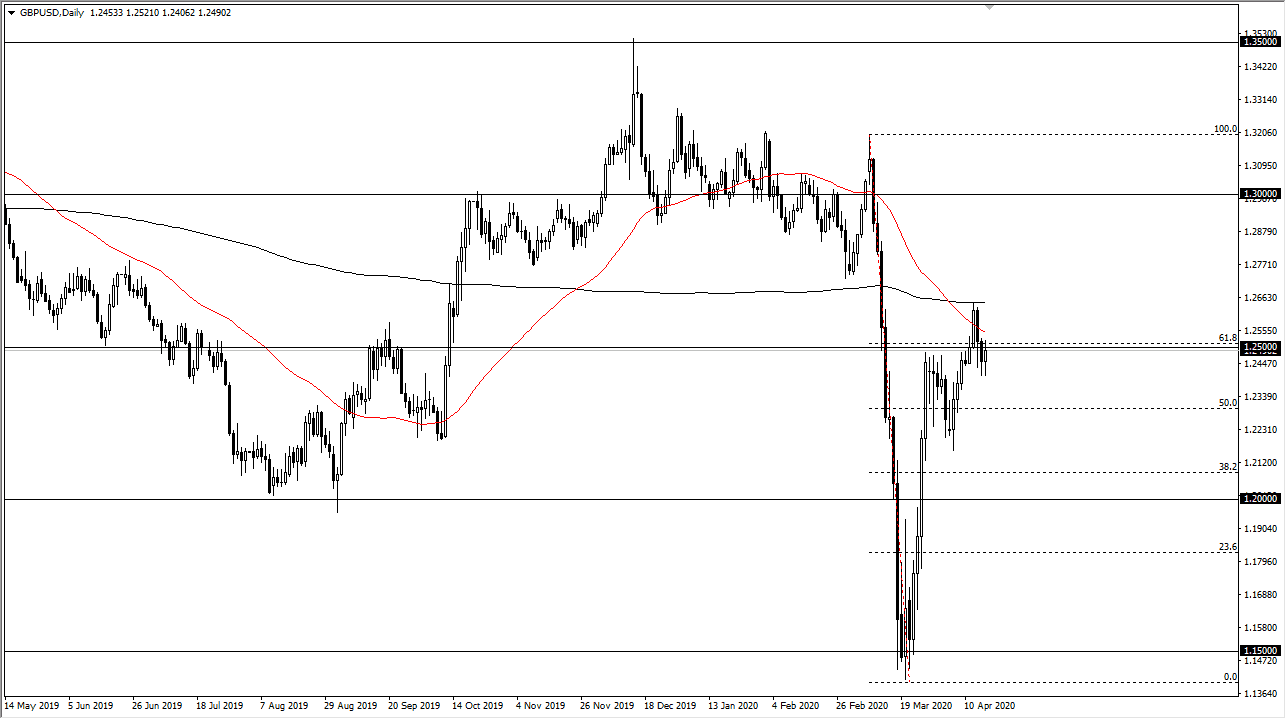

The British pound initially pulled back during the trading session on Friday but turned around to reach slightly above the 1.25 level. That’s an area that I have been saying should be rather crucial as of late, and what’s worth being noted is that the weekly candlestick is a massive shooting star, and therefore I think it’s very likely that we could see some selling come back into this market.

Don’t get me wrong, I don’t necessarily think that the market is going to melt down, but a break down below the low of both Thursday and Friday would be an extraordinarily negative sign. That would have this market looking towards 1.2250 level, the bottom of the consolidation that had led to the attempt to break out. Beyond that, treasury markets barely moved during the trading session on Friday, so it shows that even though the US dollar lost a bit of strength against several currencies, the reality is that there is still a huge demand for greenbacks. Because of this, I do believe that eventually gravity gets to the British pound, and we have to pull back a bit.

On the other hand, if we were to break above the 200 day EMA, where we pull back from on Tuesday, then the market could go as high to the 1.30 level. That would be an extraordinarily bullish sign, and probably would have something to do with a massive “risk on” type of move around the world. Obviously, anything can happen over the weekend but at this point I just don’t see what it would be. This isn’t to say that we can’t rally a bit, but I think that the 200 day EMA above is going to be extraordinarily difficult to overcome. If we break down below the low of both the Thursday and Friday candlesticks, I will be short of this pair and looking for at least a couple of handles. If we can break down below the 1.22 level, then the 1.20 level underneath would be the next logical target for sellers to try to reach towards. On top of everything else, the 50 day EMA and the 61.8% Fibonacci retracement level are right here where we finished the week as well, so that could cause some technical issues for those trading the Pound anyway. Be cautious, patient, and most of all reasonable in your trading size.