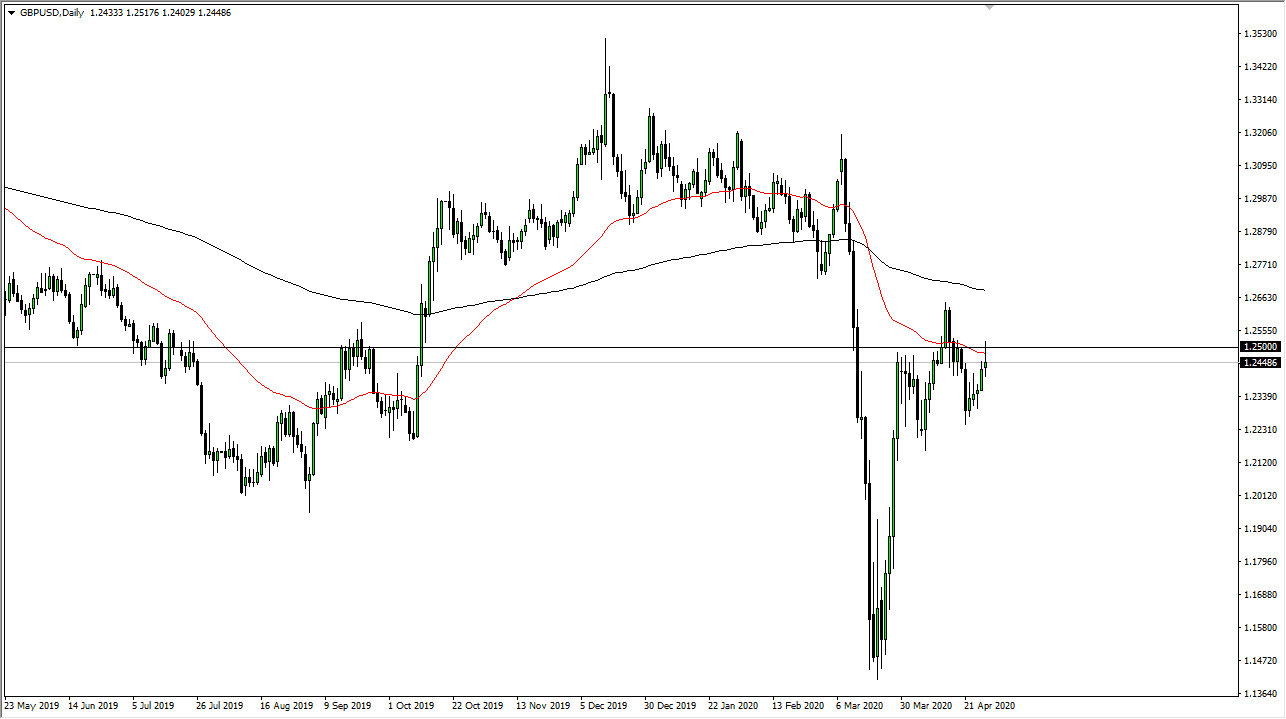

The British pound initially rally during the trading session on Tuesday, breaking above the 1.25 handle. By doing so, it showed extreme amounts of bullish pressure, but at the end of the day we ended up turning around and forming a massive shooting star. The shooting star is of course an extremely negative sign, so if we can break down below the bottom of the candlestick it is a technical signal to start selling. The British pound has been overbought, so having said that we should continue to see a lot of noise.

If we break down below the bottom of the candlestick, from a technical analysis standpoint it is likely that we go down to the 1.2250 level underneath. At this point, that level should be thought of as support and a potential target, but if we break down below there then it opens up the move down to the 1.20 level after that. Keep in mind that the British pound has to deal with the British economy, and of course the fact that the United Kingdom will be locked down much longer than the United States. What as even more fuel to the fire potentially is that the Federal Reserve it gives a statement at the end of the day on Wednesday.

If we do in fact see the Federal Reserve come and go without causing major issues, it is highly likely that we could see a bit of a pullback. Furthermore, if we get a drop from here it is possible, we may get some type of head and shoulders pattern, which brings more clarity into the picture as well. Alternately, if we break above the top of the shooting star during the trading session on Tuesday, then it is likely that the market may go looking towards 1.2850 level. The 200 day EMA above also could cause some resistance, and it would make an ideal target for short-term buyers. That being said, I do prefer the downside over the longer term as we clearly have a lot of negativity out there just waiting to happen. Expect more volatility and keep your position somewhat small until after we get beyond the Federal Reserve. And 24 hours, I anticipate that we will have quite a bit more clarity when it comes to the directionality of this pair going into the future.