The British pound had rallied a bit during the trading session initially on Wednesday but turned around to show signs of exhaustion. At this point, the market is likely to continue to see rallies sold into, and it has clear that the market has seen a complete turnaround during the trading session, as the 1.24 level appears to be too much in the way of bullishness for the market to hang onto.

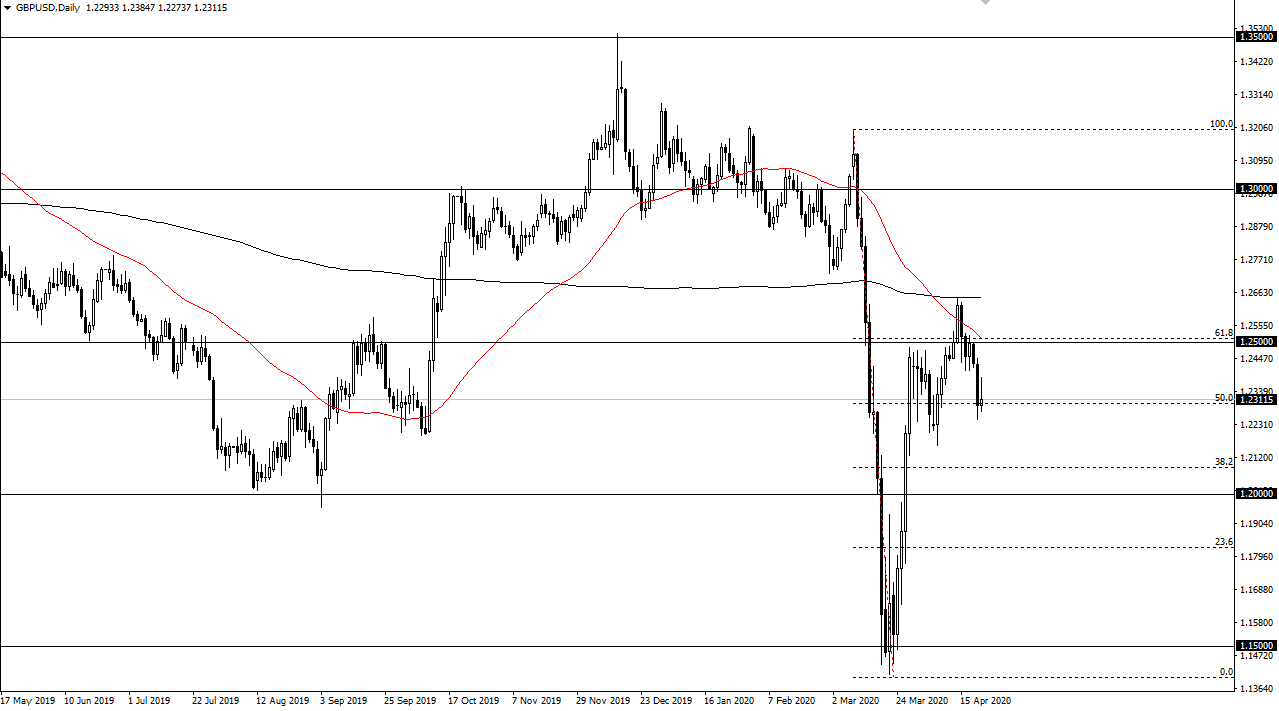

The market had recently peaked at the 61.8% Fibonacci retracement level so it is highly likely that we will continue to see bearish pressure from a longer-term standpoint. The British pound of course suffers at the hands of the United Kingdom been lockdown even longer, and of course the demand for the US dollar. That being said, it was more of a “risk on” session during the day on Wednesday, and that of course worked in favor of other currencies beyond the US dollar. That being said though, the market is likely to see sellers given enough time, and I do think that we probably break down towards the 1.22 handle. I like the idea of fading rallies on short-term charts, something that has shown itself to be important on Wednesday. All things being equal, it is highly likely that we continue to see more of a downward press on this pair.

To the upside, it is not until we break above the 61.8% Fibonacci retracement level at the very least that I would be a buyer, perhaps even the 200 day EMA above there. I do believe that it is only a matter of time before the sellers take over again, so I am more convinced that we are going to see the market reached towards the 1.22 level, possibly even the 1.20 level under there before we see the 1.26 level. Expect a lot of volatility, so having said that it is likely that the trading opportunities will come fast and furiously, but I still believe in the downside and look at those opportunities while I completely ignore buying opportunities until we break out to the upside. Ultimately, the volatility is going to continue to be a major mainstay of markets in general, and this one of course will be any different. I do not know if we can break down below the 1.20 level, but clearly the market favors the downside after the candlestick that we had formed during the trading session on Wednesday, because not been able to hang on to gains is a classic sign of weakness.