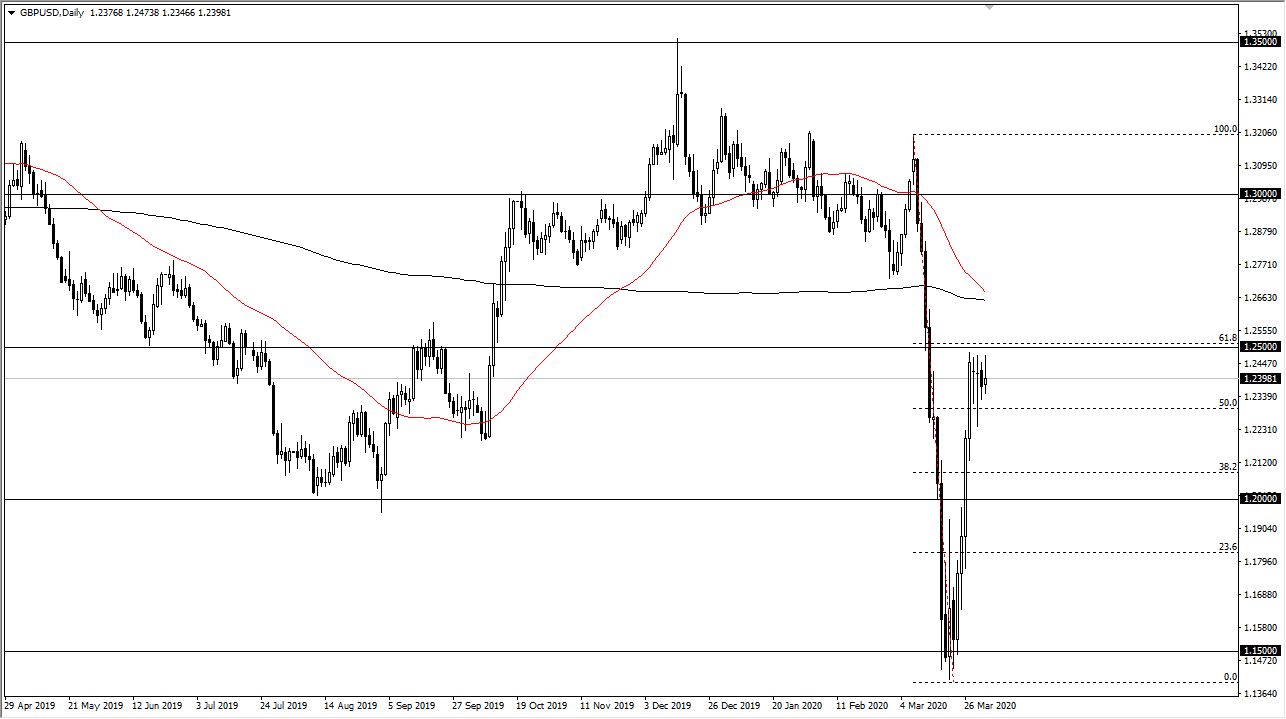

The British pound has rallied a bit during the trading session on Friday to show signs of strength before turning around to form a shooting star like candlestick. Ultimately, this is a market that continues to see the 1.25 level has been massive resistance, and now that we are heading into the Non-Farm Payroll figures on Friday, it makes quite a bit of sense that we are going to hesitate to try to break out. If we were to break out above the 1.25 handle, then it’s likely that the market will show a significant move.

If we did see that happen, it’s likely that the market then goes to the 200 day EMA, possibly even the 1.2750 level. Ultimately, the daily candlestick on Friday will probably tell us where we are going next. The fact that the Thursday candlestick does look like a shooting star suggests to me that we could very well roll over. If the market was to reach above that 1.25 handle it would show extreme US dollar weakness. However, if we were to break down below the lows of the week, then I think it sends this market down towards the 1.20 level. That isn’t necessarily something that will be easy to hang onto, but it certainly looks as if we could end up doing that. After all, the market has been rather parabolic as of late, and at the very least you need to see the markets calm down and kill a bit of time before breaking out to the upside.

The next impulsive candle could very well be the signal that longer-term traders will look towards, as the market has gone all over the place as of late. The 61.8% Fibonacci retracement level is sitting just above that 1.25 level so it certainly would favorite downside move, but the strength of the move to the upside can’t be ignored. I somehow get this sneaking suspicion that by the end of the week we could have some clarity as we close out the books for the weekend. However, keep in mind that things could be rather choppy during the announcement. Once we get through this, this could set up for a very nice move for or traders you are patient enough to take advantage of the potential set up. Expect a lot of danger so keep your position size relatively small.