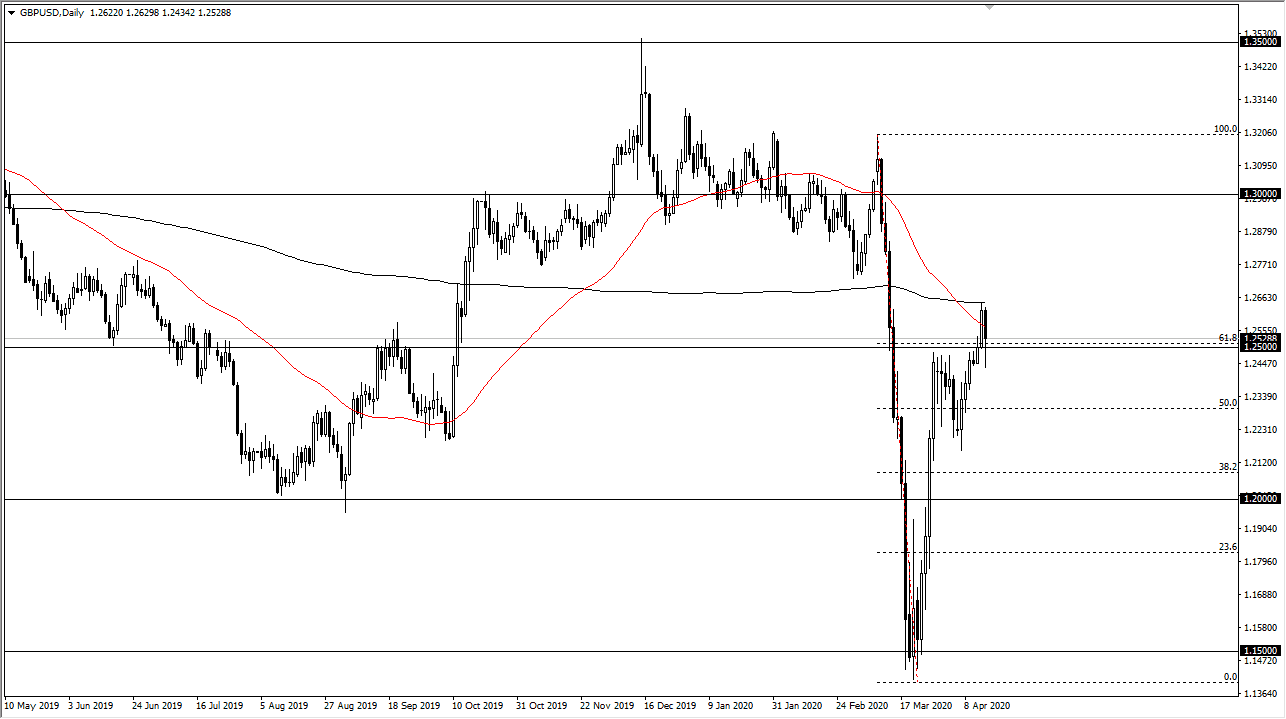

The British pound has pulled back during the trading session on Wednesday, breaking well below the 1.25 handle before bouncing a bit. That being said, it does look like the 1.25 level is offering a certain amount of support. This makes sense, considering there was a bullish flag underneath there in I think there’s just a lot of noise in general. While I am very bullish of the US dollar in general, I don’t know that the British pound is going to break down like some of the other currencies almost certainly will. After all, it is at such a historically low level that I think there is a lot of interest in trying to only for the longer term.

Underneath, I think there is plenty of support down to the 1.2250 level, so it’s not until we break down below there that I think the longer term downtrend would continue. Don’t get me wrong, it certainly can happen, but it’s a much bigger fight to take on then to short some of the other currencies against the US dollar such as the Australian dollar as an example. Other examples might include the New Zealand dollar, the Canadian dollar, and so on.

That being said, I don’t necessarily think that the British pound is going to have the easiest move to the upside. After all and stop dead at the 200 day EMA and that of course is something that a lot of people pay attention to. With that being the case, I think we are going to see a lot of choppy trading and it’s more of an intraday situation than anything else. However, if we get some type of bloodied day on Wall Street or in Europe, the market will more than likely go looking towards the safety the greenback, and that will have a bit of a “knock on effect” over here. To the upside, if we get a daily close above the 200 day EMA, pictured in black on the chart, then I think we go looking towards 1.2750 level, and then eventually the 1.30 level after that. While I do not think that’s impossible, I do find it very unlikely at this point. All things being equal though, we always have to keep both sides of the equation in the back of her head and with the United Kingdom being locked down and Brexit still needed to be worked through, I’m a bit skeptical on the British pound in the short term.