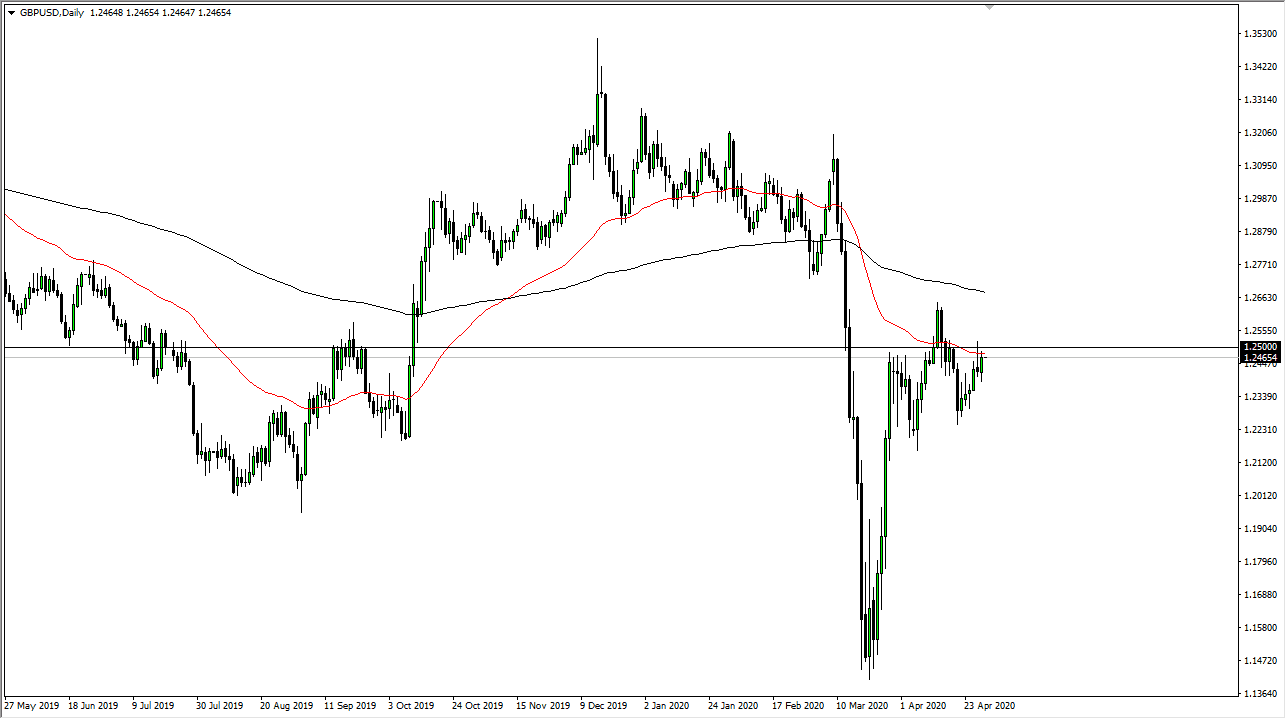

The British pound has struggled to break above the 1.25 level again during the trading session on Wednesday, even as Federal Reserve Chairman Jerome Powell suggested that the Federal Reserve was willing to liquefy markets forever. That of course is a bit of an exaggeration, but the reality is that markets are nowhere near seen a normalized Federal Reserve.

However, at the end of the day the United Kingdom has much more in the way of problems when it comes to the economy, and therefore I think it is probably only a matter of time before we see this market break apart. With that being the case, I like the idea of jumping in and shorting this market on rallies like we have seen during the trading session on Wednesday. What is rather telling for me is that we could not take out the 50 day EMA or the 1.25 handle. This looks like a market that is desperately trying to find some type of reason to break down, and even with the Federal Reserve the when everything you can to bring down the value of the US dollar, the British pound could not break out which is quite interesting to say the least. In fact, it should be noted that the US dollar was somewhat resilient.

When I look at this market, I do recognize that if we were to break out above the 1.26 level, then it is likely that the market could go towards the 1.30 level. That is a bit difficult to imagine in this environment though, although it is not impossible. All things being equal, if we break down from here and go lower, it is likely that we go towards the 1.23 level, an area that was rather supportive. If we break down below there, then it is likely that the market goes looking towards 1.22 handle, perhaps even followed by the 1.20 level after that. I do not like buying this market, and I believe that it is only a matter of time before the sellers come back in based upon the fact that we could not take off on a day that quite frankly it should have. That being said that breakout could change my mind, but I am a bit surprised that we could not hang on to gains to slice through resistance. It is a matter of “if they cannot break out now, when can they?”