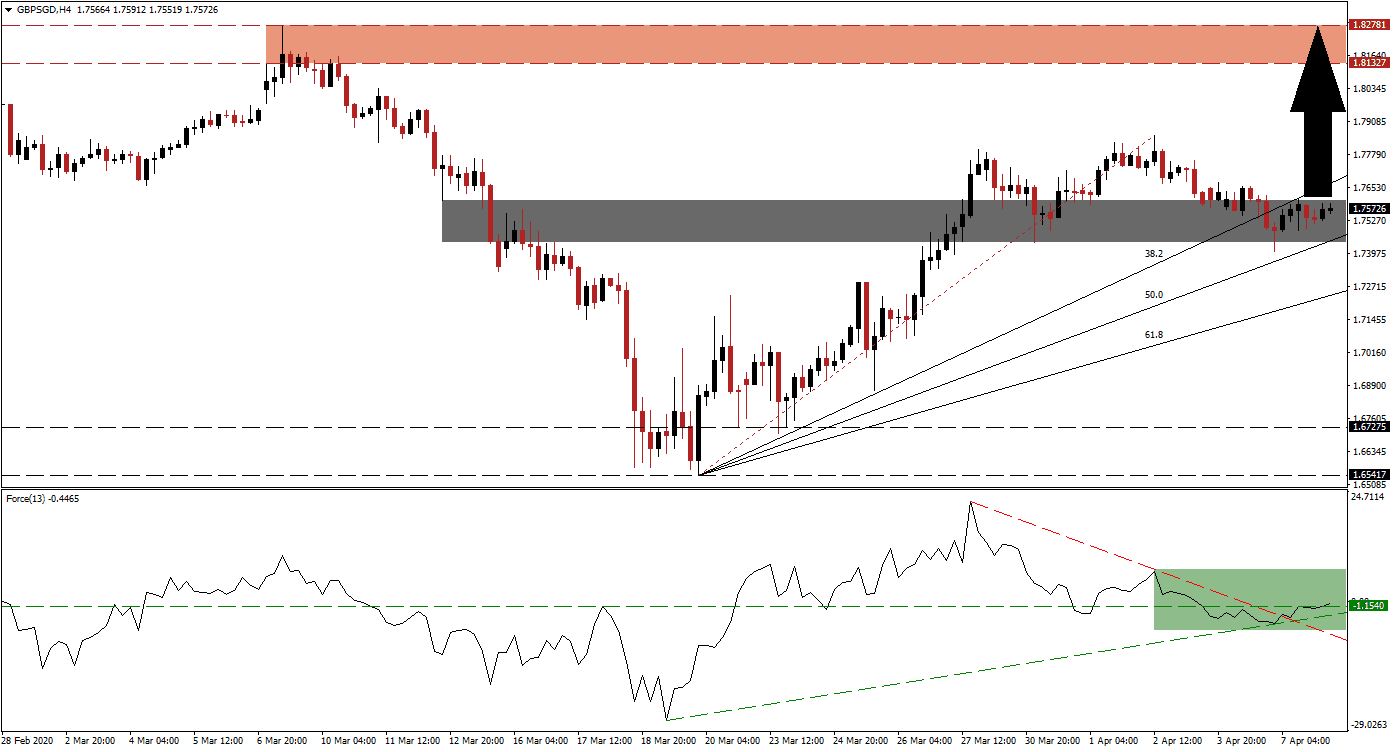

UK Prime Minister Johnson remains in intensive care, and First Secretary of State Raab has deputized the PM since Monday. While expectations for a sharp economic contraction due to the global Covid-19 pandemic is widely accepted for the second quarter, plans for a post-virus world indicate critical changes. New austerity measures are being proposed after governments spiked deb levels, while long-term GDP growth is predicted to slow significantly. Economies will struggle to adapt to change, but the UK is better positioned than many others to transition into a low-growth environment. The GBP/SGD converted its short-term resistance zone into support, from where a breakout is anticipated.

The Force Index, a next-generation technical indicator, shows the gradual increase in bullish momentum. After a brief dip below its horizontal support level, it reversed off of its ascending support level, as marked by the green rectangle. The Force Index also eclipsed its descending resistance level, which now serves as a temporary support. This technical indicator is on course to cross above the 0 center-line, placing bulls in control of the GBP/SGD. You can learn more about the Force Index here.

Price action is expected to follow bullish momentum higher by accelerating out of its short-term support zone located between 1.74423 and 1.76036, as identified by the grey rectangle. The ascending 50.0 Fibonacci Retracement Fan Support Level is adding to breakout pressures in the GBP/SGD. Singapore boosted its economic stimulus to S$59.9 billion or 12% of GDP, signaling the severe damages the virus is causing to output. Rising debt levels will become the focus after the peak of the pandemic has been identified.

A breakout in the GBP/SGD above its 38.2 Fibonacci Retracement Fan Resistance Level will provide the required technical catalyst to elevate price action into its resistance zone. This zone is located between 1.81327 and 1.82781, as marked by the red rectangle. One crucial adjustment to the world economy will be adjustments to supply chains with a focus on domestic sovereignty. Brexit granted the UK an essential head start into economic transformation, generating a long-term bullish bias for the British Pound.

GBP/SGD Technical Trading Set-Up - Breakout Scenario

- Long Entry @ 1.75700

- Take Profit @ 1.82700

- Stop Loss @ 1.74000

- Upside Potential: 700 pips

- Downside Risk: 170 pips

- Risk/Reward Ratio: 4.12

In case the Force Index collapses below its descending resistance level, the GBP/SGD is likely to be pressured into a minor correction. Given existing fundamental conditions, the downside potential appears limited to its intra-day low of 1.68718, the last instance price action reversed off of its 61.8 Fibonacci Retracement Fan Support Level. Forex traders are recommended to consider any contraction from current levels as a buying opportunity.

GBP/SGD Technical Trading Set-Up - Limited Breakdown Scenario

- Short Entry @ 1.72700

- Take Profit @ 1.69200

- Stop Loss @ 1.74000

- Downside Potential: 350 pips

- Upside Risk: 130 pips

- Risk/Reward Ratio: 2.69