Gilead Sciences Phase 3 trials of remdesivir, one of the earliest drugs mentioned as a potential cure to Covid-19, showed promising results in a test of 125 patients. Optimism is accelerating that it could be a cure, but it is important to note a similar pattern with the same drug in the fight against Ebola, which eventually turned out to be a failure. While a cure is paramount, and more essential than a vaccine, to lift nationwide lockdowns, complacency over long-term negative impacts are the primary risk in financial markets. It is evident in the UK’s Office for Budget Responsibility (OBR) scenario for a sharp recession, followed by a massive recovery in 2021. Despite the misplaced optimism, the economy is more diverse than that of New Zealand, resulting in a mild bullish bias for the GBP/NZD. A renewed advance off of its short-term support zone is anticipated.

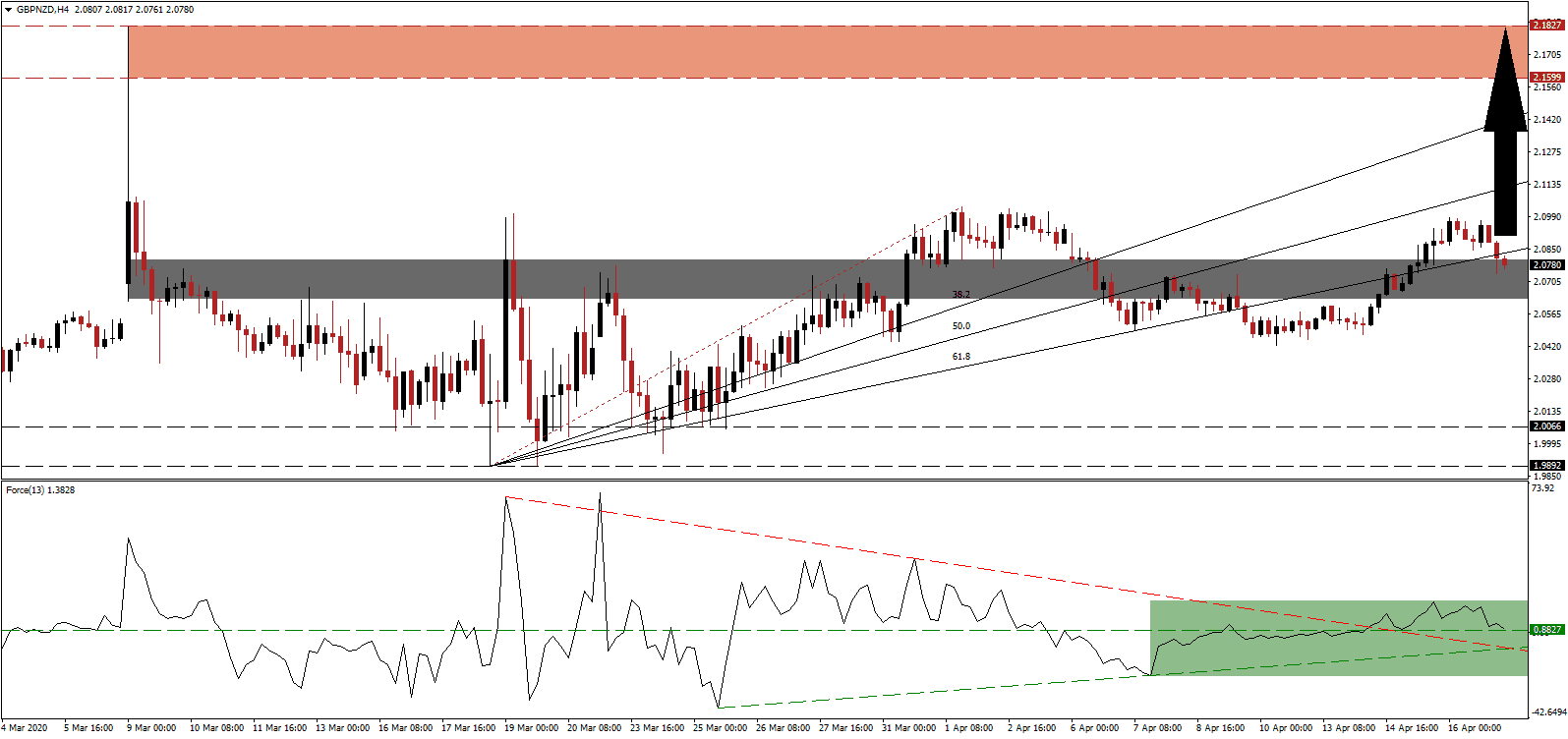

The Force Index, a next-generation technical indicator, bounced off of its ascending support level and a higher low. After converting its horizontal resistance level into support, bullish momentum sufficed to elevate the Force Index above its descending resistance level. This technical indicator remains in positive territory, as marked by the green rectangle, with bulls in control of the GBP/NZD. More upside is expected to materialize.

Price action confirmed its short-term support zone located between 2.0619 and 2.0799, as marked by the grey rectangle, with a breakout and subsequent retracement. The entire Fibonacci Retracement Fan sequence crossed above this zone, but the GBP/NZD dipped below its ascending 61.8 Fibonacci Retracement Fan Resistance Level. The New Zealand economy is heavily dependent on China, which reported a 9.8% decrease in the first-quarter GDP, due to the global Covid-19 pandemic, initially reported in Wuhan province. A sharp contraction was expected, and it remains essential to be patient until the release of second-quarter data.

Due to dominant bullish momentum, the GBP/NZD is favored to convert its 61.8 Fibonacci Retracement Fan Resistance Level into support and resume its advance. Adding a bullish catalyst is the absence of a plan forward in New Zealand, which often relies on massive infrastructure programs in times of economic worries. That strategy appears to be running out of road. Price action is well-positioned for a breakout and acceleration into its resistance zone located between 2.1599 and 2.1827, as identified by the red rectangle.

GBP/NZD Technical Trading Set-Up - Breakout Scenario

Long Entry @ 2.0775

Take Profit @ 2.1825

Stop Loss @ 2.0475

Upside Potential: 1,050 pips

Downside Risk: 300 pips

Risk/Reward Ratio: 3.50

In the event of a collapse in the Force Index below its descending resistance level, the GBP/NZD is likely to enter a minor corrective phase. The downside potential remains limited to its long-term support zone located between 1.9892 and 2.0066, with the essential psychological level of 2.0000 adding a floor under any contraction. Forex Traders are advised to view any sell-off as an excellent buying opportunity on the back of a long-term bullish outlook.

GBP/NZD Technical Trading Set-Up - Limited Correction Scenario

Short Entry @ 2.0350

Take Profit @ 2.0050

Stop Loss @ 2.0475

Downside Potential: 300 pips

Upside Risk: 125 pips

Risk/Reward Ratio: 2.40