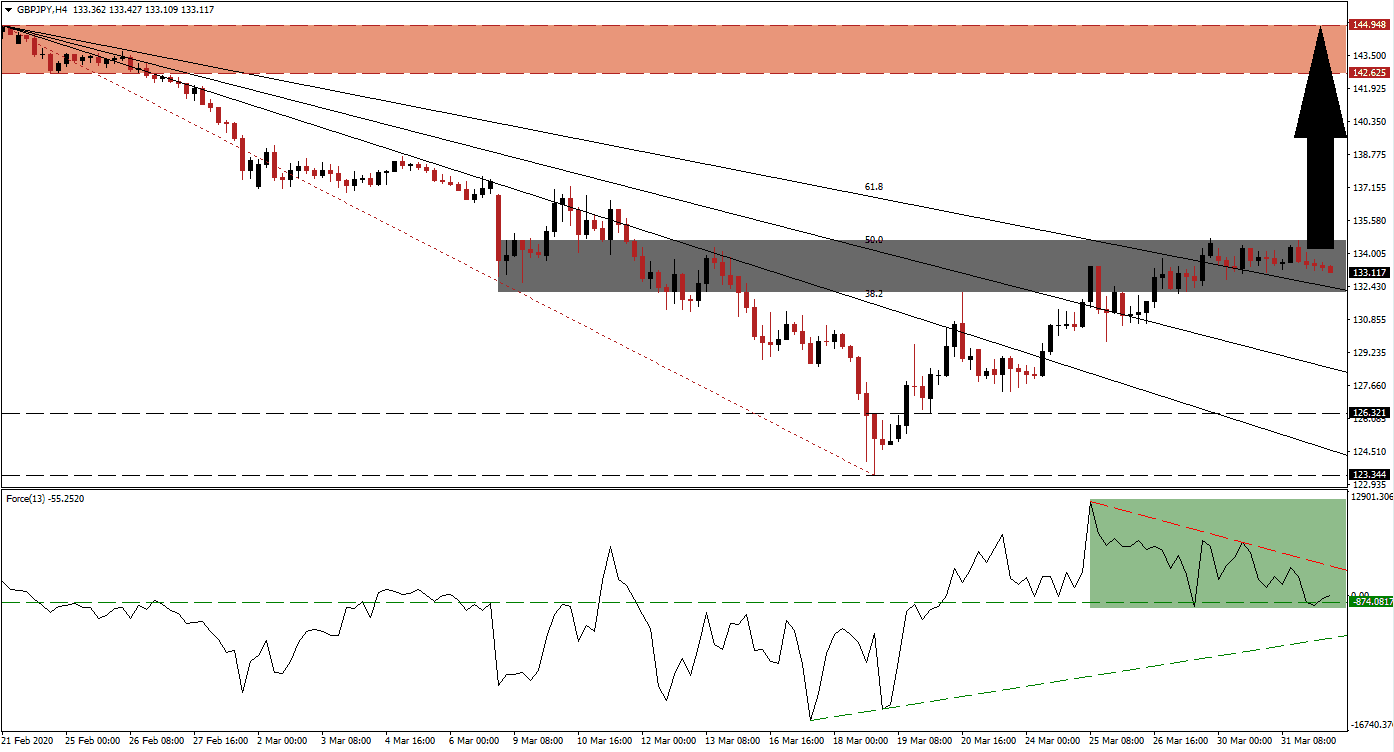

Japan released its first-quarter Tankan Survey, which showed service sector resilience. It is worth noting that Covid-19 related disruptions were not evident until the last third of the period this survey covered. The outlook is negative across the board and most evident in the smaller companies. The reaction in the GBP/JPY was muted with price action stable inside of its short-term support zone after it pushed through its descending 61.8 Fibonacci Retracement Fan Resistance Level. Bullish momentum is stable following a minor retreat, establishing conditions for a breakout extension.

The Force Index, a next-generation technical indicator, confirmed the advance in this currency pair by reaching a new high. It has since reversed, but the horizontal support level prevented two breakdown attempts, as marked by the green rectangle. The ascending support level is adding to upside pressures on the Force Index, while the descending resistance level is narrowing the gap to the horizontal support level. This technical indicator is anticipated to spike higher, confirming bulls are in control of the GBP/JPY.

A ¥60 trillion economic stimulus package was requested by Japanese Prime Minister Abe to combat the fallout of the global pandemic. The Tokyo Olympic games were postponed, and Japan’s export sector is under pressure. Adding to economic worries is the safe-haven appeal of the Japanese Yen. After the UK’s initially slow response to the virus, the government stepped-up efforts and is now getting ahead of it. The GBP/JPY is taking a temporary pause inside of its short-term support zone located between 132.144 and 134.615, as marked by the grey rectangle, from where more upside is expected.

Price action may dip into its converted 61.8 Fibonacci Retracement Fan Support Level, from where a breakout can accelerate the GBP/JPY into its resistance zone. This zone is located between 142.625 and 144.948, as identified by the red rectangle. Volatility is favored to remain elevated, as global equity markets are likely to face more selling pressure. Many countries fail to implement proper responses to the virus and remain reactive rather than proactive. The UK’s current stance and fiscal position create a distinct bullish bias for this currency pair. You can learn more about a breakout here

GBP/JPY Technical Trading Set-Up - Breakout Scenario

Long Entry @ 133.100

Take Profit @ 143.100

Stop Loss @ 130.500

Upside Potential: 1,000 pips

Downside Risk: 260 pips

Risk/Reward Ratio: 3.85

In case of a collapse in the Force Index below its ascending support level, the GBP/JPY is likely to enter a minor corrective phase. Forex traders are advised to consider a breakdown from current levels as an outstanding buying opportunity. The downside potential is limited to its 38.2 Fibonacci Retracement Fan Support Level, which entered its long-term support zone located between 123.344 and 126.321.

GBP/JPY Technical Trading Set-Up - Limited Breakdown Scenario

Short Entry @ 128.750

Take Profit @ 124.500

Stop Loss @ 130.500

Downside Potential: 425 pips

Upside Risk: 175 pips

Risk/Reward Ratio: 2.43