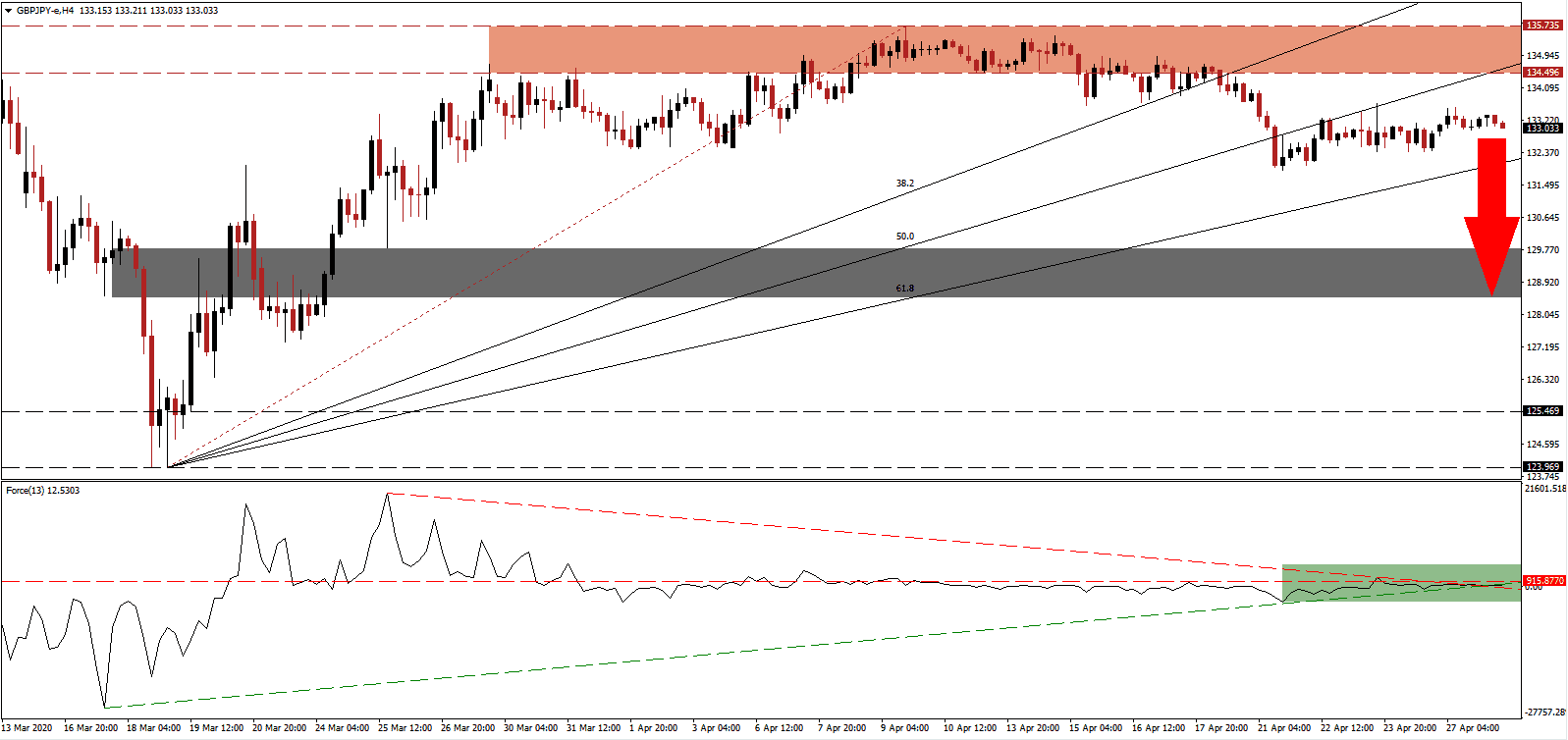

In a positive development, the Cabinet Office is realistic about market developments. In its monthly statement, It notes the rapidly worsening impact caused by the global Covid-19 pandemic. Six out of the eleven components in the report were revised lower, including industrial output and private consumption. While the negative impact on the Japanese economy will be tremendous, the Japanese Yen may advance due to its safe-haven status. Breakdown pressures on the GBP/JPY are on the rise after converting its ascending 50.0 Fibonacci Retracement Fan Support Level into resistance.

The Force Index, a next-generation technical indicator, is faced with the convergence of its ascending support level and its descending resistance level, as marked by the green rectangle. It also remains below its horizontal resistance level, from where this technical indicator is anticipated to collapse below the 0 center-line. Bears will then take control of the GBP/JPY, leading to more selling. You can learn more about the Force Index here.

Boris Johnson, the Prime Minister of the UK, on his first day back in the office after surviving his Covid-19 infection, vowed to kick-start the vast economic engine. He also warned against lifting restrictions prematurely. A balanced approach positions the UK to accelerate out of the crisis and reshape fundamentals after the Brexit transition period ends this year. The long-term outlook for the British Pound is increasingly bullish, but short-term pressures on the GBP/JPY following the breakdown below its resistance zone located between 134.496 and 135.735, as marked by the red rectangle, remain dominant.

Forex traders are advised to monitor the 61.8 Fibonacci Retracement Fan Support Level, as a breakdown is likely to result in the addition of new net short positions. Additionally, it will deliver the required volume to collapse the GBP/JPY into its short-term support zone located between 128.560 and 129.842, as identified by the grey rectangle. An extension of the corrective phase will require a massive fundamental catalyst, which is unlikely to materialize. Japan’s worsening outlook, on top of economic weakness before the pandemic, further reduces the downside potential in this currency pair.

GBP/JPY Technical Trading Set-Up - Short-Term Breakdown Extension Scenario

- Short Entry @ 133.000

- Take Profit @ 129.000

- Stop Loss @ 134.100

- Downside Potential: 400 pips

- Upside Risk: 110 pips

- Risk/Reward Ratio: 3.64

A sustained breakout in the Force Index above its ascending support level is expected to pressure the GBP/JPY back into its resistance zone. Given the brightening long-term economic outlook for the British economy, more upside is likely to follow the temporary contraction in this currency pair. Forex traders are recommended to take advantage of the pending sell-off with new net buy positions. The next resistance zone is located between 137.721 and 138.668.

GBP/JPY Technical Trading Set-Up - Breakout Scenario

- Long Entry @ 135.100

- Take Profit @ 138.650

- Stop Loss @ 133.650

- Upside Potential: 355 pips

- Downside Risk: 145 pips

- Risk/Reward Ratio: 2.45