British Prime Minister Boris Johnson was released from the hospital yesterday after spending one week, including a few nights in intensive care, at St Thomas’ Hospital. While he has not resumed his duties, fears of a power vacuum in the world’s sixth-largest economy eased. Echoing similar discussions around developed economies is the cost-benefit factor of nationwide lockdowns. The UK economy may contract by 25% in the second quarter, far more excessive than during the 2008 global financial crisis. It remains unclear how much longer the most severe response to the global Covid-19 pandemic can be maintained. The GBP/CAD bounced off of its short-term support zone with more upside anticipated.

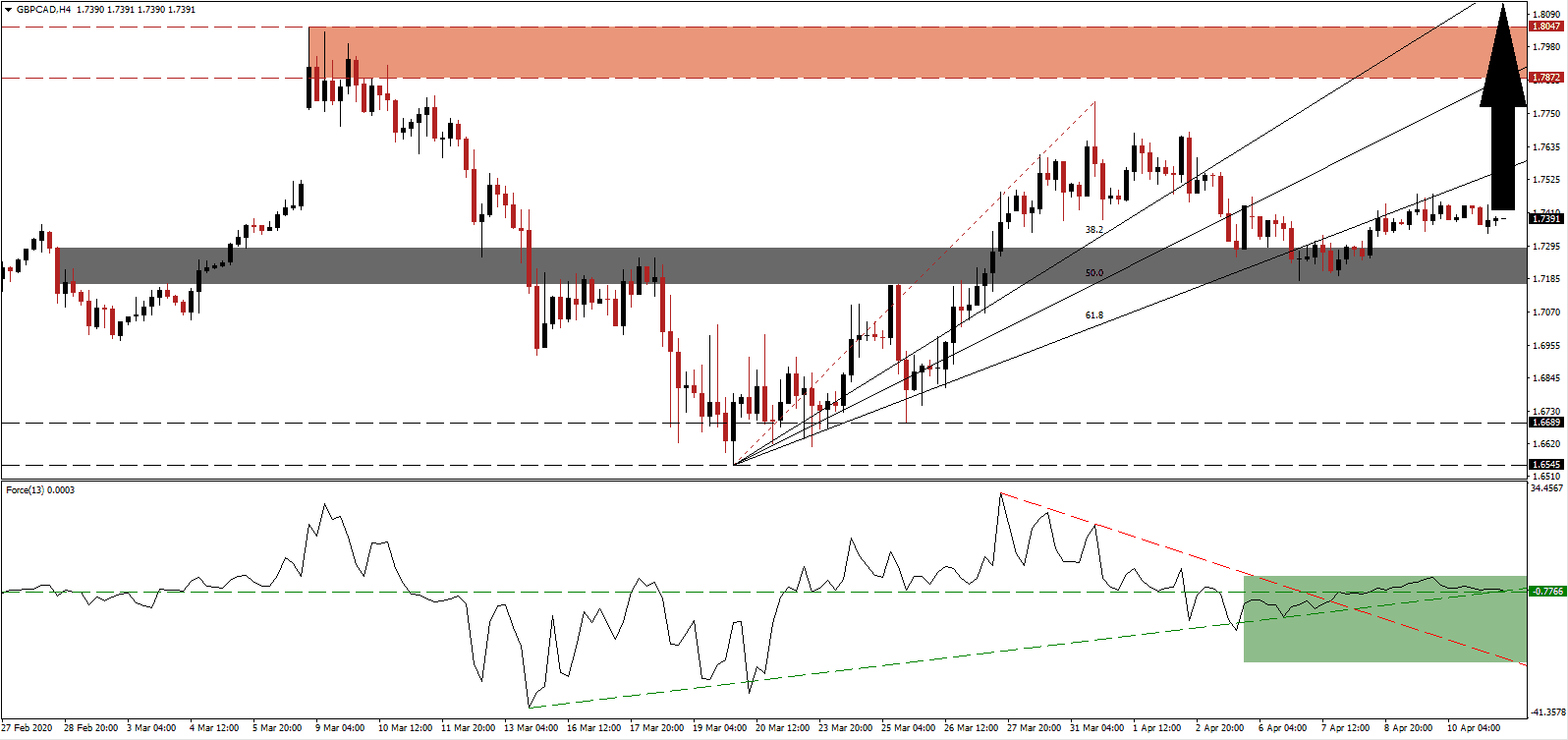

The Force Index, a next-generation technical indicator, formed a higher low and drifted higher with the assistance of its ascending support level. Momentum sufficed to convert its horizontal resistance level into support, as marked by the green rectangle. Breakout pressures increased after the Force Index pushed through its descending resistance level. Bulls took control of the GBP/CAD after this technical indicator crossed above the 0 center-line. An extension of the advance is expected.

After this currency pair retreated from a breakout-peak below its entire Fibonacci Retracement Fan sequence, the counter-trend move ended inside of its short-term support zone. This zone is located between 1.7165 and 1.7290, as identified by the grey rectangle. The GBP/CAD recovered into its ascending 61.8 Fibonacci Retracement Fan Resistance Level before drifting slightly lower. A renewed push to the upside is favored, on the back of continued bullish momentum build-up.

Enhancing the positive outlook for the GBP/CAD is Canada’s dire economic conditions. The country announced 1.010 million job losses for March, more than double the most pessimistic forecast. One essential level to monitor is the intra-day high of 1.7793, the peak of the present breakout sequence, and the end-point of the redrawn Fibonacci Retracement Fan sequence. A push higher will confirm the presence of a long-term bullish chart pattern. Price action is likely to challenge its resistance zone located between 1.7872 and 1.8047, as marked by the red rectangle. An extension of the advance is possible to elevate this currency pairs to highs last seen in March 2018.

GBP/CAD Technical Trading Set-Up - Breakout Extension Scenario

Long Entry @ 1.7390

Take Profit @ 1.8090

Stop Loss @ 1.7200

Upside Potential: 700 pips

Downside Risk: 190 pips

Risk/Reward Ratio: 3.68

A breakdown in the Force Index below its descending resistance level, acting as temporary support, may inspire a short-term sell-off in the GBP/CAD. Forex traders are recommended to consider any contraction below its short-term support zone as an excellent buying opportunity unless a material alteration in dominant fundamental conditions emerges. The downside potential is limited to its support zone located between 1.6545 and 1.6689.

GBP/CAD Technical Trading Set-Up - Limited Breakdown Scenario

Short Entry @ 1.7030

Take Profit @ 1.6690

Stop Loss @ 1.7200

Downside Potential: 340 pips

Upside Risk: 170 pips

Risk/Reward Ratio: 2.00