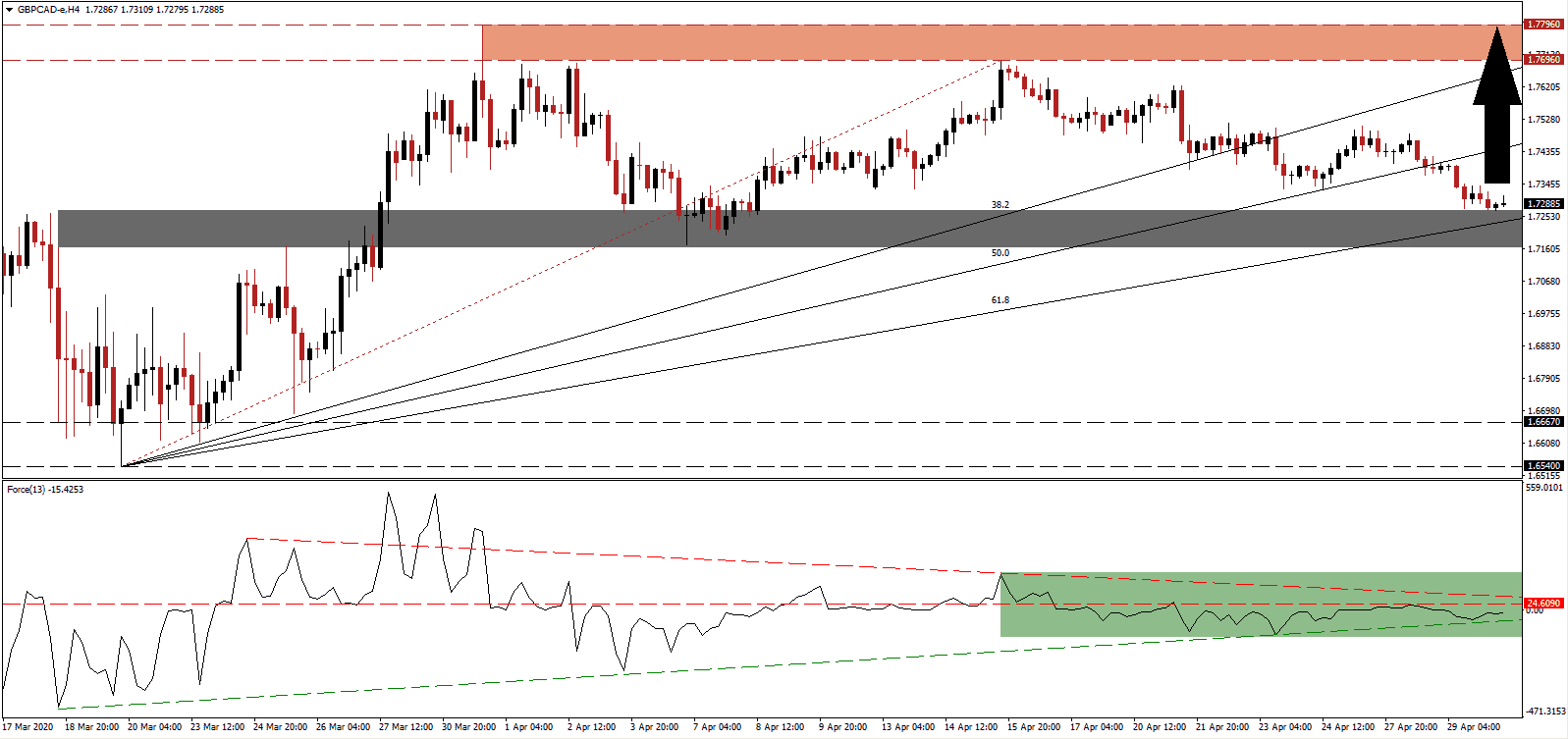

UK Prime Minister Boris Johnson urges patience when it comes to easing lockdown restrictions. It places him in a minority camp, which will ultimately lead to a more sustainable economic recovery. The most significant threat remains a premature downgrade of the alert level related to the Covid-19 pandemic. It risks a second infection wave into the summer months, creating an almost unmanageable crisis. Epidemiology and economics are forced to work together, with the former taking a lead role. Any recovery requires healthy consumers and businesses, a misunderstood concept as judged by the majority. Following a healthy correction in the GBP/CAD into its short-term support zone, the rise in bullish momentum points towards a reignition of the advance.

The Force Index, a next-generation technical indicator, remains below its horizontal resistance level, but the ascending support level is exercising upside pressures, as marked by the green rectangle. Given the proximity of the descending resistance level, a double breakout in the Force Index is expected to materialize. It will place this technical indicator in positive territory, allowing bulls to take control of the GBP/CAD.

Volatility in the oil market, in combination with a recession, is posing a significant threat to the Canadian economy. It will likely remain dominant after the peak of the virus outbreak and force an adjustment to the existing model. Job losses are expected to mount, with the oil sector adding to a short-term collapse in the labor market. Consumer behavior may permanently change, adding uncertainty to the outlook. The GBP/CAD is positioned to commence a new breakout from the top range of its support zone located between 1.7163 and 1.7270, as identified by the grey rectangle.

Adding to bullish developments is the ascending 61.8 Fibonacci Retracement Fan Support Level, currently enforcing the short-term support zone. The Fibonacci Retracement Fan sequence is anticipated to guide the GBP/CAD in its advance until it can challenge its resistance zone located between 1.7696 and 1.7796, as marked by the red rectangle. Given the divergence in the fundamental economic outlook for the UK and Canada, a breakout extension cannot be excluded.

GBP/CAD Technical Trading Set-Up - Breakout Scenario

- Long Entry @ 1.7290

- Take Profit @ 1.7790

- Stop Loss @ 1.7140

- Upside Potential: 500 pips

- Downside Risk: 150 pips

- Risk/Reward Ratio: 3.33

In case the Force Index collapses below its ascending support level, the GBP/CAD will be under pressure to renew its corrective phase. With the absence of meaningful intermediate support, a sell-off can take price action into its next support zone, located between 1.6540 and 1.6667. It represents an outstanding long-term buying opportunity for Forex traders to consider unless an element change in fundamental circumstances emerges.

GBP/CAD Technical Trading Set-Up - Temporary Breakdown Scenario

- Short Entry @ 1.7010

- Take Profit @ 1.6660

- Stop Loss @ 1.7140

- Downside Potential: 350 pips

- Upside Risk: 130 pips

- Risk/Reward Ratio: 2.69