Australian construction and service sector data showed deep recessionary readings, but retail sales for February came in better than expected. With the economy on track to enter its worst recession since 1931 and the first one since 1990, ending a record-run for the commodity-and-China dependent country. The majority of the population has no experience with economic hardship, which may exacerbate the situation. While the GBP/AUD retreated from its current peak after eclipsing its ascending 61.8 Fibonacci Retracement Fan Resistance Level, a new 2020 high is favored to emerge.

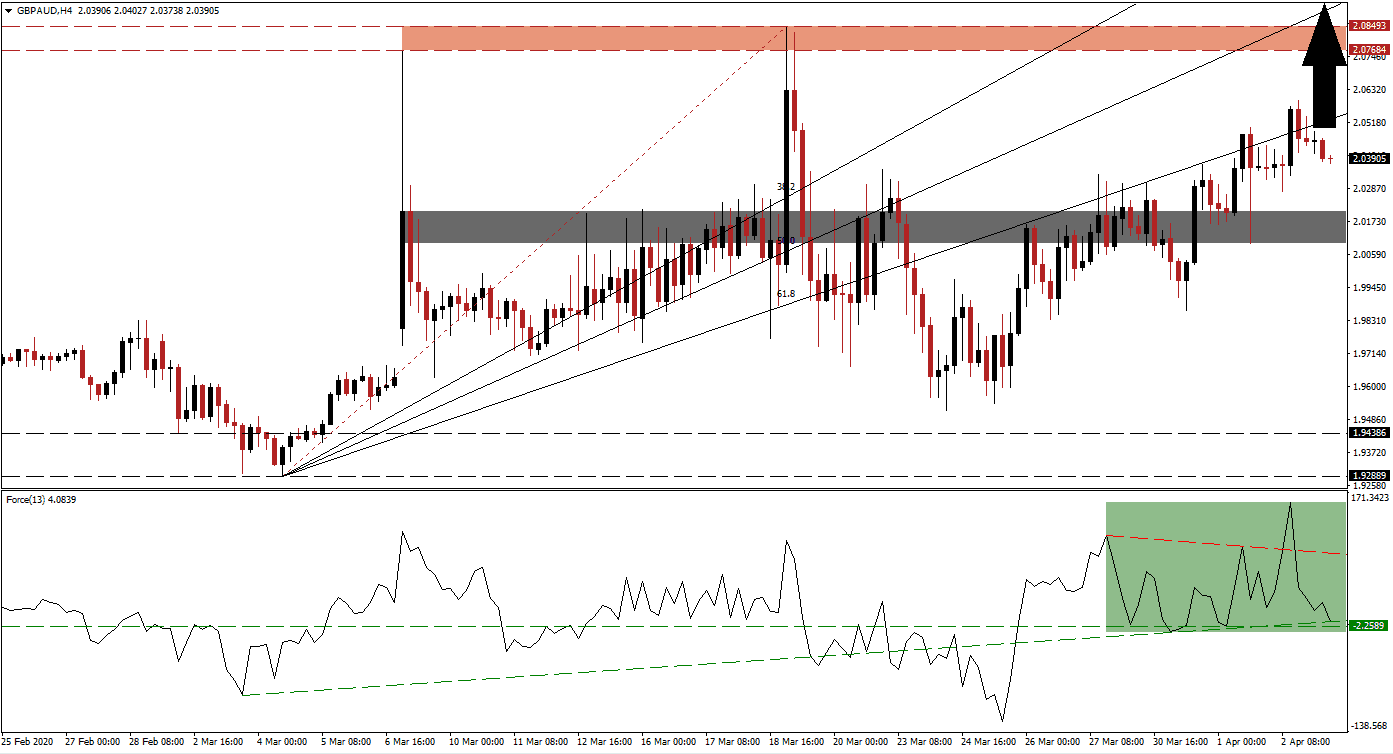

The Force Index, a next-generation technical indicator, spiked to a monthly high before correcting below its descending resistance level. The Force Index is now challenging its ascending support level, located just above its horizontal support level, as marked by the green rectangle. This technical indicator remains above the 0 center-line, allowing bulls to retain control of the GBP/AUD. You can learn more about the Force Index here.

Bullish pressures increased after this currency pair converted its short-term resistance zone into support. This zone is located between 2.00970 and 2.02078, as identified by the grey rectangle. The GBP/AUD formed a distinct bullish chart pattern through a series of higher highs and higher lows, anticipated to lead price action to a new breakout sequence. In the post-2008 global financial crisis world and spiraling debt-to-GDP ratios, the UK is home to a relatively stable debt condition, providing a post-Covid-19 pandemic boost to its currency.

One essential level to monitor is the intra-day high of 2.05923, the peak of the current advance. A breakout will convert the 61.8 Fibonacci Retracement Fan Resistance Level into support, providing a catalyst for the GBP/AUD to accelerate to the upside. The next resistance zone awaits this currency pair between 2.07684 and 2.08493, as marked by the red rectangle, which includes the present 2020 peak. With the remained of the Fibonacci Retracement Fan sequence above this zone, more gains into its 2.15270 to 2.17080 resistance zone are likely to follow.

GBP/AUD Technical Trading Set-Up - Breakout Extension Scenario

Long Entry @ 2.03900

Take Profit @ 2.16900

Stop Loss @ 1.99900

Upside Potential: 1,300 pips

Downside Risk: 400 pips

Risk/Reward Ratio: 3.25

Should the Force Index collapse below its ascending support level and into negative territory for an extended period, the GBP/AUD is expected to enter a minor correction. The downside potential remains limited to its intra-day low of 1.95162, a reaction low from a previous correction. It is located above its support zone between 1.92889 and 1.94386. Forex traders are recommended to take advantage of temporary sell-offs with new net buy orders.

GBP/AUD Technical Trading Set-Up - Limited Breakdown Scenario

Short Entry @ 1.98250

Take Profit @ 1.95250

Stop Loss @ 1.99750

Downside Potential: 300 pips

Upside Risk: 150 pips

Risk/Reward Ratio: 2.00