For the seventh consecutive day, the GBP/USD pair continued its bullish correction, and its gains reached the 1.2647 resistance, its highest in more than a month, before settling around the 1.2620 level in the beginning of today’s trading. Investor sentiment has improved toward the course of the Corona pandemic and its ebb in the past few days has contributed to risk appetite in the markets, and the abandonment of the safe haven US dollar. The dollar index, DXY, which measures the performance of the greenback versus a basket of the Euro, the pound, the Japanese yen, the Swiss franc, the Swedish krona and the Canadian dollar, rose by 8.5% in the period between March 06 and March 20, as investors disposed dangerous assets, amid a historic weakness in liquidity in the financial markets, which is a threat to the global economy.

Since early March, the Federal Reserve has announced twenty or more different measures including the unlimited quantitative easing program and more than doubling the number of other central banks that have dollar exchange lines with them. The new swap lines provide up to $60 billion in cheap dollars through off-market transactions that can be used to ease liquidity shortages in foreign jurisdictions, and as a result, reduce overall market demand for the dollar.

On the British economic side. Official data showed that the UK unemployment rate more than doubled during the three weeks of "closure" imposed on the economy in order to slow the spread of the coronavirus, and the country's unemployment rate is likely to rise during April 2020 to the highest level since February 2013.

Theresa Coffey, Sky News, has reported that there have been more than 1.4 million new claims for unemployment benefits since mid-March, which reflects a 50% increase in the number of new claims announced at the beginning of April. This is more than double the 1.33 million unemployed reported by the Office of National Statistics (ONS) for the three months ending with January, which is sufficient to raise the unemployment rate to 7.9%, the highest level since February 2013. The unemployment rate registered 5.3% in mid-March and 6.6% at the end of March, and previous disclosures indicate that, although March numbers will not be released until May 19 due to publication at a time interval of 45 days to the end of the period, on Tuesday, April 21st, February data will be released. There were 32.98 million people working full-time and part-time during the three months ending in January 2020 and about 1.33 million unemployed but actively looking for work, which is the official definition of unemployment, which made the unemployment rate at 3.9%. However, there will be 2.73 million unemployed after taking into account the recent job losses, which will raise the unemployment rate to 7.9% if the total workforce size remains the same.

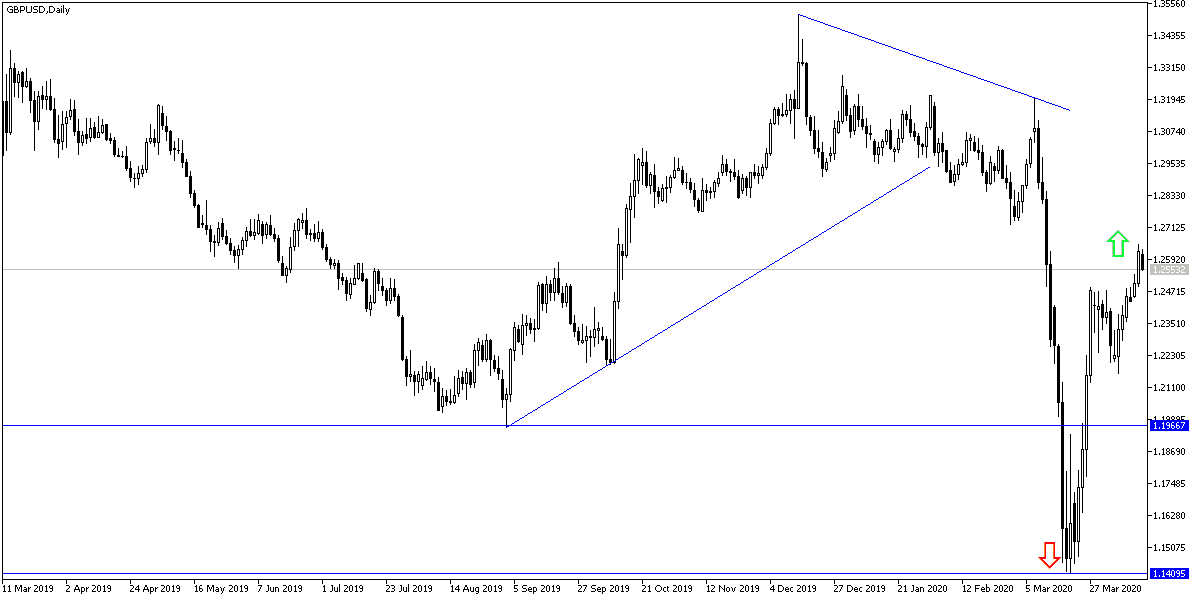

According to the technical analysis of the pair: According to the performance on the daily chart, the GBP/USD pair succeeded in confirming the upward reversal in light of the pair's movement within the bullish channel that lasted for a longer period. Continued optimism among investors and markets may push the pair towards the 1.3000 psychological resistance later this week, especially if the US economic releases continued to give disappointing results. On the other hand, a worse British situation due to the Coronavirus and the return of the USD demand, in addition to the technical indicators reaching overbought areas, may support the profit-taking operations that may push the pair back to the support levels at 1.2545 and 1.2430, respectively.

For today's economic calendar data: All focus will be on US data, retail sales and industrial production numbers.