The Pound received new support amid reports indicating an improvement in Boris Johnson's health, his response to medications getting close to recovery from symptoms of Coronavirus. Therefore, the GBP/USD price moved higher to reach the 1.2420 resistance during yesterday's trading, before settling around the 1.2370 level in the beginning of Thursday’s trading. The pound's gains were constrained by the willingness of US lawmakers to add hundreds of billions to the financial support package that has already crossed the $2 trillion barrier, and as investors continued to hope that the outbreak of the coronavirus was close to the "peak" in the United States and a number of major European economies. However, the mood in the market was fragile and some say that the British Pound needs to gain more momentum or face the prospect of a reversed recovery.

Investor sentiment was soured again due to high death tolls from the Coronavirus in the United Kingdom, Germany, Spain and New York. Thus, investors returned to buy USD again.

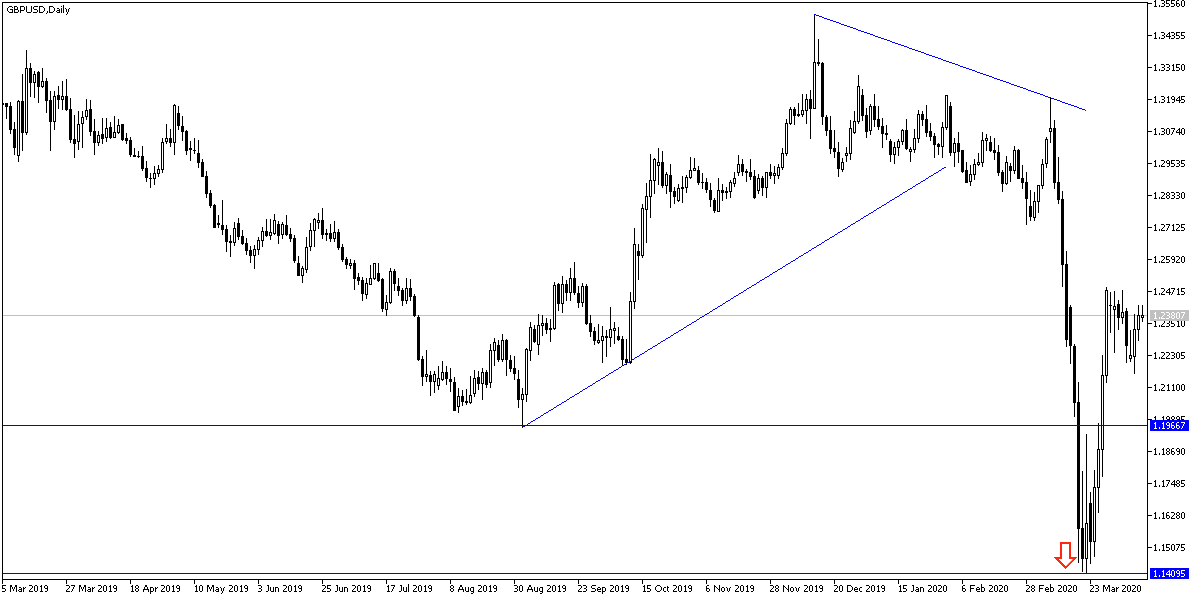

Analysts believe that the British economy is in the beginning of a long period of economic adjustment, and they expect the government to mix its management of COVID-19 with Brexit and its economic strategies. Although the initial extension of the current Brexit transition phase appears to be a little more likely in 2020, we see increased scope for eventual moves to WTO rules, and thus will cause violent pressure on the exchange rate of the British pound. Therefore, the outlook is bleak for the GBP/USD, as the possibility of Britain not leaving the European Union along with other factors, will push the price back towards 1.15 support by the end of the year, near its lowest level since early 1985.

On another important aspect of the pound, a high-ranking British government minister said yesterday that British Prime Minister Boris Johnson is still in intensive care to recover from the coronavirus, and is improving, while the UK has recorded the largest rise in COVID-19 deaths so far. Johnson, the first global leader diagnosed with the disease, spent two nights in the intensive care unit at St Thomas' Hospital in London. That glimpse of the good news came as the number of COVID-19 deaths in Britain approached the peaks recorded in Italy and Spain, the two countries with the largest number of deaths.

The confirmed death toll in Britain was 7,097 on Wednesday, up 938 from 24 hours earlier. Italy recorded a death toll of 969 on March 27 and Spain 950 deaths on April 2.

According to the technical analysis of the pair: GBP/USD price gains are still facing risks and I still prefer to sell from every upside level. Despite the varying numbers of coronavirus cases and deaths, in favor of a greater damage in the United States, the USD is a target for investors as a safe haven, alongside the strength of the US economic stimulus. The closest resistance levels for the pair are currently at 1.2445, 1.2520 and 1.2600, respectively. A return to the 1.2200 support vicinity confirms how strong the bears control the performance, as is the case in the long term.

As for the economic calendar data today: From Britain, the GDP growth and industrial production index will be announced. From the United States, unemployed claims and the producer price index and Michigan consumer confidence will be announced.