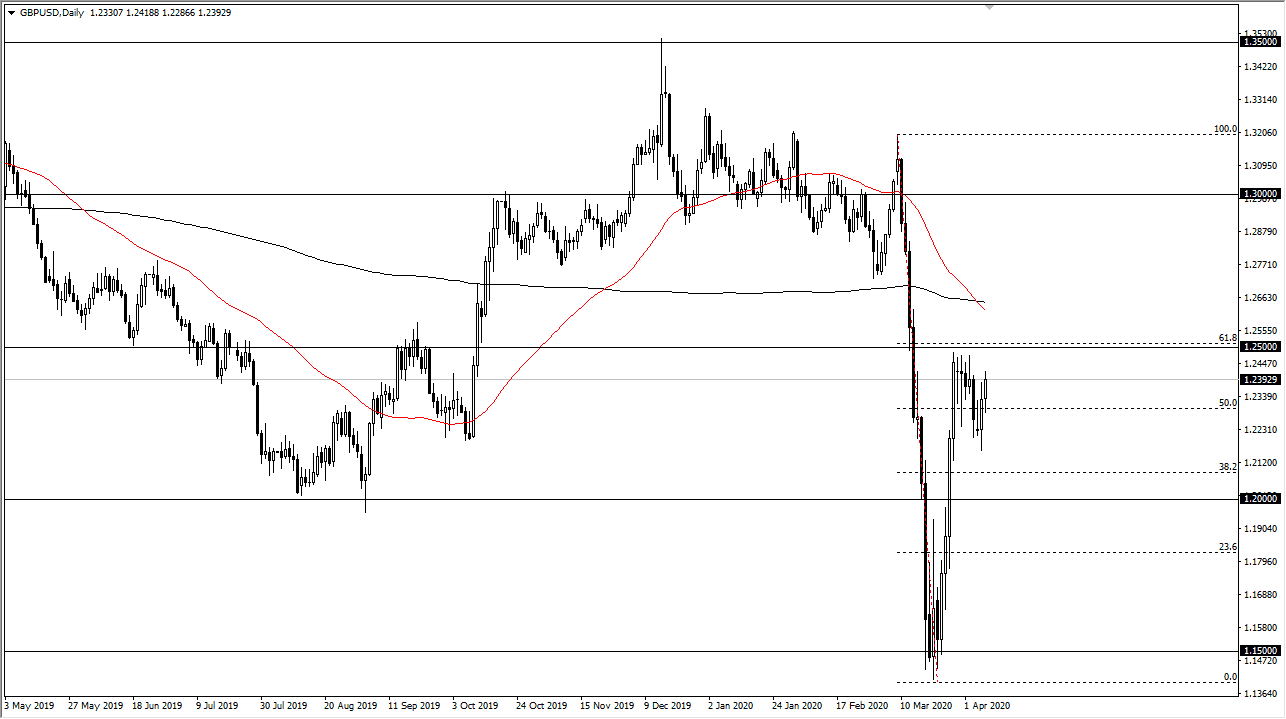

The British pound has pulled back slightly during the trading session on Wednesday to look for buyers underneath. By doing so, the market then rallied into the 1.24 handle where there was significant selling. The market seems to have a lot of resistance between the 1.24 level in the 1.25 level above, and I do believe that the 1.25 level is a massive barrier that needs to be over, if the British pound is going to continue to go even higher. Furthermore, the 61.8% Fibonacci retracement level is just above there, so it’s very likely that we will continue to see a lot of trouble just above.

That being said, as long as there is a “risk on” type of attitude out there, that could help the British pound. The US dollar certainly will suffer as a result, but I think what we are looking at here is a continuation of the potential bullish flag being built. If we were to break above the 1.25 handle and the 61.8% Fibonacci retracement level that could open up the door to the 100% Fibonacci retracement level, closer to the 1.32 handle. At this point, it’s very noisy and as a result it’s very likely that the market will continue to shake back and forth.

If the market was to break down below the 1.22 handle, that would of course be very negative sign and could send this market down to the 1.20 level underneath. That is a large, round, psychologically significant figure as well, and as a result it could cause a bit of a bounce. A breakdown below that level opens up the market down to the 1.1750 level. However, keep in mind that the markets are essentially moving on a risk appetite basis, which is driven by the coronavirus numbers more than anything else. Even Boris Johnson has gotten a virus, so obviously this has a certain amount of influence on the UK as well.

Ultimately, the market is trying to figure out its next bigger move, so pay attention to the 1.25 level and the 1.22 level as both of those will be the gateway to much bigger moves. Be aware the fact that a breakout should send this market quite a distance, regardless of which direction it does in fact set on. Keep your position size relatively small until we break out, and then you can add to your position if it works out in your favor.