After the GBP/JPY stability for several trading sessions, after reaching the 135.75 resistance, the highest level in a month, the pair returned to start a bearish correction amid selling, as markets digested an improvement in the health of British Prime Minister Boris Johnson, from Coronavirus symptoms. The pair is stable around 134.18 at the time of writing, as investors turned their attention to the official numbers of British Coronavirus infections and deaths, after surpassing those of China, the source of the epidemic.

The UK has 94,823 cases of coronavirus and 12,125 recorded deaths. In contrast, China has 83,306 cases and 3,345 deaths, although some have questioned the accuracy of these figures. In the area around the U.K, there are 17,251 cases in Spain and more than 18,000 deaths. While in Italy there are 162,788 cases and more than 21,000 deaths. In France there are 137,887 cases and nearly 15,000 deaths. In Germany, there are 130,434 lesser cases and 3220 deaths.

In light of the policy of economic closure in Britain to contain the spread of the disease, the unemployment rate in the country is likely to rise during April 2020 to the highest level since February 2013. According to official figures, there are more than 1.4 million new unemployment claims since mid-March, which reflects a 50% increase in the number of new claims that were announced at the beginning of April. This is more than double the 1.33 million unemployed reported by the Office of National Statistics (ONS) for the three months ending by January, enough to raise Britain's unemployment rate to 7.9%, the highest level since February 2013.

On Tuesday, the Office of Budget Responsibility stated that a total of 2 million jobs could be lost due to the coronavirus, in light of the contraction that could see a 35% drop in GDP in the second quarter and the raise of unemployment rate to 10%. As a result, the agency expected 273 billion pounds of government borrowing for 2020, which would raise the budget deficit to 14% of GDP, while raising the debt-to-GDP ratio to 95% this year and above 100% next year.

The National Bureau of Statistics will release job figures for February on Tuesday, April 21, but these will reveal little about the impact of efforts to contain the coronavirus on the labor market and the economy given that the government's response was moderate until mid-March when it began advising citizens not to go to bars, cafes and restaurants. It asked companies to close their doors after less than a week and was trying to impose a "closure" nationwide by March 23.

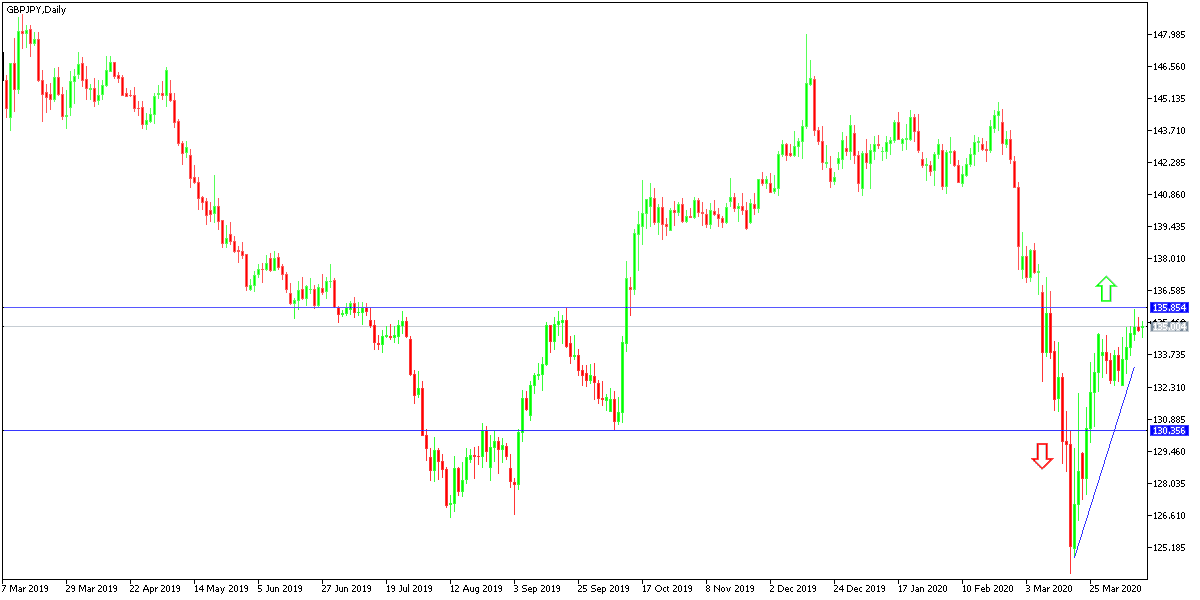

According to the technical analysis of the pair: As is clear on the daily chart below, there is a gathering area for the GBP/JPY pair, and with the loss of momentum to complete the upward correction, it was normal to start selling to take profits, and the pair might lose the upward momentum if it moved towards the 133.20 support and settle below it. If it returns to the break the last resistance at 135.75, it may strengthen the formation of a bullish channel, and may extend the bullish reversal going on since March 20.