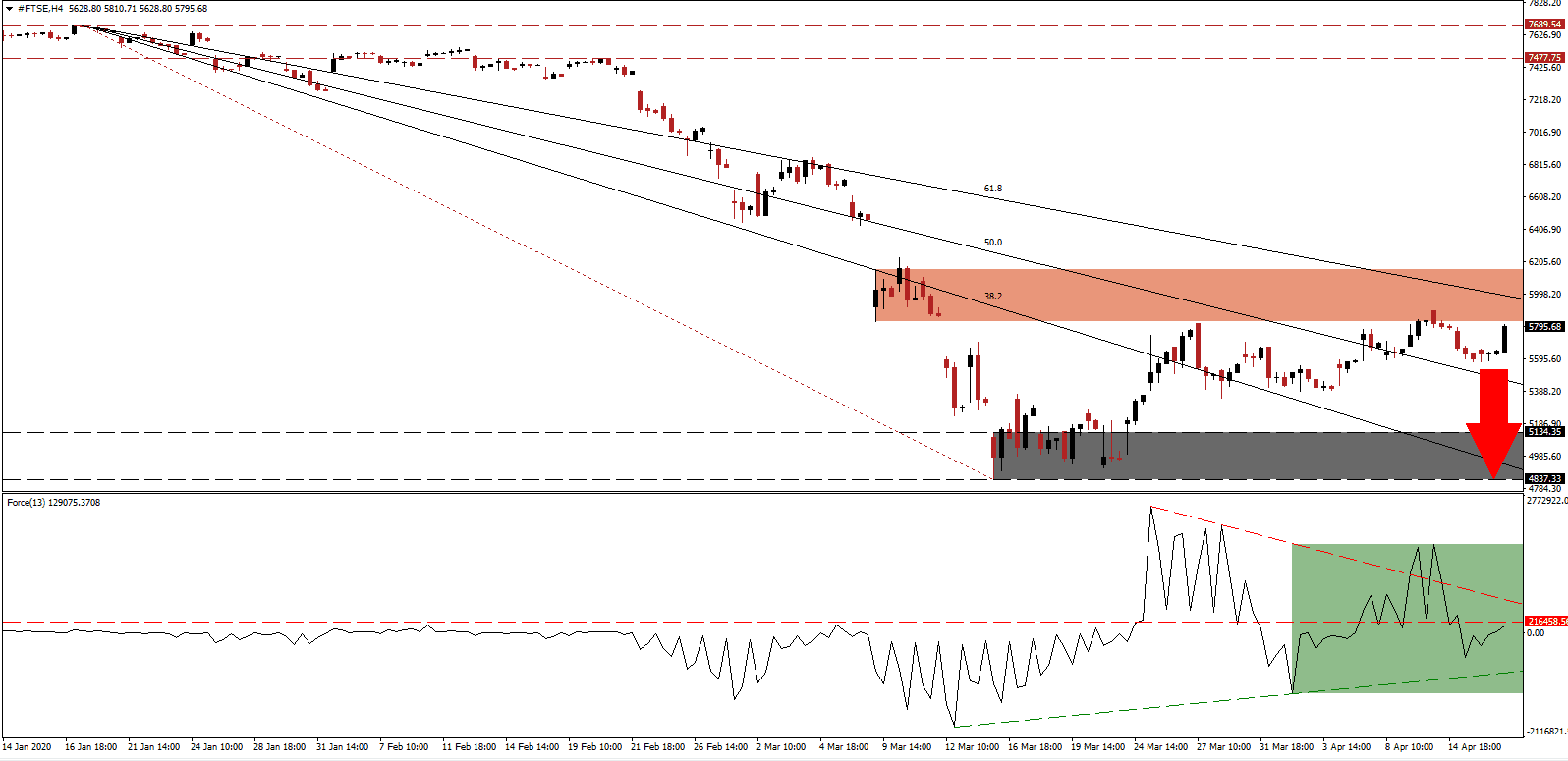

Equity markets around the world adapted a risk-on mood, sparked by a report indicating positive results of one Phase 3 remdesivir trial, Gilead Sciences' failed Ebola drug, which was noted as one of two prominent treatments for Covid-19. It is not the first case where initial hopes remained unconfirmed. A cure is more crucial to the global pandemic than a vaccine, expressly if the virus copies influenza and mutates each season. A dominant misconception remains concerning an economic recovery following the peak-infection cycle. Financial markets remain vulnerable to the second wave of selling, which may challenge the March lows, on the back of severely worse than expected fundamental developments. The FTSE 100 is at risk to reverse its opening price spike, with the descending 61.8 Fibonacci Retracement Fan Resistance Level enforcing the dominant downtrend.

The Force Index, a next-generation technical indicator, maintains is position below the horizontal resistance level but moved above the 0 center-line, as marked by the green rectangle. Despite the moderate improvement, bears remain in control of the FTSE 100. The Force Index is exposed to pressures in either direction with the descending resistance level favored to collapse it below its ascending support level. This technical indicator is likely to revert into negative territory after the initial bullishness of today’s open falters.

Buy orders flooded the open of today’s trading session, but the FTSE 100 now confronts a dual resistance level. Price action is closing in on the bottom range of its short-term resistance zone located between 5,830.30 and 6,157.41, as marked by the red rectangle. The 61.8 Fibonacci Retracement Fan Resistance Level is passing through this zone, adding to significant bearish pressures. Without more data, any extension of the current rally is prone to an equally quick reversal. The trading volume during rallies has been weak, confirming the strength of the underlying bear market. You can learn more about a resistance zone here.

Companies have withdrawn earnings guidance, clouding the future outlook for equities. While a cure will allow draconian measures like nationwide lockdowns to be lifted sooner and broader than currently anticipated, it will not alleviate the long-term negative impact of the virus. Permanent modifications to existing economic models are not priced into financial markets, which continue to operate based on hope rather than fundamentals. The cost of short-term government reactions will provide an additional long-term bearish catalyst. Traders are advised to remain cautious with the threat of a breakdown in the FTSE 100 into its support zone located between 4,837.33 and 5,134.35 in place.

FTSE 100 Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 5,800.00

Take Profit @ 4,850.00

Stop Loss @ 6,100.00

Downside Potential: 95,000 pips

Upside Risk: 30,000 pips

Risk/Reward Ratio: 3.17

Should the Force Index maintain a breakout above its descending resistance level, the FTSE 100 is favored to close to a previous price gap to the downside. The upside potential remains limited to the intra-day high of 6,859.15, the last instance price action was rejected by the 61.8 Fibonacci Retracement Fan Resistance Level. Given the long-term fundamental outlook and mispriced risks, traders are advised to take advantage of temporary price spikes with new net sell orders.

FTSE 100 Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 6,300.00

Take Profit @ 6,850.00

Stop Loss @ 6,100.00

Upside Potential: 55,000 pips

Downside Risk: 20,000 pips

Risk/Reward Ratio: 2.75