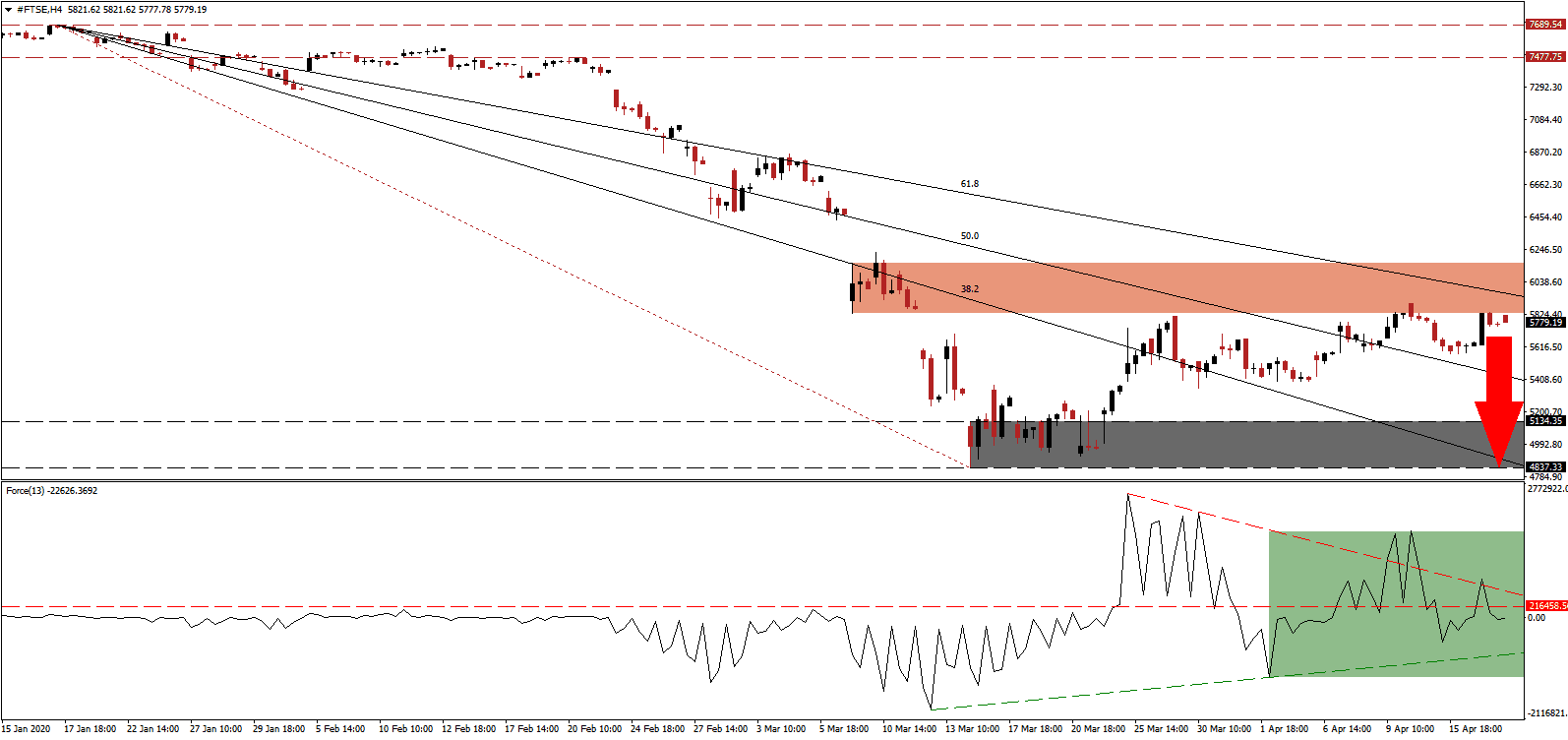

Some European countries are partially reopening their economies with restrictions in place. The UK remains in a nationwide lockdown, but new cases are flatlining. Pressure in the government to announce plans on how society will function in a limited capacity are on the rise. The absence of Prime Minister Johnson from the cabinet is evident in the coordination effort. He continues to recover from Covid-19, and First Minister Dominic Raab deputizes for him. PM Johnson asked him to take over his duties when he was submitted to intensive care. He has since left the hospital but remains in isolation until doctors clear him to return to his post. The FTSE 100 exhausted its bear market rally at its enforced short-term resistance zone, while the ongoing oil price collapse is pressuring energy companies to the downside.

The Force Index, a next-generation technical indicator, suggests a sell-off is imminent. After forming a series of lower highs, it converted its horizontal support level into resistance, as marked by the green rectangle. Adding to bearish pressures is the descending resistance level, which is expected to pressure the Force Index below its ascending support level. Bears are in control of the FTSE 100 with this technical indicator in negative territory, with more downside favored.

Uncertainty over the severity of the global Covid-19 pandemic on the economy and company earnings remains a significant challenge moving forward. The most massive risk is the failure to realize the forced change to fundamental conditions. With the majority of politicians mired in an illusion of a quick recovery, Bank of England Governor Bailey acknowledged the potential of disappointment in this regard. The FTSE 100 was once again rejected by its short-term resistance zone located between 5,830.30 and 6,157.41, as identified by the red rectangle. It is enhanced by its descending 61.8 Fibonacci Retracement Fan Resistance Level.

Equity markets recovered from their March lows, but a second sell-off is anticipated to materialize. Costs of government stimuli propelled the global economy closer to the collapse of the debt market. It has been in a fragile state since the 2008 bailout of the financial system. A breakdown in the FTSE 100 below its 50.0 Fibonacci Retracement Fan Support Level will clear the path for a retest if the support zone located between 4,837.33 and 5,134.35, as marked by the grey rectangle. Given the ongoing disruptions to society, more downside cannot be excluded.

FTSE 100 Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 5,790.00

Take Profit @ 4,840.00

Stop Loss @ 6,100.00

Downside Potential: 95,000 pips

Upside Risk: 31,000 pips

Risk/Reward Ratio: 3.07

In the event Force Index spikes above its descending resistance level, the FTSE 100 is likely to attempt a breakout above its short-term resistance zone. Any advance remains limited to the intra-day high of 6,859.15, which marks the last rejection of price action by the 61.8 Fibonacci Retracement Fan Resistance Level. Traders are recommended to consider this as an outstanding selling opportunity on the back of mispriced long-term risk and accumulation of bearish conditions.

FTSE 100 Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 6,300.00

Take Profit @ 6,850.00

Stop Loss @ 6,100.00

Upside Potential: 55,000 pips

Downside Risk: 20,000 pips

Risk/Reward Ratio: 2.75