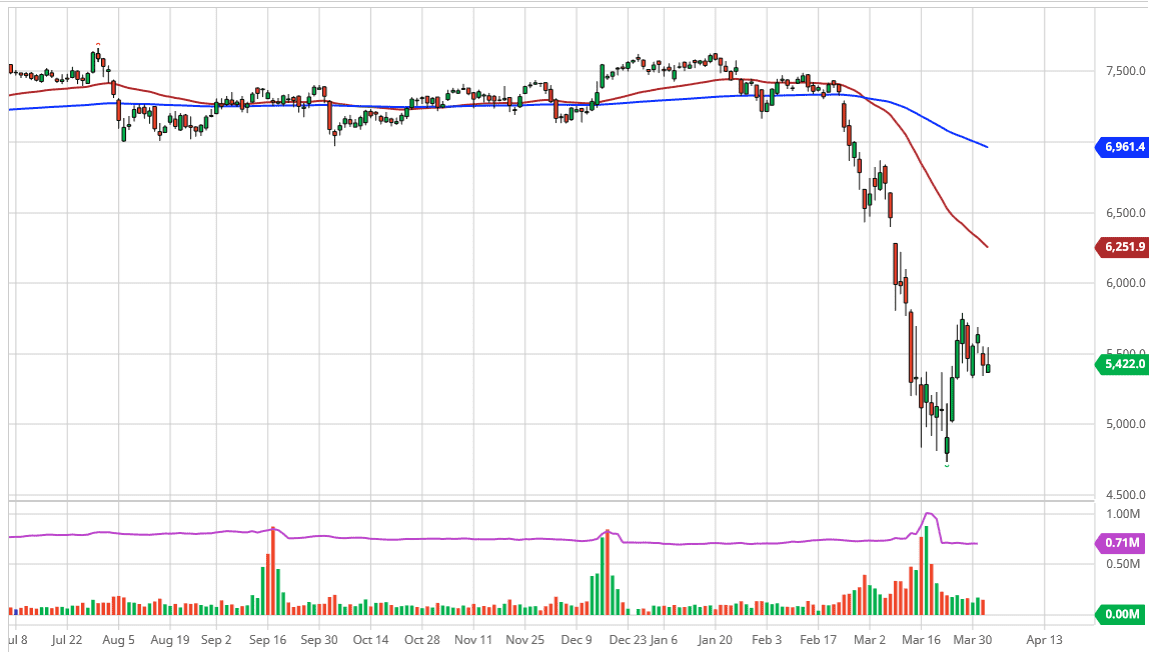

The FTSE 100 initially tried to rally during the trading session in the futures market on Thursday but as you can see the 5500 level has caused enough resistance to turn the market back around. That being said, I’m not necessarily of mind that anything in particular set this market lower other than the general fear trade that’s going on. One thing that you can see on the daily chart is that we are forming a descending triangle, and that of course is relatively negative at this point. A breakdown below the 5250 level could open up a move towards the 5000 handle underneath that. There was a gap that saw the market break above the 5000 handle, so that could be nice support on a drop from here.

The alternate scenario is that we turn around a breakout to the upside, but I would need to see the 5750 level cleared in order to feel comfortable. At that point it’s very likely that the market will go looking to reach the 6000 level initially, the 50 day EMA, and then possibly the gap that sits just below the 6500 level. At this point, the market is looking rather weak, but if we turn around from here it’s very likely that what we could see is a “higher low”, and as a result it could send this market turning right around to reach to higher levels. It is the beginning of a trend change when we see this happen so the next couple of days could be rather crucial as to where we go next.

If we do break down, there is still a slight chance that we could see enough support to keep this market for making a “lower low”, but if it does it’s very likely that this market goes down to the 4500 level, possibly even the 4000 level after that. All things being equal, the FTSE 100 looks just as vulnerable as the rest of the indices around the world, as a global slowdown in the economy could very well bring drastic measures. At this point I think that the market participants are cautious to say the least, so one would think that negative headlines will continue to cause major issues. Having said that, if we do get negative headlines in the markets don’t budge, that would be an extraordinarily bullish sign. In the meantime, keep your position size smaller than usual.