At the beginning of yesterday's trading, the EUR/USD pair fell to the 1.0926 support, but the pair quickly benefited from the decline in the US dollar and rose to the 1.1037 resistance, where it is stable around the beginning of today’s trading. It appears that the Euro has benefited from indications that the Corvid19 virus is spreading at a slower rate in many parts of Europe and the United States. The number of new coronavirus infections increased in many European countries on Monday, but only after several days of steady decline that sparked speculation about a "peak" in the outbreak.

Italy, the European center of corona virus outbreak, has experienced three consecutive days in which the number of new infections has decreased from the previous day while similar situation have been observed in Spain and France. The decline in momentum behind the contagion has encouraged markets to believe that the "closures" taken in many economies may now bear fruit, even though the data has done little for the EUR so far.

The Euro currency has been more volatile than at any time in recent years amid the spread of the coronavirus, which has fueled investor desire for sharp and standard sell-offs. In general, the global economic recession that blew up the risk of asset valuation and raises a large demand for liquidity will favor the dollar over the Euro most of the time, and this demand for the dollar is the primary driver of the Euro against the dollar on the short term. According to data from the Johns Hopkins University, there were more than 800,000 confirmed cases of coronavirus around the world on Tuesday, and more than 38,000 deaths from viral pneumonia that are currently found in most of the world. However, the United States has overtaken the numbers in both Italy and China, leading to the closure of major U.S. states in an attempt by the Trump government to contain the disease.

The European Central Bank, which has long suffered from its ability to help the economy after a decade, has been spared as the only survival boat for the European single currency bloc, and no effort to spur attempts to mitigate the economic impact of the Covid-19 crisis to support investors’ confidence. Most European governments have announced financial support packages with a relative value of two figures of gross domestic product in order to support companies and families to cope with the unprecedented interruption of economic activity that may extend for months.

European Commission President Ursula von der Leyen said last Thursday that "an ambitious new European budget will support the European Union economy" which is necessary to overcome the crisis. The comments came after another meeting in which national leaders neglected the approval of so-called "Corona bonds" that would enable the European Union to increase the ability to combat crises in countries with economic brutality and financial constraints such as Italy.

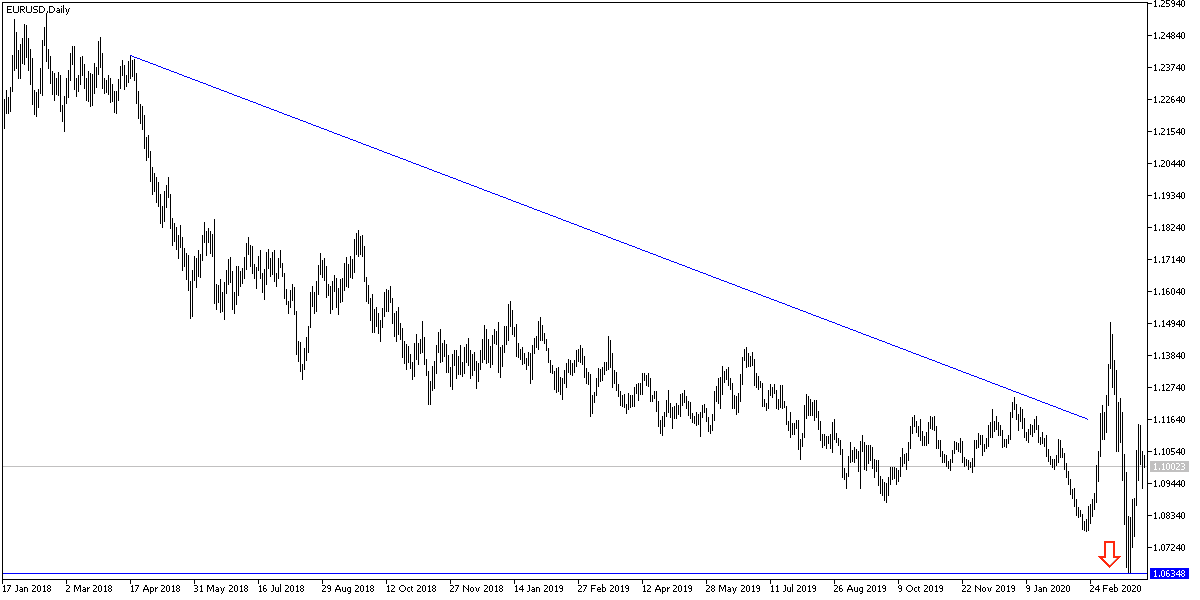

According to the technical analysis of the pair: The return of the EUR/USD stability above the 1.1000 resistance will support the bullish momentum to exit from its descending channel, which is still the strongest on the long term, and currency traders will need to push the pair to the resistance levels 1.1120 and 1.1260 to confirm the trend reversal. Bears will gain momentum if the pair moves through the 1.0900 psychological support. In general, I still prefer selling the pair from every upside level.

As for the economic calendar data today: German retail sales and the industrial purchasing managers’ index for the bloc economies will be announced with a focus on the German numbers. Then the unemployment rate in the Eurozone. From the United States, ADP change in the numbers of non-agricultural American jobs and the ISM Manufacturing PMI data will be released.