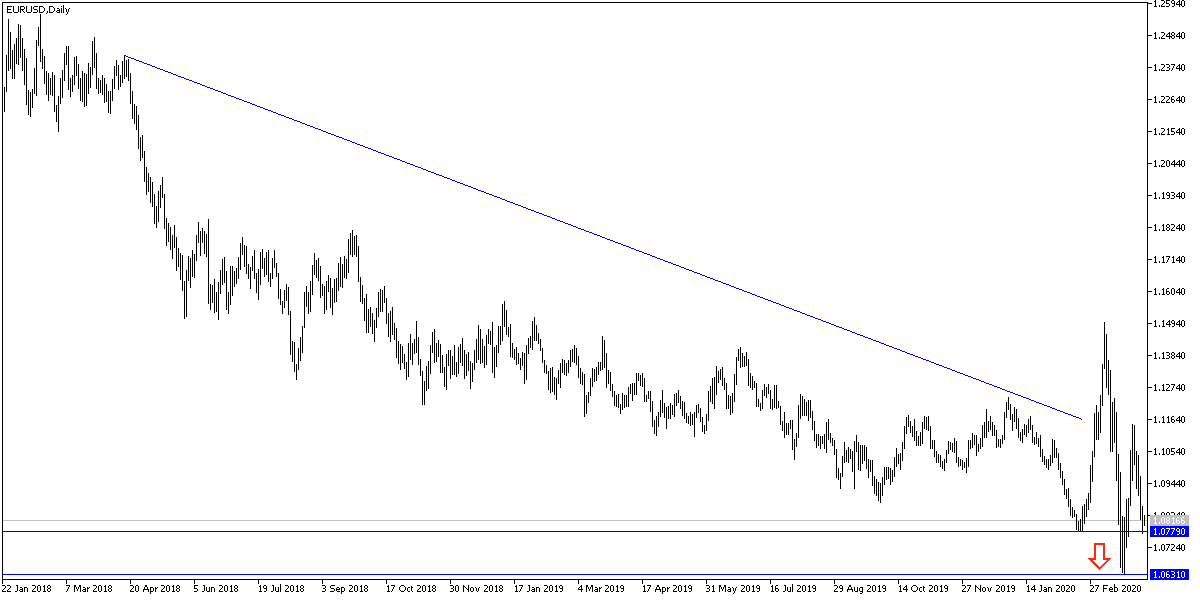

Throughout last week's trading, the EUR/USD pair was under strong downward pressure pushing it towards the 1.0772 support before closing the week's trading around the 1.0812 support. The bears were controlling the performance since the pair abandoned the 1.1000 psychological resistance. In terms of European human losses numbers from the Corona epidemic, Britain recorded 708 new deaths on Saturday, while Italy recorded 631 deaths on that day. And with 621 other deaths recorded on Sunday, Britain recorded 4,934 deaths, with a total of 47,806 confirmed cases. Among the infected in the UK: Prime Minister Boris Johnson, Minister of Health, Chief Medical Officer of England, and Prince Charles, heir to the British throne.

There are widespread fears that the conservative Johnson government did not take the virus spread seriously enough at first and that a beautiful spring weather would attract Britons and others to break the rules of social distancing. Movement restrictions vary from country to country. The Swedish authorities have advised the public to exercise social distancing, but schools, bars and restaurants are still open.

Spain reported 6,023 new confirmed cases of the disease on Sunday, bringing the total number in the country to 130,759, but down from an increase of 7,026 cases the previous day. New confirmed deaths in Spain fell for the third day in a row, to 674 - the first time that daily deaths had dropped to less than 800 last week.

For his part, Spanish Prime Minister Pedro Sanchez said: "We are beginning to see the light at the end of the tunnel."

The Euro almost gave up all of its gains against the dollar in the last week of March, and the charts warn of more losses in the future, the Euro fell by more than three percent last week, which is the most important movement in the downtrend in almost two weeks, but it is not as big as 4.5% gain seen in the previous week. The large but unimportant price action last week also confirms the magnitude of the volatility that we witnessed during the month of March.

The Euro losses were exacerbated by the investors' indignation over the lack of a common solution from politicians and decision-makers to support the European single currency, in order to face the economic repercussions of the Coronavirus crisis. National governments have withdrawn all their plans and only taken care of their respective countries to cope with the spread of the Corunavirus, measures that have been taken to prevent health systems from overloading and reaching the point of collapse.

The slow spread of the coronavirus can lead to an improvement in investor willingness to take risks in the beginning of transactions this new week, which may lead to raising the Euro and weighing on the dollar, especially after the American currency benefited from a classic demand as a safe haven, even after the US Labor Department report that the coronavirus eliminated all US job gains that occurred during Trump's presidency. Four years of gains evaporated within one month.

According to technical analysis of the pair: As is the previous forecast, the continuation of the EUR/USD moving around and below the 1.0800 psychological support will increase the bear's control over the performance and foreshadows a downward movement towards stronger support levels that may reach to 1.0760, 1.0690 and 1.0580, respectively. And there will be no close opportunity for the bulls to reverse the current trend without stabilizing strongly above the 1.1000 psychological resistance. Gains will remain a selling target as long as Europe suffers from an increase in human losses from the Corona epidemic. The US stimulus is still the strongest.

As for the economic calendar data today: German factory orders will be announced in addition to Sentix's reading of investor confidence in the Eurozone. There are no significant US releases today.