The EUR/USD pair is trying to show cohesion ahead of the important announcement today by the European Central Bank led by Christine Lagarde to update its monetary policy at a time when the single European currency is searching for strong support to avoid more losses against most other major currencies. The pair's losses this week pushed it to the 1.0809 support, and the pair is consolidating around the 1.0880 level of at the time of writing. In addition to the bank’s decisions and the governor’s statements, the economic agenda contains a package of important European economic data, but the interaction with the bank will be the most important and most influential.

The pair got some support after announcing a larger-than-expected drop in GDP growth in the Q1 in the United States, but it faces its own challenges today as the Eurozone GDP is due. Official results showed that the largest economy in the world contracted by -4.8% in the first quarter, which is a much larger than the -4% expected. The Eurozone Q1 GDP will be released at 10:00 with reports by individual countries before and after, and expectations indicate an economic contraction of -3.7%, which will be the largest decline in growth since early 2009.

The pair received some support from Gilead Sciences' notification that the Remdisivir antiviral drug has made a key endpoint in clinical trials designed to measure its effectiveness as a treatment for coronavirus. But Gilead warned that remdesivir "has not yet been proven to be safe or effective for treating COVID-19". Because of the deadly epidemic, Italy, Spain, Germany and France stopped before the streets of New York became deserted. This is the Eurozone that was growing less than half the pace of the United States by 2.1% in the last quarter of 2019, when the Union saw GDP rise by an annual rate of only 1%, and with Europe's longest-running battle against the coronavirus taking into account, it is difficult to understand how the average of all chosen economic forecasts could indicate friendly results from the Euro to the dollar. It is difficult to imagine how the first quarter could produce such an outcome.

The largest-than-expected US contraction came at -4.8% although the country suffered only a few weeks of turmoil and devastation at the hands of the coronavirus in that quarter, while it was steadily constricting the Italian economy that had already begun to stagnate since late February, and stopped all major economies in the Eurozone to a dead end by mid-March. This was before it began to cause serious and widespread turmoil in the United States.

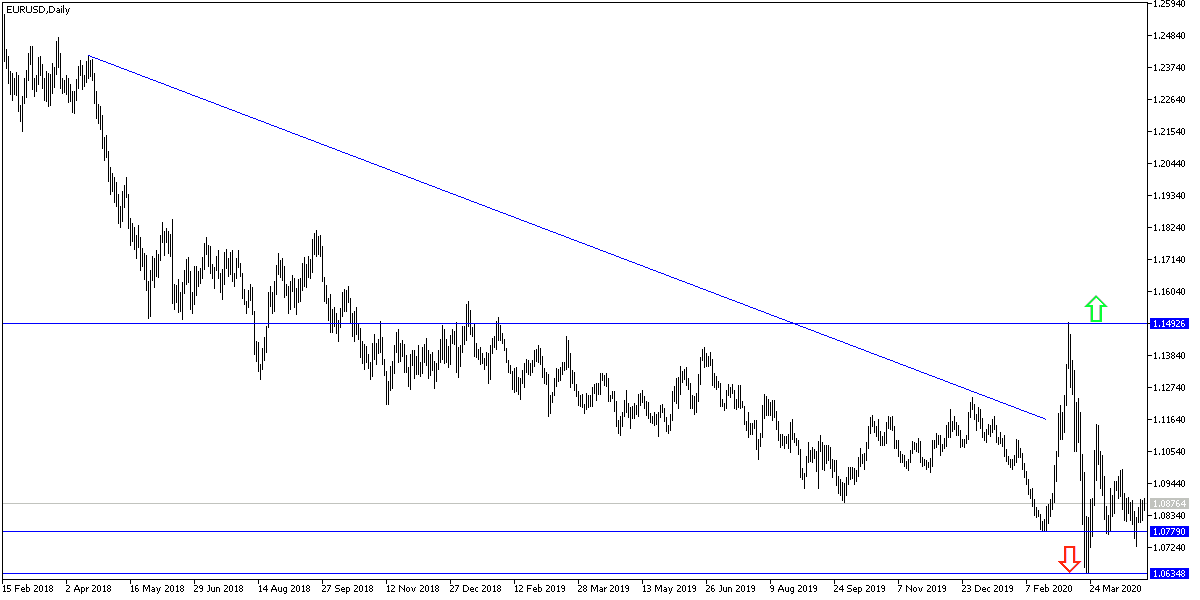

According to the technical analysis of the pair: Despite recent attempts to rebound, the general trend of the pair is still bearish as long as it is near the 1.0800 support. A new disappointment from the European Central Policy may push the pair towards stronger support levels, reaching 1.0785, 1.0690 and 1.0600. The stubbornness between Lagarde and the leaders of the countries with the most financial interests, such as Germany, about bearing the Corona bill, continues to put negative pressure on the single European currency. On the other hand, the United States of America, with the lion's share of the global stimulus, is in the face of the epidemic shock. The pair’s success in breaking through the 1.10 psychological resistance will cause an important shift in its path.

As for the economic calendar data today: There is a package of important European economic data today, the most important of which are the gross domestic product, inflation and unemployment for the Eurozone, then the European Central Bank monetary policy decisions and Lagarde's statements. From the United States, the unemployed claims, the personal consumption expenditures index, and the rate of spending and income for the American citizen data will be released.