At the beginning of this week's trading, the EUR/USD pair got some support to move up, with gains reaching to the 1.0860 resistance before returning to stability around the 1.0820 support at the beginning of trading today, Tuesday. The rebound came after the pair fell to the 1.0726 support, the lowest in a month during last Friday's trading session. Although the economic calendar yesterday lacked any important and influential data, the pair got a boost of optimism from the desire of global economies to reopen the global economy to alleviate the severe economic recession caused by the closure policy to contain the rapid spread of the Coronavirus, which infected more than 3 million person around the world and caused more than 200,000 deaths.

Countries have taken cautious steps to ease the closure imposed to tackle the epidemic, but fears of escalating infections have made even some companies affected by the virus reluctant to reopen. US states such as Georgia, Oklahoma, and Alaska have begun easing restrictions on companies, despite expert warnings that such moves may be premature. India has reopened neighborhood stores, on which the country's 1.3 billion people depend, for everything from drinks to mobile phone listings. But the mitigation has not been applied to hundreds of quarantined towns and other places severely affected by the outbreak that has killed at least 775 people in the country where many poor people live in highly crowded slums due to social distancing.

Although European countries are among the countries most affected by the epidemic, they intend to reopen economies even if gradually, especially in light of the failure of the European Union states to provide the necessary stimulus to face the crisis, in contrast to what the United States has done with their plans, which are the largest in the country's history, as the disease is causing 26 million jobs loss in a month, which are the gains of the US labor market for four years and in reaction to the longest economic growth period ever.

All economic figures that the Trump administration boasted about evaporated quickly due to the COVID-19 virus.

Spanish Prime Minister Pedro Sanchez announced that the Spaniards will be allowed to leave their homes for short walks and exercise starting May 2 after seven weeks of strict confinement at home, although he said "the utmost caution will be our guideline”. “We have to be very careful because there is neither evidence nor a roadmap to follow," he added.

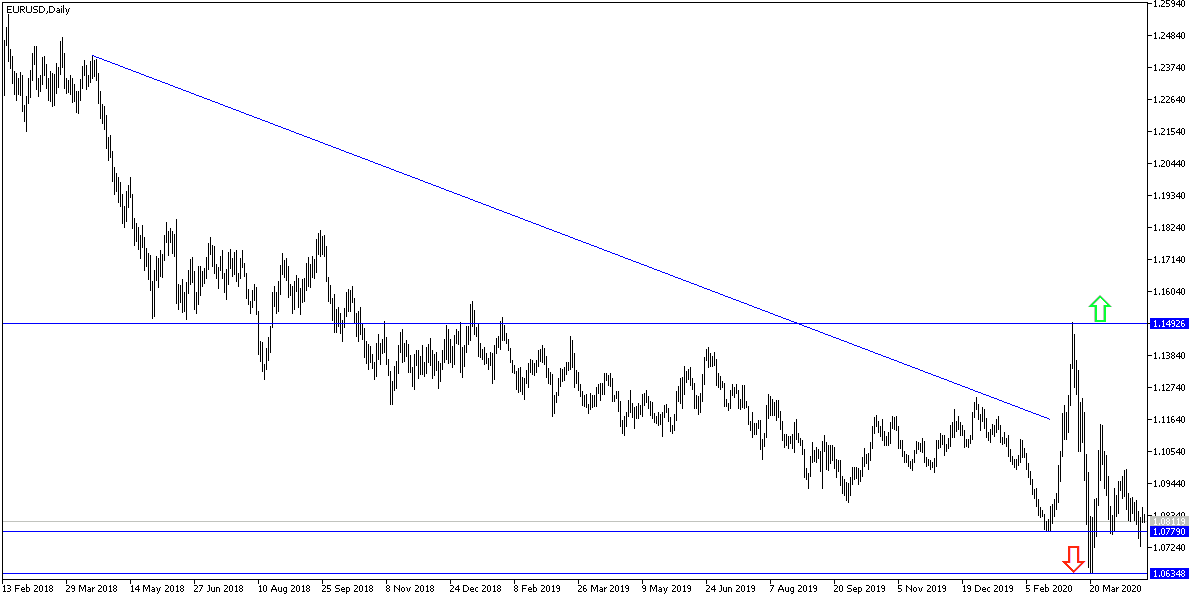

According to technical analysis of the pair: Despite the recent bounce attempt of the EUR/USD, the general trend is still downward. Bears are still in control over the medium and long term. The bulls will take control if the pair succeeds in crossing the 1.0950 resistance. I still prefer to sell the pair from every higher level.

As for the economic calendar data today: Change in the Spanish unemployment will be announced. From the United States, the consumer confidence index and the Richmond industrial index data will be released.