Throughout last week's trading, the EUR/USD was under downward pressure pushing it towards the 1.0726 support, the lowest in a month before closing trading around the 1.0765 level, and settling around the 1.0825 level at the time of writing. The European single currency did not find any support to stop the losses. This week, the pair will interact a lot with the announcement of the monetary policy of both the US Federal Reserve and the European Central Bank. Losses were recently stopped, albeit temporarily, in light of the declines in the yields of Italian and Spanish government bonds, which rose earlier in the past week and which were tantamount to headwinds to the Euro.

Extension of EUR/USD losses this week may require a supportive environment for other risk assets such as stocks and commodities, although it may be possible that some countries are increasingly seeking to reopen their economies from the closures caused by the Corona virus. This is because the number of new daily cases discovered in major economies is still on a downward path.

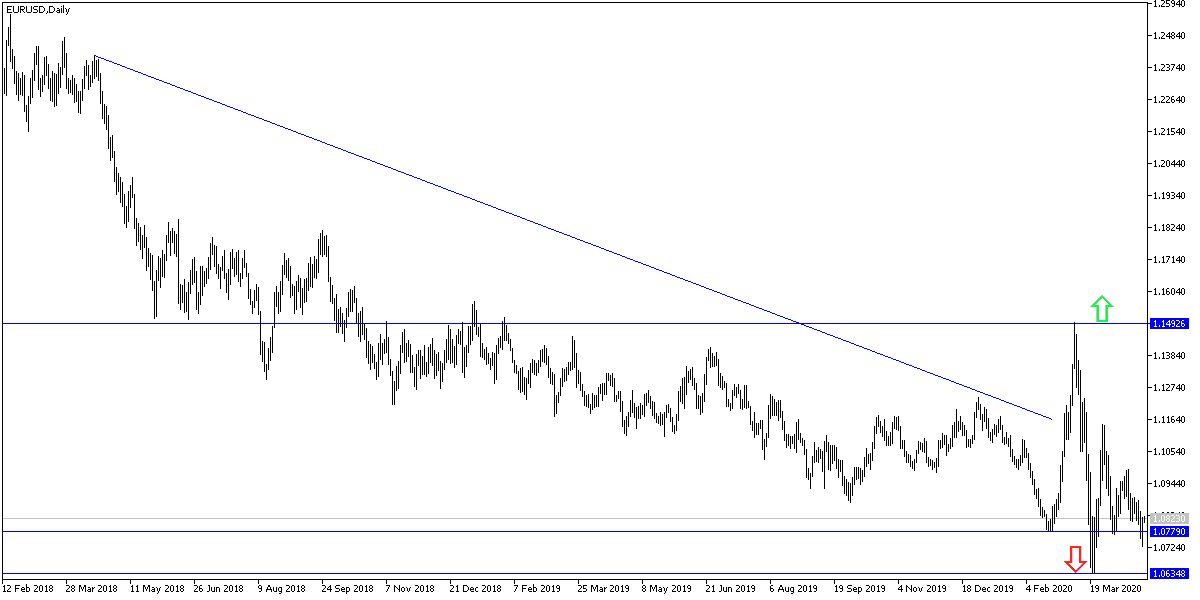

The most important domestic financial event for this week will be the European Central Bank’s policy decision and the Thursday 12:45 press conference led by President Christine Lagarde, which may provide some reasons for joy this time. The price of the Euro against the dollar will need reasons to encourage because after entering 2020 with the markets expecting a steady increase throughout reaching to 1.15 by the end of the year, the increasing numbers are now making the 1.05 level is the opportunity to close the transactions at in 2020.

The European Council has agreed in principle to agree to a long-awaited recovery fund, but to postpone decisions on the size and nature of its financing until May 06, which was a widespread disappointment to a market that had been hoping that leaders would agree to a form of mutual loan or grant financing to the most affected member states From the Coronavirus crisis. The European Union leaders also supported the 540 billion Euro package.

The outcome of last Thursday's meeting means that the recovery fund, if realized, will not function before January 2021 although many economists expect that the actual recovery from the economic collapse caused by Coronavirus will begin as soon as next month. This comes after the discussion that preceded the meeting helped spark the fire of European pessimism in Italy, given the apparent lack of solidarity and that the 540 billion Euro bailout package required Eurozone members to use the Crisis Era Fund.

According to technical analysis: No change to my technical view of the EUR/USD pair. The downside will remain stronger, and stability below the 1.0800 support will add to the bear's control. It should be noted that the pair reached oversold levels, and that with optimism returning and global fears subsiding may give the pair an opportunity for an upward correction at any time. Support levels of 1.0690, 1.0625 and 1.0580, respectively, could be long-term buying targets. As I mentioned before, the 1.1000 psychological resistance is the key to the return of bulls control and exiting the current descending channel.

Today's economic calendar has no economic data from the Eurozone or the United States of America.