The EUR/USD pair is still trying hard to avoid moving below the 1.0800 psychological support so as not to have more selling on the pair. However, the pressures on the European single currency are many, and the pair is expected to fail a lot. The Euro is watching the results of the European Council meeting, which will have a significant impact on the short and long term outlook for the Euro. The selling pressure will increase if the video conference meeting of the European Council ends without the leaders agreeing a sufficient European response to the coronavirus which paralyzed the global economy.

This comes after the finance ministers of the Euro group agreed to a 540 billion Euro financing package for troubled member states two weeks ago. There is uncertainty about whether this will be adopted by those who need it most, given that it requires countries to benefit from the "rescue" fund in a period of crisis, although markets will also be keen to obtain details about the "recovery fund". “It is eagerly anticipated and expected to accommodate the bulk of the additional European response. The short and long-term outlook for the Euro depends, at least in part, on whether European leaders can agree on a mechanism by which the bloc can fund the “recovery fund” and collectively defend its weaker members from the crisis threats that have returned as the epidemic spreads to chase some of its most needy members, who are also the hardest hit by the Corunavirus, and whose economies have suffered for a longer period of time with "closure" strategies as a way to contain the disease.

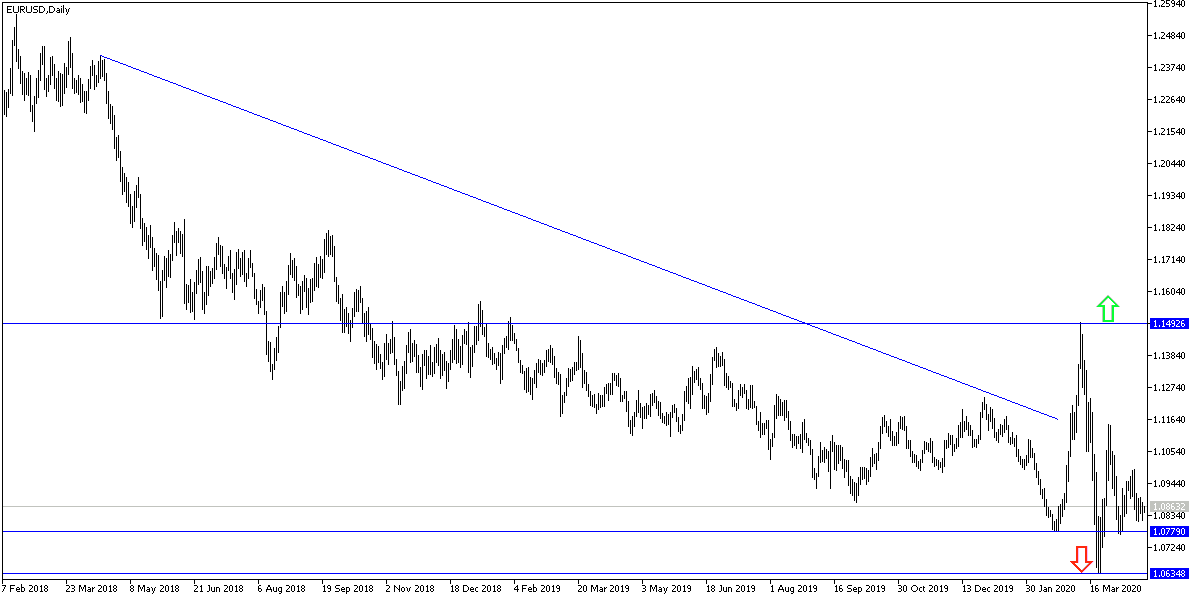

The economic stalemate caused by confronting the Corona virus has weighed heavily on the Euro and pushed the dollar higher, but the financial damage done by containment efforts and the many potential effects of the controversy erupting in Europe about the correct financial response, which is increasingly burdened by expectations of the Euro price against the dollar. At the beginning of 2020, expectations were for the Euro to reach $1.15 by the end of the current year, but the rudder turned a lot due to the epidemic, and the expectations had reached $1.05.

According to technical analysis of the pair: Not much has changed in my perception of the EUR/USD. The general trend is still bearish and 1.0800 psychological support supports this trend and if the European meeting today fails to find a formula for harmony and support for the continent's economies in the face of the epidemic, the sales operations may push the pair towards 1.0755, 1.0680 and 1.0500 support levels, respectively. On the other hand, in the event of an agreement that was convincing to the markets, the pair may be tempted today to break through the 1.1000 psychological resistance.

As for the economic calendar data today: From the Eurozone, the industrial and service sectors PMI will be announced. From the United States, unemployment claims and new home sales data will be announced.