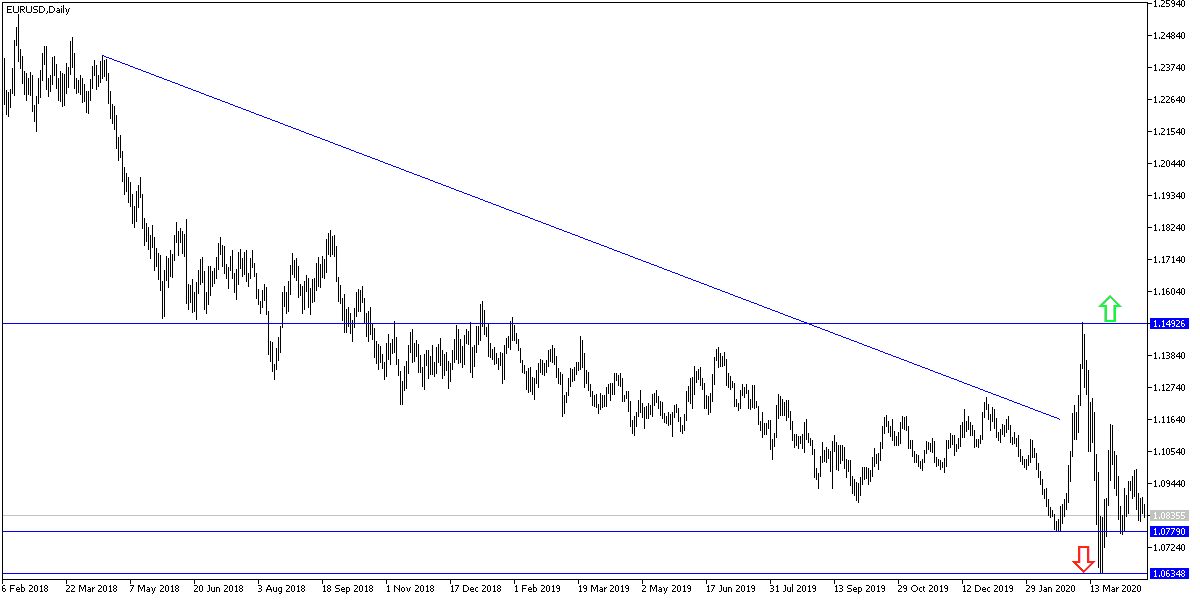

The single European currency, the Euro, has received little support ending the recent sharp decline against most other major currencies. The absence of intensity among the European Union countries in facing the economic shock of the Corona epidemic is a decisive factor in the continuation of this situation. The EUR/USD pair continued its downtrend and fell to the 1.0825 support in morning trading today, Tuesday, before settling around the 1.0840 level at the time of writing. In addition to the demand for it as a safe haven, the US dollar got support from the resumption of Boeing and other major manufacturers of heavy American equipment again, and some states began implementing active reopening plans for the economy, despite fears at the national level, where there is not enough tests done so far to prevent a new outbreak of coronavirus.

In one of the strongest steps to date, Georgia State Governor Brian Kemp announced plans to restart the state's economy before the weekend. Kemp said gyms, hair salons, bowling alley and tattoo parlors can be reopened on Friday, as long as their owners follow strict social and cleanliness requirements.

Boeing said it returned about 27,000 people to work this week to build passenger planes at its factories in the Seattle area, with precautions to slow down viruses, including face masks and other measures. Doosan Bobcat, an agricultural equipment maker and the largest manufacturer in North Dakota, has announced the return of about 2,200 workers at three factories across the state.

The reopening came amid a state of economic gloom, as oil futures fell below zero on Monday, and stocks and Treasury yields fell on Wall Street. The cost of US crude barrels for May delivery fell to negative $37.63. It was almost $60 at the beginning of the year.

Elsewhere around the world, the reopening was taking place step by step in Europe, as the crisis began to subside in places such as Italy, Spain and Germany. Parts of the continent may be weeks ahead of the United States on the infection curve, which has killed more than 170,300 people worldwide, according to Johns Hopkins University. Companies that start working again in the United States are likely to generate goodwill with the Trump administration as billions go to corporate relief. But the announced reopening may not quickly compensate for the 22 million Americans losing their jobs due to the crisis.

According to the technical analysis of the pair: I still adhere to my bearish view of the EUR/USD price path as long as it remains stable around the 1.0800 psychological support and is expected to decline below it, and therefore stronger control of the bulls to push the pair to the support levels 1.0765, 1.0660 and 1.0590, respectively. And there will be no return to bulls control without moving the pair to 1.1000 psychological resistance. Otherwise, the general trend of the pair will remain bearish.

As for the economic calendar data: the ZEW economic sentiment index will be announced for the German economy, then the existing US home sales data will be released.