After the unsuccessful attempt of the EUR/USD pair during last week's trading to move towards the 1.1000 psychological resistance to get the momentum needed to break out of the bearish bog, the pair returned with a correction down to the 1.0811 support during last Friday's session before closing trading around the 1.0845 level. As is well known, the 1.0800 support will increase the strength of the recent drop. The European single currency is under constant pressure. French President Emmanuel Macron recently sparked a new political uncertainty after he said in an interview with the Financial Times that the European Union might find itself collapsing if no joint mechanism could be agreed upon to fund economic recovery in the face of the Coronavirus crisis.

Macron said there is no "option" but to create a fund "that can issue a joint debt with a joint guarantee" to finance member states according to their needs rather than the size of their economies. This is an idea opposed by Germany, the Netherlands and other countries. The initiative - commonly referred to as the Corona Bond - was promoted by the weakest and most financially weak Eurozone members, such as Italy and Spain. But some countries opposed this because of the reluctance to loan other Eurozone countries that are often drawn with excessive spending habits.

So far, a rescue package of 540 billion Euros has been approved instead of joint debt issuance, and the European Central Bank has added 850 billion Euros to its quantitative program to facilitate bond purchases since the start of the coronavirus crisis and this has led to strongly new purchases towards the two most affected countries, Italy and Spain. These countries are also the weakest economically and financially among Eurozone countries, at best times, although the “difference” - or the difference in bond yields between those countries and Germany - is less than 2% in 2020 when between 2011 and 2013 it reached 7.5% and the Euro fell with investors fear a policy intersection in one part, and unsustainable borrowing costs eventually leading to a breakdown of the block.

The bond market interventions from the European Central Bank under the leadership of new President Christine Lagarde led to a financial crisis before it actually began and obscured the true level of anxiety that existed among the bond market investors, but the signs of stress go beyond the bond market. The GBP/EUR price has been positively linked to the South African rand until recently, which was reversed on March 26 when European Union leaders rejected the idea of Corona bonds.

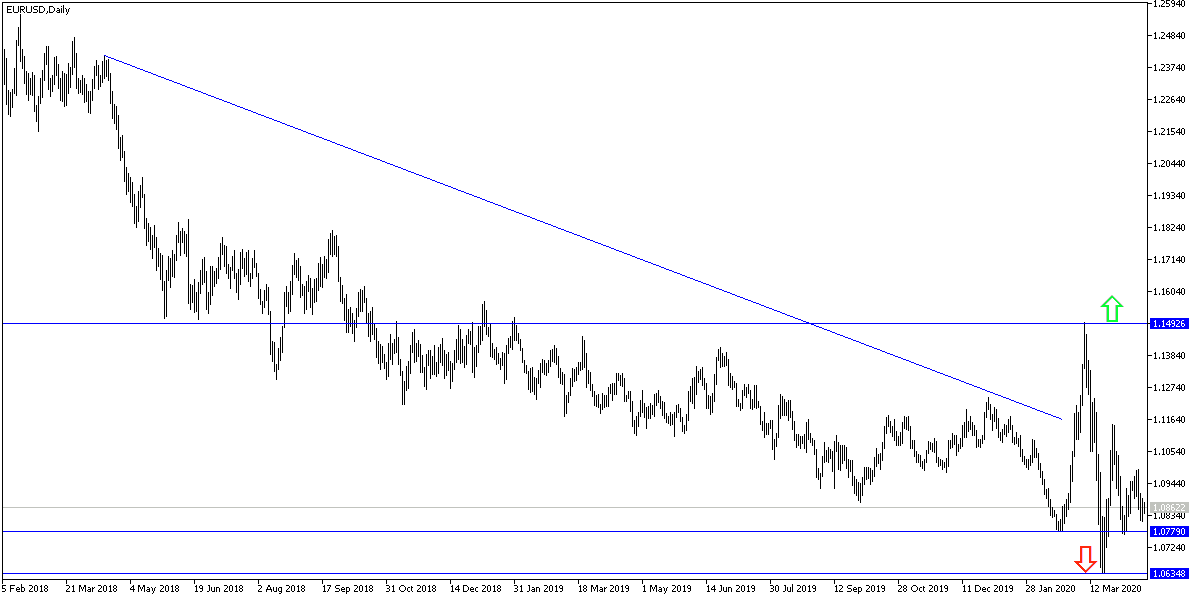

According to technical analysis of the PAIR: Bears still dominate the performance of the EUR/USD and will strengthen their grip if the pair moves below the 1.0800 support, where it is expected to move towards stronger support levels, the closest ones are currently 1.0760, 1.0690 and 1.0600, respectively. As I mentioned in previous technical analyzes, there would be no better opportunity to correct higher without the pair moving above the 1.1000 resistance, otherwise the drop will remain and may continue for a longer period.

As for the economic calendar data today: The German Producer Price Index will be announced, then the current account and the Eurozone trade balance. There are no significant US economic releases today.