For three consecutive trading sessions, the EUR/USD pair is under selling pressure pushing it towards the 1.0902 support before returning to stability around the 1.0965 level of in the beginning of Thursday’s trading, and after the announcement of disappointing results from the United States. The pressure on the single European currency was added due to the results of data showing that manufacturing activity in the Eurozone contracted at the fastest pace in more than seven years in March, due to the coronavirus outbreak. Final data from IHS Markit showed that the final manufacturing PMI fell to 44.5 from 49.2 in February. The reading was also below expectations of 44.8. The result remained below 50.0 for fourteen months in a row and reaching its lowest level in 92 months.

Sentiments worsened as reports of increasing number of coronavirus cases, which increased pessimism about the potential impact of the disease on the global economy.

The United States of America has recorded a major daily jump of 26,000 new cases, bringing the total to more than 189,000. The death toll there has jumped to more than 4,000, and officials expect that the disease can kill between 100,000 to 240,000 Americans.

Data from Eurostat also showed that the unemployment rate in the Eurozone fell unexpectedly to its lowest level in more than a decade in February, ahead of the announcement of measures to contain coronavirus in many countries in the region. The unemployment rate fell to 7.3 percent, while economists expected it to remain unchanged at 7.4 percent in January. The agency added that this is the lowest unemployment rate in the bloc since March 2008.

From Germany, retail sales saw an unexpectedly large growth in February, as consumers stock the basics before containment measures taken by the government to reduce the spread of coronavirus. Retail sales rose 1.2 percent on a monthly basis in February, after a 1 percent increase in January. Economists had expected sales growth to fall to 0.1 percent.

It is the United States, The ADP survey reported a slight decrease in private sector employment in the United States in March. Jobs fell by 27,000 jobs in March after jumping by 179,000 jobs in the February adjusted report. Economists had expected private sector jobs to drop by 150,000 jobs, compared to the addition of the 183,000 jobs that were originally announced for the previous month. The decline was much smaller than expected but still reflects the first drop in private sector employment since September 2017.

ADP also indicated that the National Employment Report, or NER, uses data only until 12th of the month, the same period that the Ministry of Labor uses for the closely watched monthly jobs report. Commenting on the results, Ahu Yildermaz, co-chair of the ADP Research Institute, said: “As such, the full month NER of March does not fully reflect the recent impact of COVID-19 on employment status, including unemployment claims announced on March 26, 2020 ″.

On Friday, the US Department of Labor is to publish the closely watched monthly jobs report, although the data may be seen as old news amid the Coronavirus pandemic. Economists now expect employment to drop by about 100,000 jobs in March after jumping 273,000 jobs in February. The unemployment rate is expected to rise to 5.3% from 3.5%

.

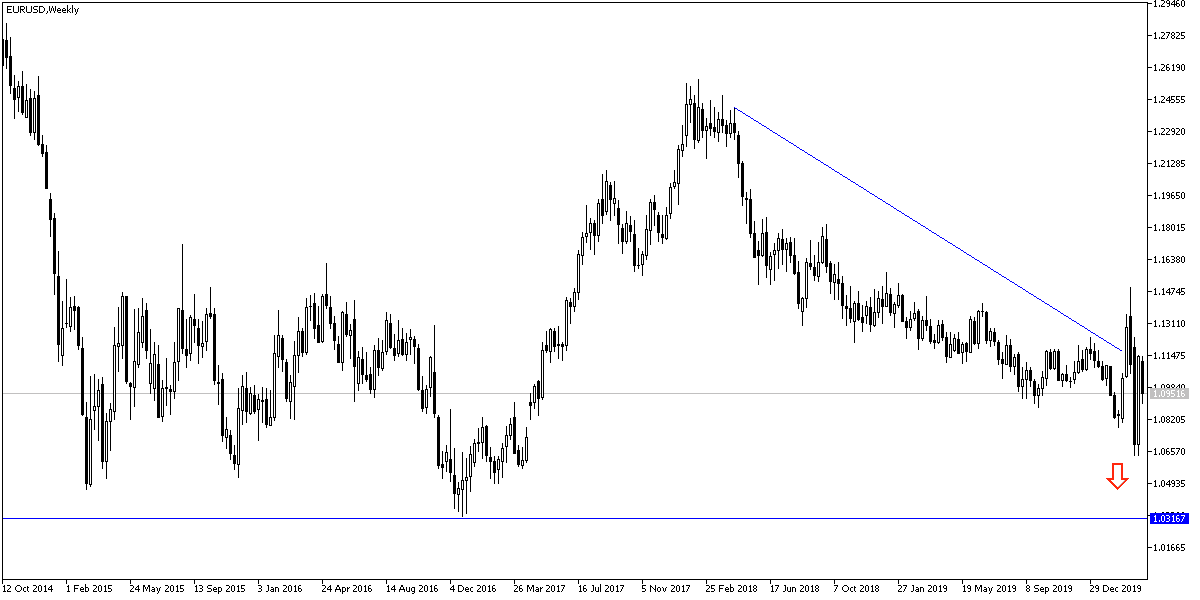

According to technical analysis of the pair: the success of the bears in pushing the EUR/USD pair below the 1.0900 support will increase sales operations to push the pair towards stronger support levels, the closest ones are currently 1.0880, 1.0790 and 1.0660, respectively. The health situation in Europe is worrying due to the Coronavirus, but the anxiety has increased more in the United States. However, the US economic stimulus in the face of the crisis is much greater than that of Europe and there will be no chance for the bulls to control the performance again without moving back above the 1.1155 resistance.

As for the economic calendar data today: The rate of change in Spanish jobs and the producer price index in the Eurozone will be announced. From the United States, weekly jobless claims, trade balance, and factory orders well be released.