The US dollar has returned to assert that it is the strongest. Growing pessimistic outlook for the future of the global economy, which faces the Coronavirus pandemic for nearly four months, amid complete paralysis of the global economy, will support investors returning to buy the dollar as a safe haven again. The EUR/USD fell during yesterday's trading by more than 100 points, reaching the 1.0856 support from its recent gains, which hit the 1.0990 resistance, and settled around the 1.0910 level the beginning of Thursday's trading. The important US economic record low results below expectations, confirm the depth of the crisis.

The results of the official US economic data showed a record decrease in US retail sales in March. Where it fell by - 8.7 percent in March, after falling by - 0.4 percent adjusted rate in February. Economists had expected retail sales to drop - 8.0 percent, compared to - 0.5 percent that was announced the previous month. The closure policy to contain the outbreak and the end of the panic buying phase contributed to the record sales decline.

On the European side. Yesterday, the European Union moved to avoid a possible chaotic and catastrophic easing of restrictions aimed to contain the spread of the coronavirus, and warned its 27 countries to act with extreme caution when it intends to return to normalcy and to base its actions on health directives. Austria, the Czech Republic, and Denmark have already eased some of the closures, so the European Union’s executive arm, the European Commission, has developed a road map for members of the world's largest trade bloc to coordinate exit from closings, which they expect to take at least a few months and involve a broad test.

According to the European Center for Disease Prevention and Control, about 80,000 people in Europe are now killed by the disease - about two-thirds of the world's death toll. The commission said these scientists must be relied upon to guide national exit strategies in the coming weeks and months.

Brussels is deeply concerned about the damage that could happen if every country in the European Union charted its own path to reopen the economy, especially given the ensuing panic after the epidemic first spread in Italy, with the unspecified closure of borders that raised huge traffic jams and a banned export, that has severely forbidden countries of the must needed medical equipment.

And for the largest economy in Europe, the German economic ministry said in a report published on Wednesday that the economic recovery in Germany will begin in the second half of the year, supported by the measures taken by the government to alleviate the contraction caused by the Corona virus. The ministry estimated that the economy has been in recession since March and is expected to continue until mid-year.

The ministry stated that the collapse of global demand, the interruption of supply chains, changes in consumer behavior and uncertainty among investors have a major impact on Germany. Because of the Corona pandemic, an unprecedented fall in the industrial economy is expected in the coming months.

According to the spring report prepared by five leading research institutes, Germany's GDP will decrease by 1.9 percent in the first quarter of 2020 and by 9.8 percent in the second quarter due to the closure. The ministry noted that the main labor market indicators have slowed down significantly, indicating that employment will decrease.

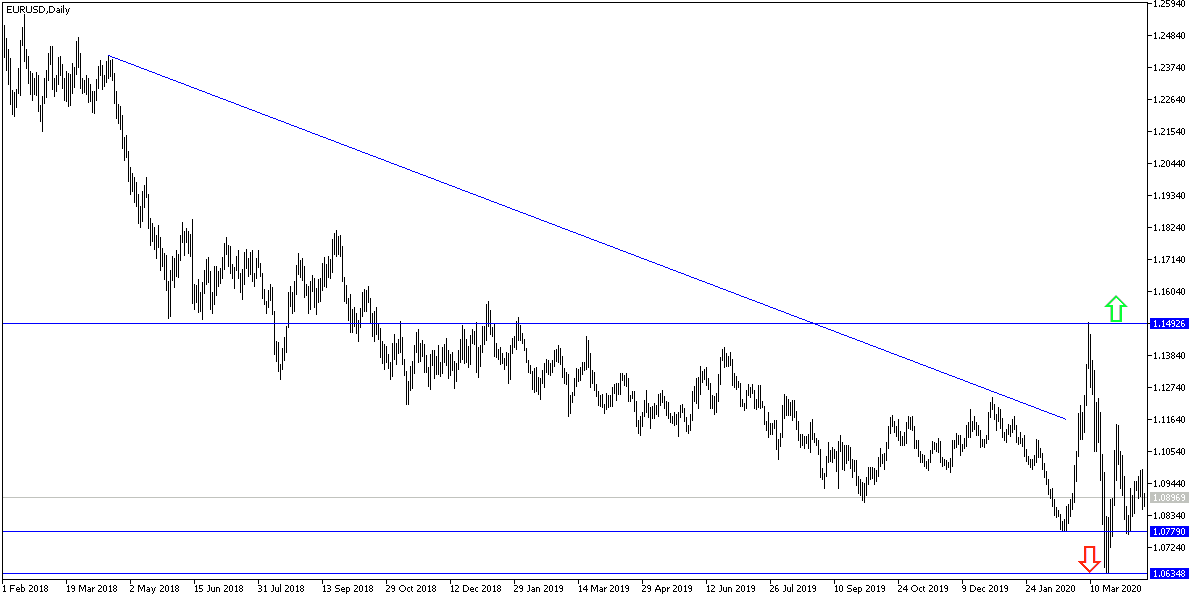

According to the technical analysis of the pair: The EUR/USD return to stability below the 1.0900 support will restore the strength of the bear's control over the performance, as is the case on the long term. Support levels 1.0880, 1.0790 and 1.0600 will be the next targets if the demand for the US dollar as a safe haven continues. There would be no initial opportunity for a bullish correction without stabilizing above the 1.1000 resistance again. I still prefer to sell the pair from every upper level.

As for the economic calendar data today: German consumer price index and industrial production in the Eurozone will be released. From the United States of America, the most important jobless claims data and building permits will be announced, as well as the Philadelphia Industrial Index.