Despite the weakness of the US dollar during last week's trading, gains of the EUR/USD pair did not exceed the 1.0952 resistance, and for both trading sessions, it failed to overcome it. Accordingly, it closed last week’s trading around the 1.0935 level, the European single currency is still suffering from the lack of necessary momentum to complete the bullish correction strongly, as Europe remains an active point for the coronavirus spread. The countries of the continent are still leading the numbers of deaths from this epidemic, and in return the United States of America tops the list of countries in the world in terms of the number of infections.

The Euro has received some support after the Euro group’s finance ministers approved a financial support package for the bloc's economies, although it faces immediate and strong resistance on the charts, and technical analysts believe that the Euro may move in limited ranges for a period of time.

Investors gave up the US dollar, so the risk currencies rose, along with the rise in global stock markets, which have now recovered from nearly half of their historical declines in March. And the hopes for slowing the progression of the coronavirus on the global economy were behind these recent moves, which made investors carefully monitor the numbers of infections and deaths of coronavirus.

The EUR/USD price path will be influenced significantly by the general mood among investors, which is in itself a sign of the momentum behind the effect of the coronavirus on the global economy, and increasingly the political background in Europe. European investors will have the first opportunity to make a judgment about the European financial response to the Coronavirus when they return to their offices from this weekend this Tuesday, which could have an impact on the Euro. In general, the disagreements between national leaders on the best way to prove boastful European solidarity, often spoiled what was supportive of the Euro last week, and it cannot be ruled out that disputes about responding to the economic impact of the virus will affect the European single currency again this week.

Eurozone finance ministers reached an agreement at the last minute last Thursday to provide more than 500 billion Euros in aid to the severely hit economies, but the plan needs the unanimous approval of national leaders in the European Council, and Italian Prime Minister Giuseppe Conte indicated that he may not Support it.

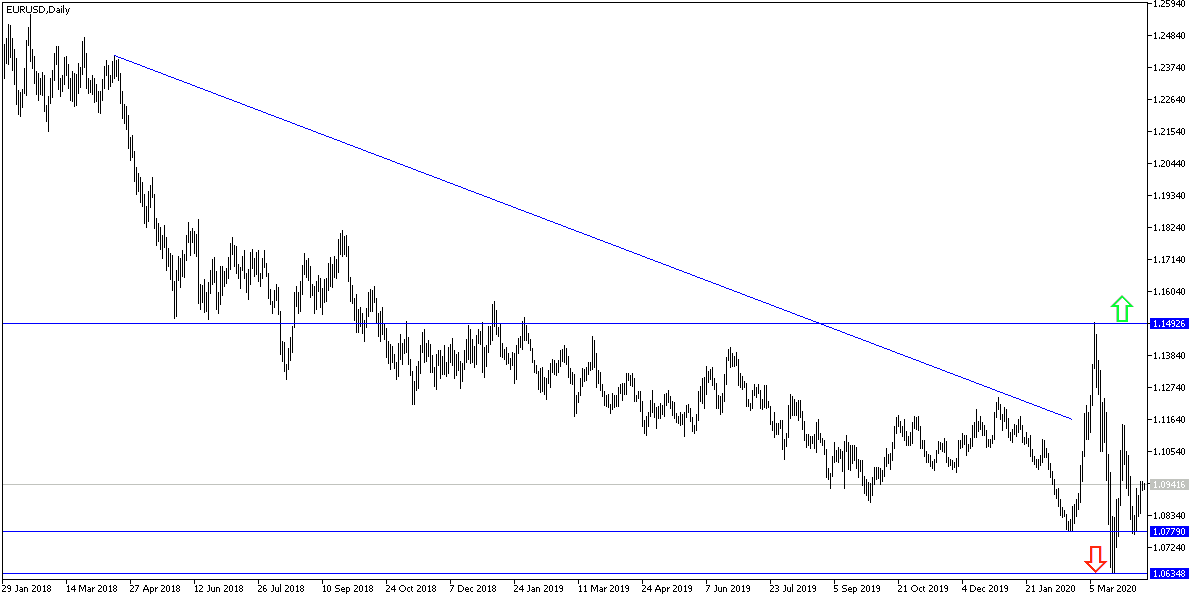

According to the technical analysis of the pair: Recent bullish EUR/USD movement still lacks the strong momentum in order to be able to reverse the general trend, which is still bearish. At the same time, the resistance levels 1.1020, 1.1100 and 1.1185 may be the first correction stations to support stronger bulls control over performance. On the other hand, a return to the move towards the support levels 1.0855 and 1.0790 is a confirmation of the strength of the current downtrend.

As for the economic calendar data today: There are no important data, whether from the Eurozone or the United States of America.