Over the past two weeks, the US saw initial jobless claims surge by roughly ten million due to the global Covid-19 pandemic. The labor market is more significantly impacted than during the 2008 Great Recession or the 1933 Great Depression. While today’s NFP report does not include the two weeks where initial jobless claims sky-rocketed, it may give an early indicator where job losses are headed. ADP data released earlier this week showed private-sector job losses far below expectations. Any disappointment today is likely to spike the EUR/USD into its short-term resistance zone.

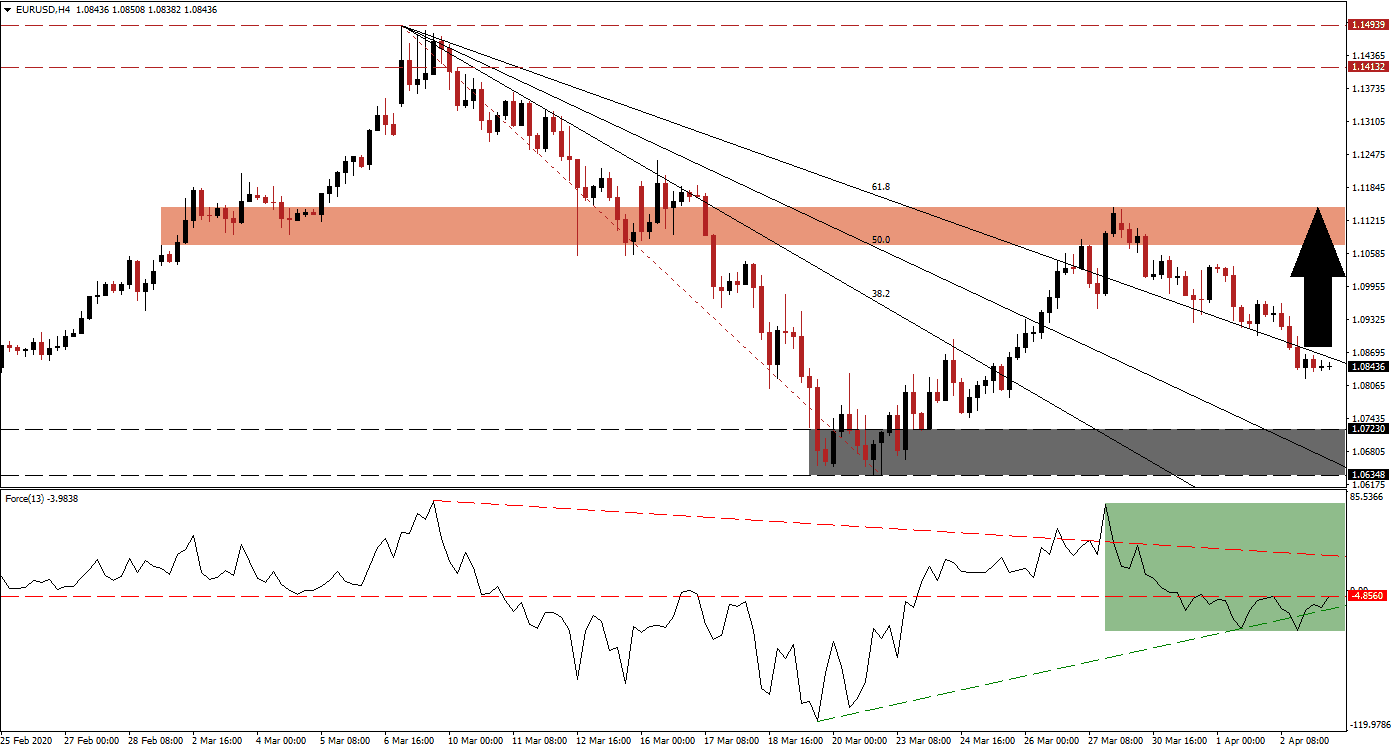

The Force Index, a next-generation technical indicator, recovered from a temporary dip below its ascending support level and is now challenging its horizontal resistance level, as marked by the green rectangle. Bullish momentum is anticipated to suffice for a breakout, followed by an advance into its descending resistance level. Bulls will take control of the EUR/USD after this technical indicator crosses above the 0 center-line.

After this currency pair completed a breakout above its support zone located between 1.06348 and 1.07230, as marked by the grey rectangle, it crossed through its complete Fibonacci Retracement Fan sequence. The existing reversal, on the back of structural Euro weakness, took price action below its descending 61.8 Fibonacci Retracement Fan Resistance Level. Selling pressure eased, and the EUR/USD entered a holding pattern until the release of the March NFP report.

Given the long-term bearish outlook for the Eurozone economy, any breakout from current levels is favored to remain a short-lived price spike. A breakout above the short-term resistance zone located between 1.10732 and 1.11462, is unlikely. With the US outlook equally bearish, Forex traders should expect volatility to increase in the EUR/USD. Price action will be dominated by Covid-19 related headlines out of Washington and Brussels until more clarity about the costs of stimulus packages emerges. You can read more about a breakout here.

EUR/USD Technical Trading Set-Up - Breakout Scenario

Long Entry @ 1.08400

Take Profit @ 1.11400

Stop Loss @ 1.07650

Upside Potential: 300 pips

Downside Risk: 75 pips

Risk/Reward Ratio: 4.00

A reversal in the Force Index below its ascending support level and more profound contraction into negative territory may pressure the EUR/USD into its support zone. The 50.0 Fibonacci Retracement Fan Support Level, passing through its support zone, could allow price action to recovery. With an uncertain outlook on the back of two economies plagued by slow initial responses to the global pandemic, this currency pair is likely to remain confined to its dominant trading range between its support zone and its short-term resistance zone.

EUR/USD Technical Trading Set-Up - Reversal Extension Scenario

Short Entry @ 1.07150

Take Profit @ 1.06350

Stop Loss @ 1.07550

Downside Potential: 80 pips

Upside Risk: 40 pips

Risk/Reward Ratio: 2.00