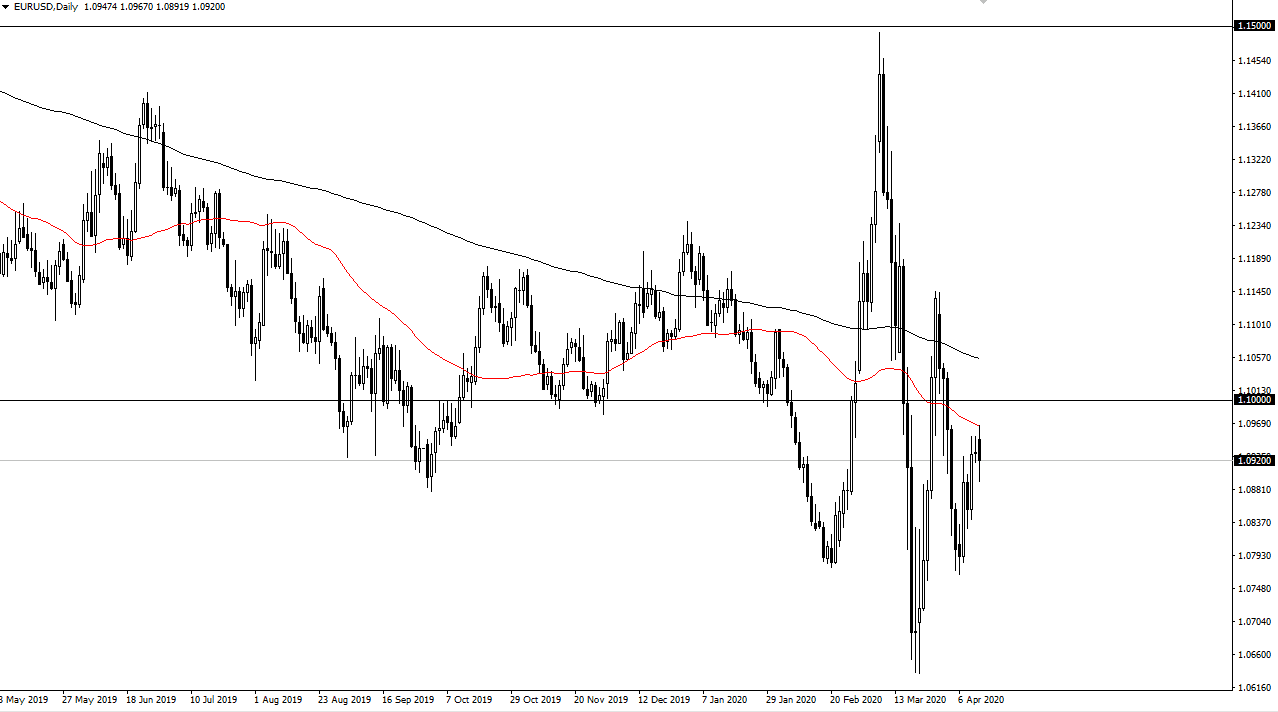

The Euro initially tried to rally during the trading session on Monday but found the 50 day EMA above to be a bit too resistive. At that point, the market rolled over and broke down a bit, but I think what we are going to see now is a tightening of the overall consolidation. This makes sense, because quite frankly this pair barely moves under the normal circumstances. Looking at the chart, I believe that the most logical place to find a lot of resistance would be the 1.10 level as it is a large, round, psychologically significant figure and an area that has counted before. To the downside, the 1.08 level underneath is significant support, so I believe that we are trying to carve out some type of consolidation range of those 200 pips.

The US dollar is a bit soft due to the Federal Reserve throwing money into the system and buying anything that isn’t nailed down, but at the same time the European Central Bank is going to be forced to do many of the same situation. Beyond that, it seems as if the market is basically trading on the latest coronavirus numbers more than anything else, so that of course will continue to be the biggest driver of where we go next.

With that, keep in mind that you will need to pay attention to the infection numbers and of course the death rates. It seems as if the European Union is starting to slow down, but at this point the United States is as well. If that is in fact going to be the case, then we will start to pay attention to the economic numbers again, at least that’s the hope. If that is going to be the case, then it’s very likely that the gains in the Euro will be somewhat limited. Furthermore, one has to wonder whether or not there is going to be enough global growth out there to drive the value of the US dollar down. At this point there are no true signs of that, so I do anticipate that the Euro will probably be on the receiving end of a surge into US treasuries going forward and perhaps even the US stock market as it will outperform European indices on the whole. One thing is for sure, the range that we have been trading is starting to tighten up so normal behavior is probably on its way.