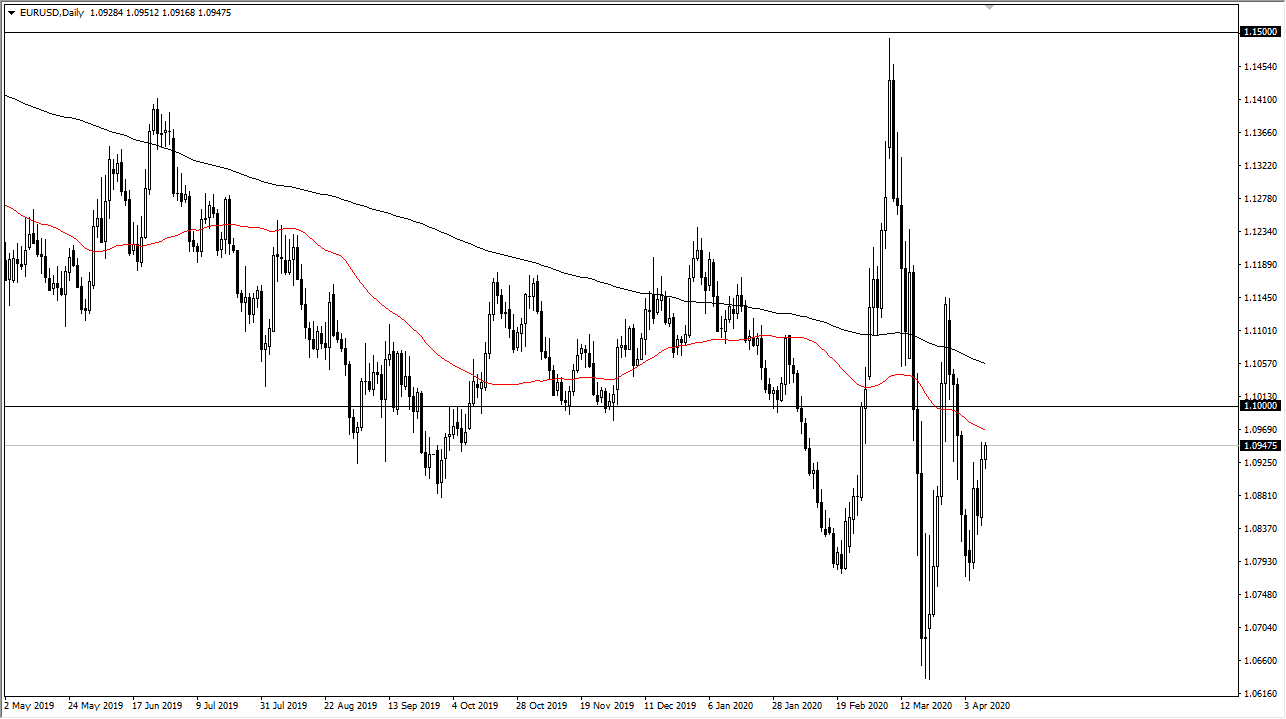

The Euro rallied slightly during the trading session on Friday, reaching towards the highs of Thursday during the holiday. Remember, Friday was Good Friday so there wasn’t a lot of volume in the market, so I would not read too much into the candlestick itself. Having said that, if you look at the Thursday candlestick it looks like the market is going to go looking towards 1.10 level. That of course is a psychologically important figure and I think would attract a lot of attention in general.

The 50 day EMA is sitting below there while the 200 day EMA is sitting above it. With the 1.10 level being in the middle, that’s essentially “fair value” at this point. Any signs of exhaustion in that region should continue to be sold into, because quite frankly this is a pair that is in a longer term downtrend although the last couple of weeks have been extraordinarily choppy and noisy. I think what we are trying to do is figure out a fulcrum for price where we can continue the same “chop-chop” action that this pair is known for. In a sense, that’s probably good sign because it shows the markets trying to return to some type of normalcy.

This is one of the multitude of reasons that I think the 1.10 level will be a bit of a magnet for price, so I don’t have any interest in trying to buy the Euro, because if we start to see US dollar weakness, I think that there are other currencies out there that will outperform the Euro. The first one that comes to mind that the British pound as it is pressing significant resistance right now and therefore has been building up a significant amount of inertia.

The Australian dollar has broken out rather significantly over the last several days, so the Euro could play a little bit of catch-up, but quite frankly the situation in the European Union is not very healthy and that should continue to work against the value of the common currency. It’s not that we can’t go higher, it’s just that the Euro should underperform in relation to its competitors out there. To the downside, if we break down below the lows of the Friday session, we could go looking towards 1.07 level, where we had seen a lot of support underneath.