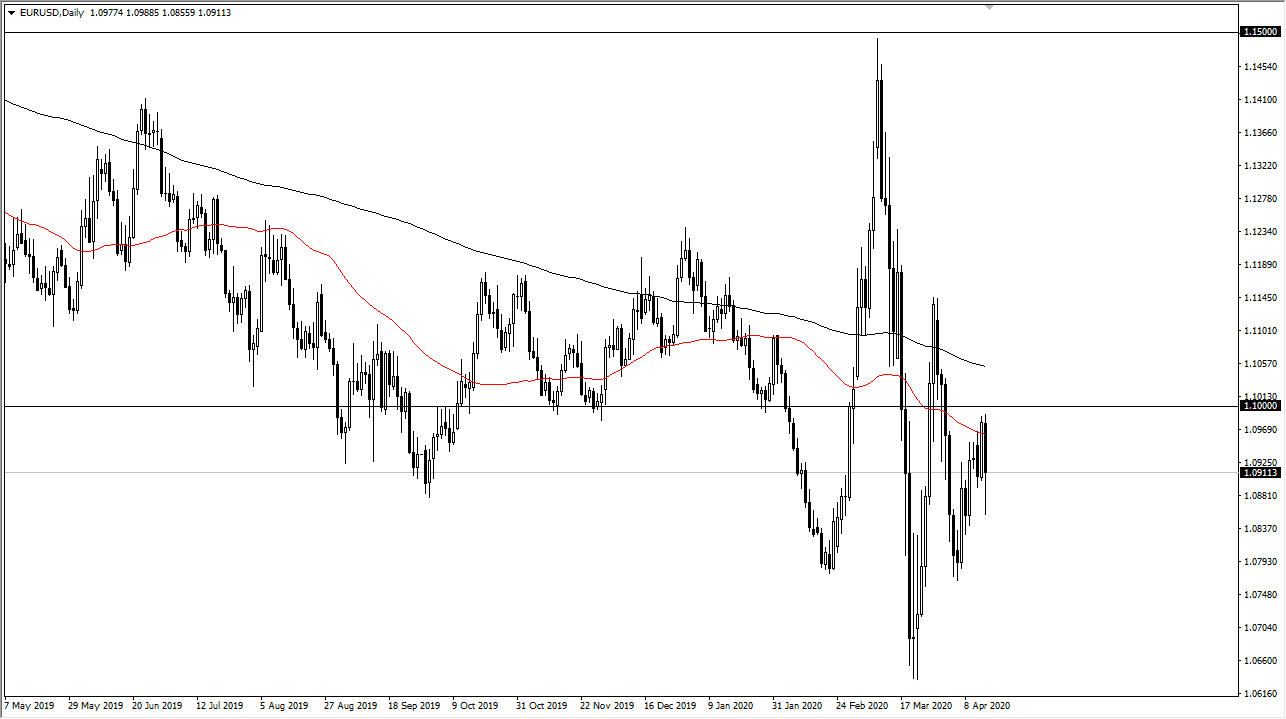

The Euro broke down rather significantly during the trading session on Wednesday but did bounced significantly to recover quite a bit of the losses. That being said, the market certainly looks as if it is compressing in order to make a bigger move, but I think you will need to be very cautious about trying to jump into the Euro with both feet, as we could get a significant move sooner or later. To the upside, if we broke above the 1.10 level, we will more than likely go looking towards the 200 day EMA above there. Once we get above that area, then it could change the entire trend.

However, if we do continue to see a lot of negativity out there and of course need for US dollars, then I think the market drops to the 1.08 level underneath. A breakdown below that level opens up the door to the 1.0650 level, and possibly even as low as the 1.06 handle. The Euro is probably the most important currency to watch against the greenback right now, because it will give us an idea as to whether or not the greenback rises or falls against most currencies, with perhaps the exception of the British pound which seems to be in its own world at the moment.

The European economic situation is not good, and I think that continues to be a major problem. Because of this, it is very likely that consolidation is the main theme here, as well as compression. The candlestick for the day is bearish, but we did get a bit of a bounce and therefore it’s likely that the market continues to chop around more than anything else. If that’s going to be the case, then it’s likely that we will continue to keep this market in more of a tight range, but I still think there is plenty of negativity to keep this market on its back foot. Overall, I believe the choppiness continues to be the biggest driver and therefore you need to keep your trades based upon short-term charts more than anything else. Keep in mind that the 1.10 level will attract a lot of headlines, and of course a lot of resistance. That being said, if we do break down below the lows of the trading session for Wednesday, I think that opens up more selling pressure than anything else.