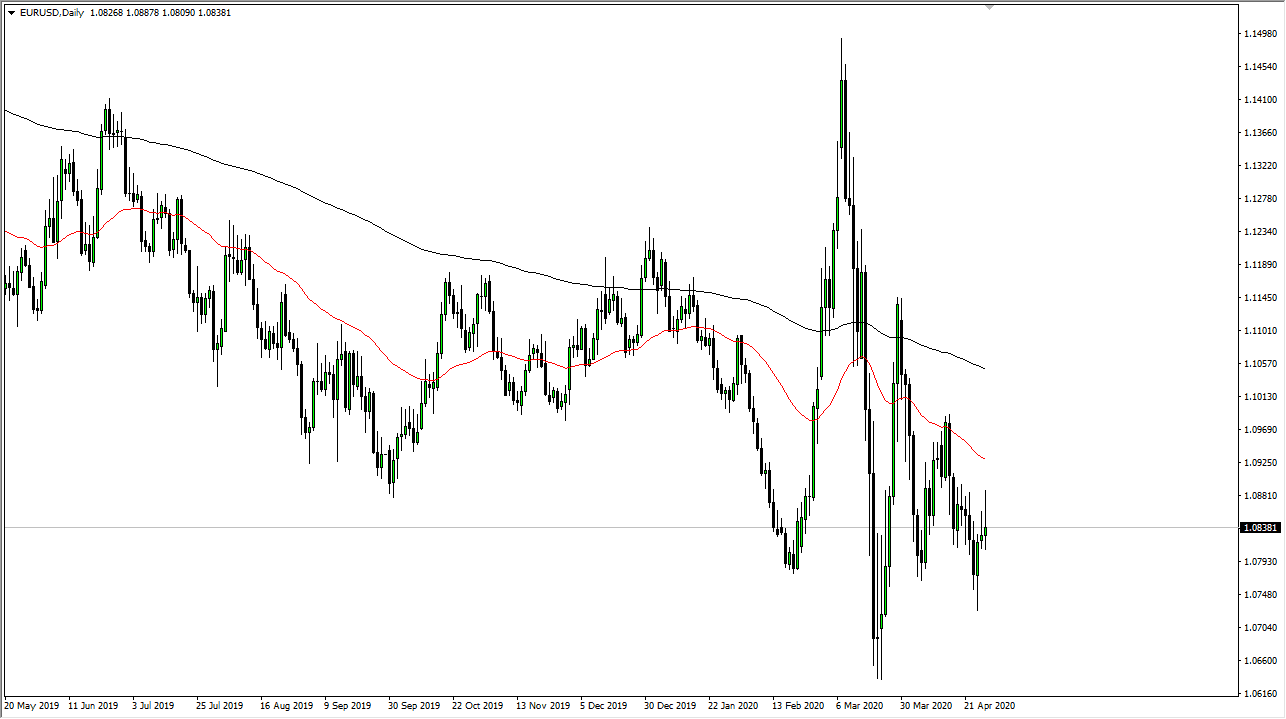

The Euro rallied significantly during the trading session on Tuesday but give back all of the gains essentially to form a massive shooting star. This shows just how weak the Euro is currently, as the market cannot hang on to gains. The 1.09 level continues to be a major resistance barrier, and therefore it makes quite a bit of sense that we have given back gains there. When you look at the several candlesticks previously, they all have major wicks on the top of them, showing signs of weakness.

To the downside, I believe that the 1.0750 level is the target as it is a significant support level. At this point, the market should continue to see a lot of choppiness, as we clearly have a lot of negativity overall. The market has broken down over the longer term, and the downtrend seems to be most certainly intact. What is going to be even more crucial is the fact that the Federal Reserve is giving a statement at the end of the day on Wednesday, and that will almost certainly determine the direction of the dollar going forward.

The downtrend has been intact for several years, even though we have seen extreme amounts of volatility as of late. That being said, the market is likely to continue to fade rallies so even if we do take off to the upside, I will be looking for an opportunity to short the Euro overall, because unless the Federal Reserve does something to absolutely kill the dollar, the United States will still be a much more preferable destination than the European Union when it comes to putting capital to work. That being said, I think that one thing to pay attention to is that the most recent high was lower, just as the most recent low was. In other words, we are starting up the overall downtrend, but it should be noted that the market is getting very choppy, which is a little bit more along the lines of normalcy. This is one of the choppy as currency pairs you can trade, but it does tend to grind in one direction for long periods of time. I have no interest in buying the Euro, at least not unless something changes drastically from a fundamental standpoint, something that I just do not see happening unless the Federal Reserve does something to make that happen, something that is not necessarily out of the realm of possibility. In 24 hours we should have quite a bit more clarity.