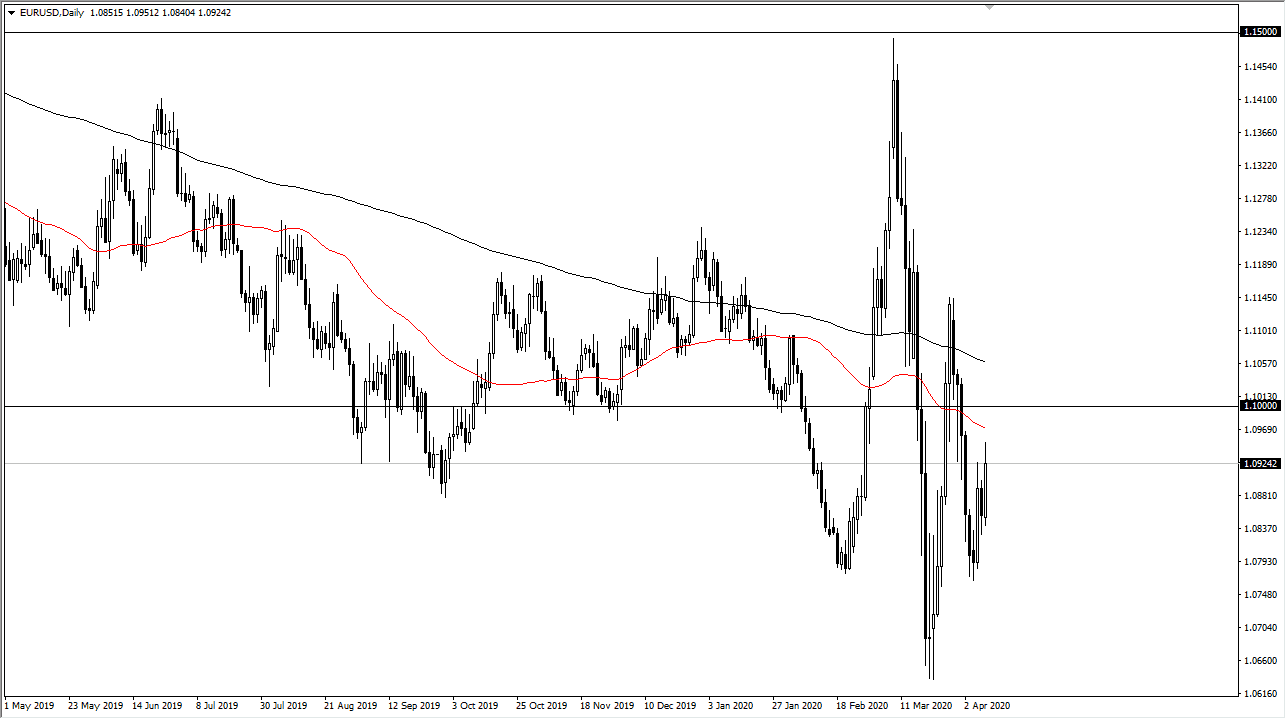

The Euro has rallied during the trading session on Thursday, breaking above the 1.09 level above, and it does suggest that the market may go looking towards the 1.10 level given enough time. The 1.10 level will attract a lot of attention, and therefore I think that selling pressure will reenter this area based upon the psychological importance of the figure, and of course the structural noise that we have seen at this level more than once.

The link the candlestick during the trading session on Thursday suggests that we are going to continue to see a little bit of momentum. That being said, one thing that you can look at is that the highs and the lows of this market continue to contract, so the question then becomes whether or not we are trying to build up the necessary momentum to make a huge move, or are we simply going back to the norm? The normal attitude and pattern of the EUR/USD pair is to simply chop back and forth and show almost no real momentum. Granted, it does have more of a downward tendency over the longer term, but at the end of the day it is one of the lease volatile pairs under most circumstances.

At this point in time I believe that the 50 day EMA and the 200 day EMA lead the way lower. That being said though, with the Federal Reserve offering $2 trillion worth of stimulus, the question now becomes whether or not the European Central Bank follows the same path. It very well could, but it’s obviously a much more complex situation in the European Union. Ultimately, fading rallies probably works but I’m not sure whether or not it happens on Friday, or if it’s early next week as a lot of traders will probably be a bit hesitant to put a lot of money into the market ahead of the weekend as headlines could come out to cause major issues if you aren’t careful. At this point, I think what you are more than likely going to see is a short-term rally in the early hours of Friday, perhaps followed by some selling later in the day, especially if we get close to the previously mentioned 1.10 level above. That being said, the situation with the Euro could be a fluid one, as we will await the ECB and its next move.