The Euro broke down a bit during the trading session on Thursday, reaching towards the 1.08 level. That being said, the market looks very likely to continue seeing downward pressure as the European Union struggles for growth again. Remember, the European Union was rather soft it before any of the coronavirus situation arose, so it makes sense that we would simply see a continuation of previous trends.

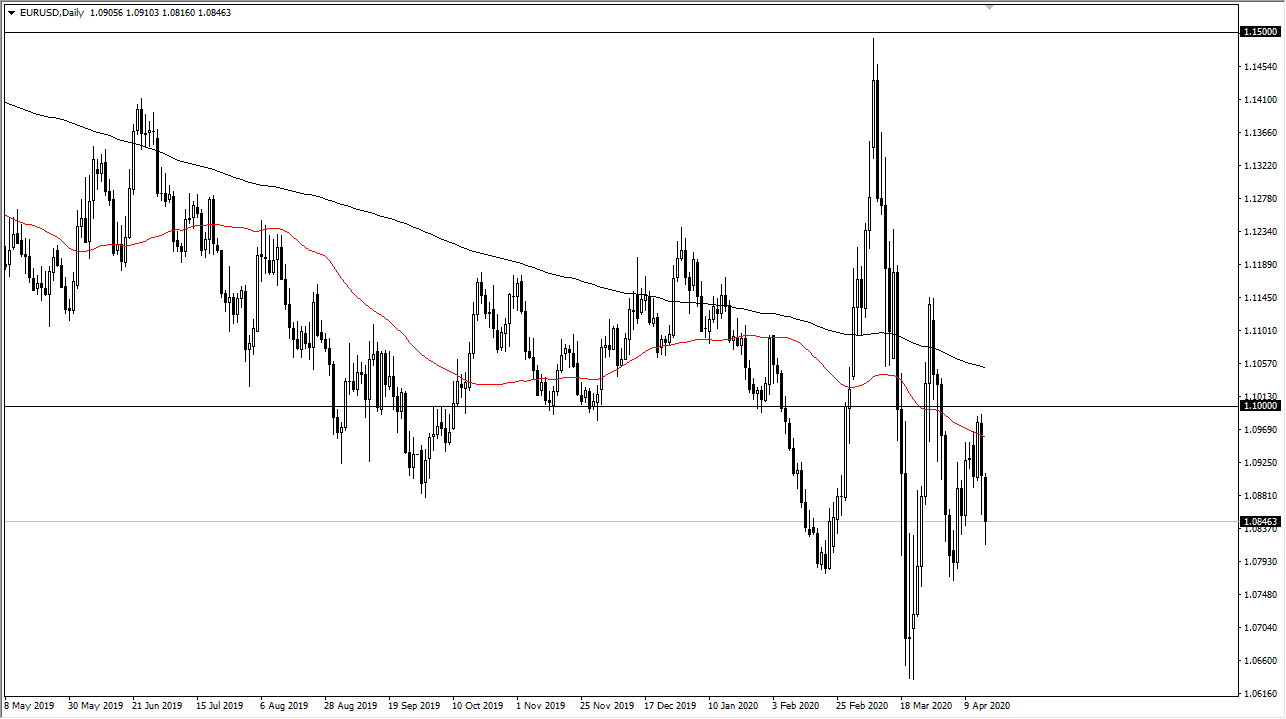

While we did bounce slightly during the trading session on Thursday, I can also see that the 50 day EMA above has offered significant resistance. The 200 day EMA is sitting above the 1.10 level, so I think that also offers a lot of resistance. Essentially, the 1.10 level is in the middle of these two moving averages, and therefore I think it will continue to be a major barrier and psychological resistance level as well. I think sellers will return if we get anywhere near there, but if we can get a significant move below the 1.08 level, it opens up the door for the Euro to go down to the 1.06 level after that.

For what it’s worth, we had a significant bounce during the previous session on Wednesday and have sliced through it. This suggests to me that we still have more of a negative bias, but this pair does tend to be very choppy in general, which is why the spread is so thin. Nonetheless, I still bearish this market until we clear the 1.11 level, which is something that’s going to take an extraordinarily bullish move to make happen anytime soon. Furthermore, the US dollar is considered to be a “safety currency”, and we have seen 10 year yields plummet in the United States, showing a significant amount of demand for the safety of treasuries, which of course require US dollars, so it’s a bit of a feedback loop at that point. Beyond that, the Euro has the misfortune to being handled by the European Central Bank, which is probably one of the few central banks out there that is trying to outdo the Federal Reserve when it comes to stimulus. Until we get some type of significant recovery with the coronavirus situation and the global economy, I believe that the US dollar continues to strengthen against the Euro, even though we may see the occasional bounce in this pair, I simply look at it as an opportunity to short from higher places.