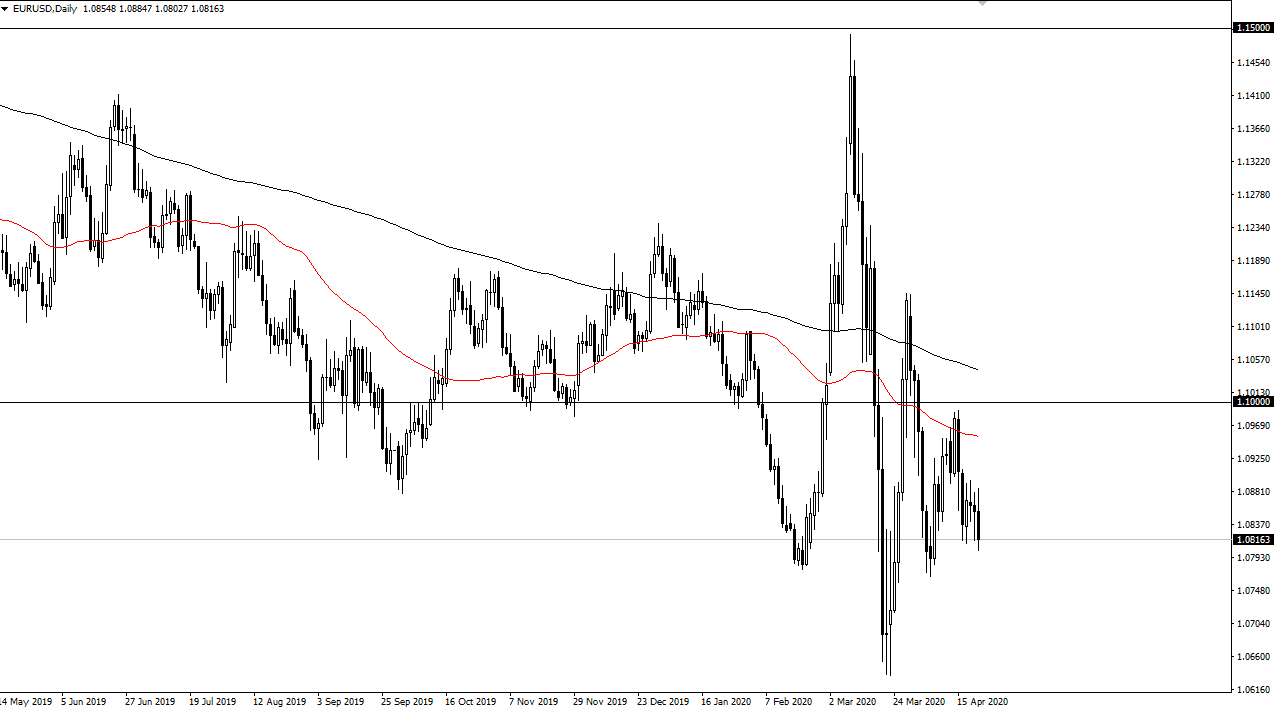

The Euro initially tried to rally during the trading session on Wednesday but found enough resistance just below the 1.09 level to rollover and reach back towards 1.08 level. If we can break down below the candlestick during the trading session on Wednesday, then it is likely that we go looking towards 1.0650 level after that. All things being equal, the Euro does favor the downside, as there are a lot of concerns when it comes to the Euro and of course the European Union.

The United States on the other hand has the treasury market that continues to attract a lot of capital inflows. At this point, when the rallies fail, it is time to start shorting again. That being said, the Euro does not necessarily look like it has much of a range right now but breaking down below the 1.08 level does open up a bigger move. To the upside, if we were to break above the 1.09 level then it is possible that we could go looking towards the 1.10 level, but that is an area that I think is a bit of a “ceiling” in this market.

The volatility in this pair picked up a little bit during the trading session on Wednesday and that of course is something worth paying attention to, especially considering that the market has done almost nothing over the last several days. With that being the case, it is a short-term traders type of environment and that is exactly how you should approach it. Ultimately, I like the idea of using the 1.09 level as a bit of a short-term ceiling, but I would keep my position size relatively small as the market is so choppy in general. Expect more the same, because this pair is very choppy in general, and simply has nowhere to be anytime soon. That being said, short-term rallies offer short-term profits, but anything beyond that is probably asking way too much. The US dollar continues to be the most favored currency overall, and therefore I think you will continue to see that here as well. In other words, it’s a matter of being patient and waiting for the Euro to get a little bit “expensive”, and therefore offering “cheap dollars”, which a lot of funds in for that matter governments are doing right now as US dollars are needed to pay off emerging market debt and many other concerned.