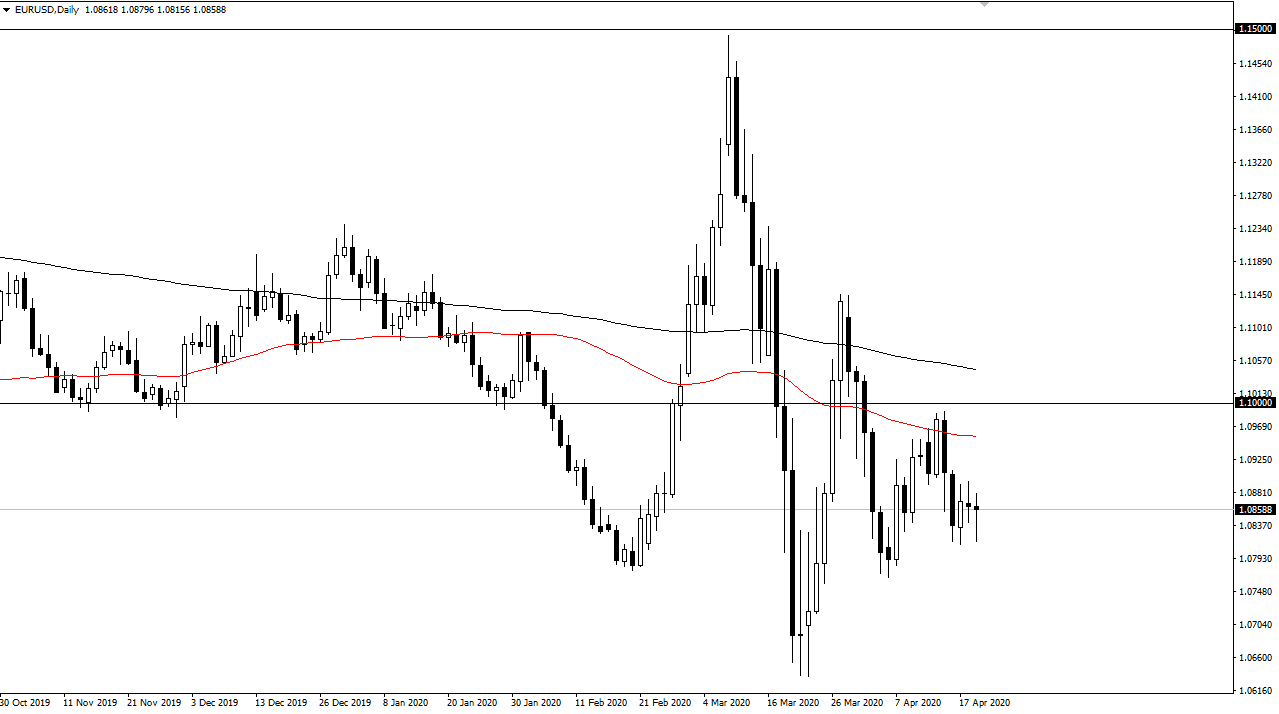

The Euro has gone back and forth during the trading session on Tuesday, simply because we are hanging around a very highly contested area. This is a market that tends to be very choppy, so the fact that we have seen this market simply go back and forth is just more of the usual. At this point, I believe that the 1.08 level underneath offer significant support, so therefore if we were to break down below that level it is likely that we could go towards the 1.0650 level underneath. To the upside, I think that we could test as high as 1.10, but obviously we need some type of “risk on” type of scenario in order to have that happen.

The Euro will continue to struggle with the idea of the various financial issues that are so prevalent in the banking system, and of course the demand for US dollars continues to be a major driver of the currency markets in general, as debt around the world continues to be a major issue. Beyond that, US Treasuries continues to be a major source of demand for the dollar as well.

The 50 day moving average is sitting at roughly 1.0950 level, which will only solidify the resistance that extends to the 1.10 level. At that point, I would look for some type of exhaustion that you can take advantage of. Clearly, the global situation is getting worse, not better so I think it makes more sense that the US dollar will strengthen over the Euro, not to mention most other currencies globally. The 200 day EMA is sitting just above the 1.10 level as well, so I think it is only a matter of time before selling pressure comes in and pushes the market lower.

If we break down to the downside right away, then I feel it is only a matter of time before we grind towards the 1.0650 level, and then possibly the 1.05 level. The candlestick is a bit of a hammer, so it looks like we may be ready to go back and forth more than anything else. A short-term bounce might help a bit, but I do not think that changes much. At this point, simple “fading the rally” should continue to work and therefore it is something that you need to be paying attention to. Either way, you are going to be seeing big moves in this pair unless something drastic happens.