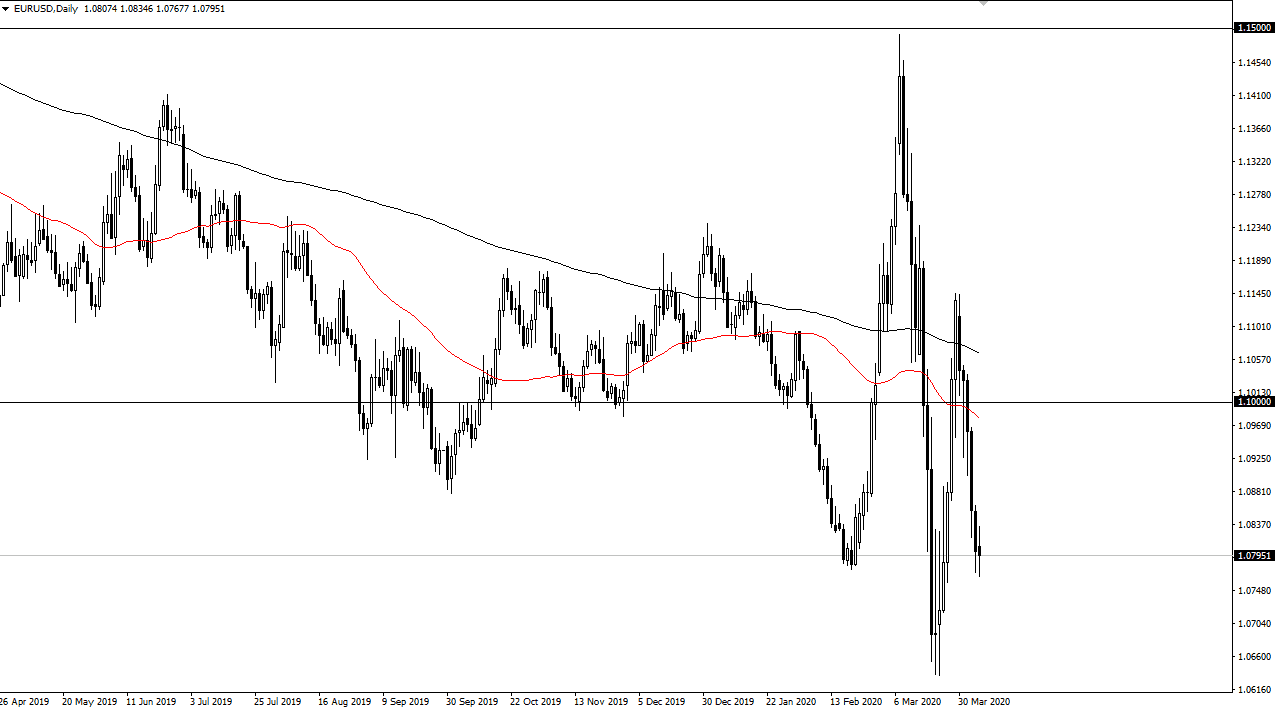

The Euro has gone back and forth during the trading session on Monday to kick off the week. That being said, the market seems to be hanging around the 1.08 level which of course is a large, round, psychologically significant figure and of course an area where we have seen both support and resistance at previously. Looking at the candlestick for the trading session on Monday, it shows plenty of neutrality, and therefore a bit of confusion. The fact that it is at the support level suggests that there is going to be a certain amount of trouble in this general vicinity.

At this point, I believe that the next trait signal will we formed by breaking out of the range for the trading session on Monday. If we can break above the top of the range for the day, it’s very likely that the market will then go looking towards 1.09 level followed by the 1.10 level after that. If the market breaks below the bottom of the candlestick, it opens up a move down to the 1.0650 area. That being said, I expect this pair to be very volatile over the next couple of days because quite frankly it normally years. The choppiness will continue, and I don’t see an argument for that to change anytime soon.

Looking at the longer-term chart, you can see just how destructive this market has been over the last several weeks, so keep in your position size relatively small is probably going to be advisable for the foreseeable future. The European Union has seen a lot of destruction to its economy and I suspect it will see even more going forward. Remember, the EU looked rather anemic before the coronavirus hit so hard. With that, one would think that it’s only worse at this point so it’s difficult to imagine that the economy is suddenly going to turn around. Granted, there will be some discussion about the coronavirus totals in the United States but in the end the US treasury market makes the demand for US dollars important. At this point in time, it’s very likely that the market will continue to be volatile and dangerous, but I do believe it’s only a matter of time before the sellers would come in, even on a break out to the upside so if you do take a long position in this pair, I’d be extraordinarily careful on that breakout.