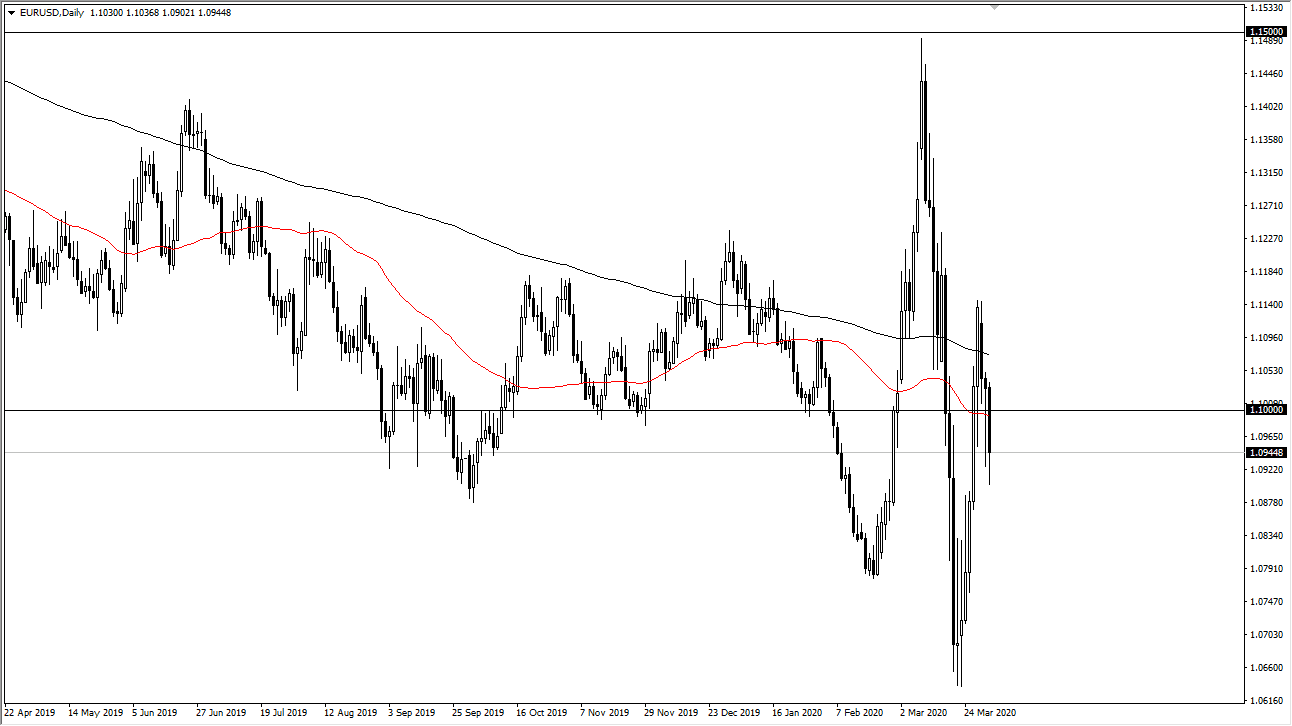

The Euro continues to go back and forth, and I simply think there’s no real directionality to this pair right now. It’s obvious that the 1.10 level is a bit of a magnet for price, and until we can make a significant break away from it, it’s probably pointless to trade this pair. The EUR/USD pair is typically one of the choppiness pairs in the Forex world anyway, so the fact that we have seen so much choppiness in an even bigger range probably isn’t a huge surprise either.

At this point, it’s probably best to leave this pair alone, but you can use it as an indicator for other pairs. The EUR/USD pair is a good way to measure US strength in general, as it is such a large portion of the US Dollar Index. That being said, you can see that we broke the bottom of the hammer from the previous session, which is typically very bearish, but we have also seen a complete turnaround late in the day. In other words, we simply have no idea where we are going next. All one has to do is look at the overall charts and see how we are probably trading in very thin markets, with algorithms trading the latest headline. I have seen moves in this pair that look a lot more like a Third World exotic emerging market currencies.

A breakdown below the bottom of the range for the trading session on Wednesday should send this pair lower, but nonetheless we continue to see a lot of erratic behavior. Because of this you need to be very cautious and recognize that position sizing is crucial. This is true with all currency pairs, even this one that normally puts most traders to sleep. We have been in a downtrend for quite some time, but obviously that is starting to change into some type of erratic panic driven buying and selling on a daily basis. With this, I think I favor the downside but it’s hard to say anything with complete confidence in this type of environment. You can say that the most recent high was lower than the one before it, but with the jobs number coming out on Friday it’s going to be difficult to get overly excited one way or the other until we get that out of the way. More likely than not, the jobs number could be a bit of a surprise in a positive sense as so many people are pricing in Armageddon for the United States.